Optimistic CBR Publishes Summary of Key Rate Decision on May 12

Bottom Line: Central Bank of Russia (CBR) published the summary of the key rate decision on May 12, showing CBR’s views on economic developments. CBR highlighted in its report that “The current inflationary pressures eased in Q1, whereas food and services prices were still rising at a fast pace. Domestic demand was increasing more slowly as compared with the previous quarters.” Despite CBR underscored that there were more signs indicating that the economic overheating had started to decrease, we feel sanctions, elevated inflation, labor shortages and adverse global developments will likely continue to pressurize Russian economy in H2. We foresee a peace deal in Ukraine could ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite we think sealing a full scale peace deal will take longer-than-expected under current circumstances.

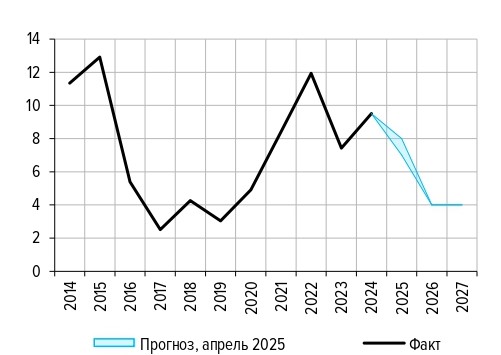

Figure 1: Inflation Forecast (%, YoY), 2014 – 2027

Source: CBR’s Summary of Key Rate Decision (May 2025)

After the CBR held its third MPC meeting of the year on April 25 and kept the key rate unchanged at 21%, the regulator published its summary of the key rate decision on May 12. According to the publication, current inflationary pressures eased in Q1, albeit unevenly across various groups of goods and services. The growth of non-food prices decelerated considerably, whereas food and services prices were still rising at a fast pace. Lending continued to expand modestly and domestic demand was increasing more slowly as compared with the previous quarters.

The report on May 12 demonstrated that that there were more signs indicating that the economic overheating had started to decrease while more time is needed to make sure these trends are sustainable. We feel sanctions, elevated inflation, labor shortages and adverse global developments will likely continue to pressurize Russian economy.

Despite the interest rates remain at their highest level in two decades, it appears this has so far failed to soften rising inflation since the ongoing war in Ukraine exacerbates economic capacity constraints. We think there are no signs of a significant inflation slowdown in the horizon yet. (Note: Inflation ticked up to 10.3% YoY in March after hitting 10.1% in February, remaining well above the CBR’s midterm target of 4%, due to surges in services and food prices, huge military spending and elevated inflation expectations).

Additionally, CBR highlighted in its MPC statement on April 25 that the key proinflationary risks are associated with a longer upward deviation of the Russian economy from a balanced growth path and high inflation expectations. A further decrease in the growth rate of the global economy and oil prices in case of escalating trade tensions may have proinflationary effects through the ruble exchange rate dynamics.

We also think the risks to the inflation outlook remain upside as the fiscal policy is making a big contribution to domestic demand, coupled with high military spending. Surging inflation expectations, likely deterioration in the terms of external trade during trade wars and rising wages do not signal a significant inflation slowdown in the horizon yet. (Note: We feel inflation will likely peak at around 10.4%-10.5% YoY in April.)

We foresee a peace deal in Ukraine could ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a full scale peace deal will likely take longer-than-expected. Ukraine war will continue to be the key for Russian economy in H2.