Sweden Preview (Aug 20): Riksbank to Cut for Final Time?

We see the Riksbank delivering a further 25 bp rate cut on Aug 20, taking the policy rate to new cycle low of 1.75%. This would chime with the hints after the last meeting and cut in July of a further move is possible. And with both real activity and CPI data having delivered downside news and surprises, the rationale as well as scope is there for what we think will be flagged as a final move in an update that will not include formal forecasts as there will be no fresh Monetary Policy Report (MPR) until the autumn. This is something we go along with, albeit with downside risks given what may be marked spare capacity in the economy (Figure 1) and where inflation pressures seen to have fallen at least to levels consistent with the 2% target (Figure 2). As a result, we do not see a looming policy reversal, as we see this projected rate cut staying in place into 2027

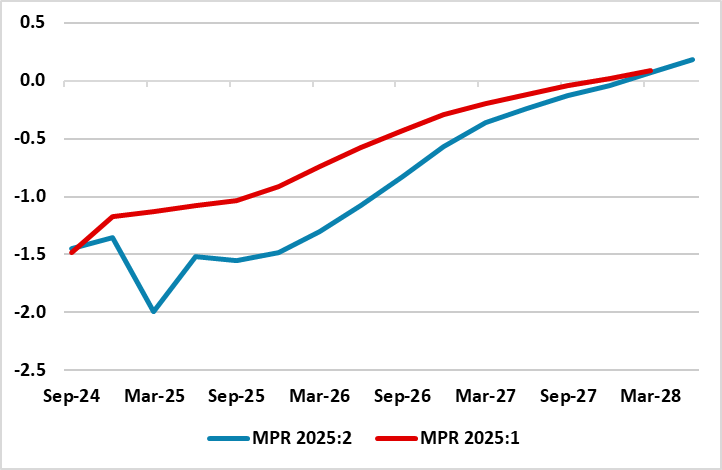

Figure 1: Riksbank Revised and Larger Output Gap Outlook

Source; Riksbank, % of GDP

As widely expected, the Riksbank cut its policy rate by a further 25 bp to a new cycle low of 2.0% in June. Moreover, the Board then suggested that a further move is possible. Given that even with what was a substantial paring back of its growth forecast and with an ensuing revision that now sees an output gap of almost 2% of GDP, we remain puzzled that there was no appreciable downgrade to the inflation outlook. Instead, while we see CPIF inflation falling below target by next year we think the economy will under-perform the 1.2% and 2.4% GDP projections for this year and next and that this will make the Riksbank have to react and deliver the half-hearted rate cut it has flagged.

This is made all the more likely by recent data. The Q2 flash GDP estimate showed only a modest 0.1% q/q rise, much weaker that the Riksbank’s forecast (0.9%), something backed up by other weak hard data ( big fall in retail sales and weak household consumption in May) and falling business confidence indicators supports that economic activity remained subdued in Q2 and probably continued so into Q3 and weak sentiment can probably be linked to the uncertainty about the global economy in the wake of the new US trade policy and inflation concerns among households. As a result, we still point to a below-consensus 2025 GDP outlook of 0.9% (0.6 ppt below what we envisaged three months ago) and only a moderate further pick-up to 1.8% next year, both partly a result of the U.S. tariffs that will very likely hit all EU countries. This may mean an even larger output gap emerges than Riksbank envisages now (Figure 1)

Regardless, the Riksbank bases policy on an assessment of the inflation outlook and the balance of risks associated with it. Surely an economy that may be more than a full ppt weaker than its existing thinking would suggest added downside price risks. But we think an even softer profile is likely, both as trade tensions and uncertainties persist and given the manner that the jump in exports in Q1 may reverse as it was likely based on anticipating U.S tariffs being imposed from Q2 onwards. As for the tariff threat, it is noteworthy how important the U.S is to Sweden. As a Riksbank research paper notes - the Swedish economy is closely linked to the United States, both directly and through global value chains, and Swedish exports to the United States have increased in recent years.

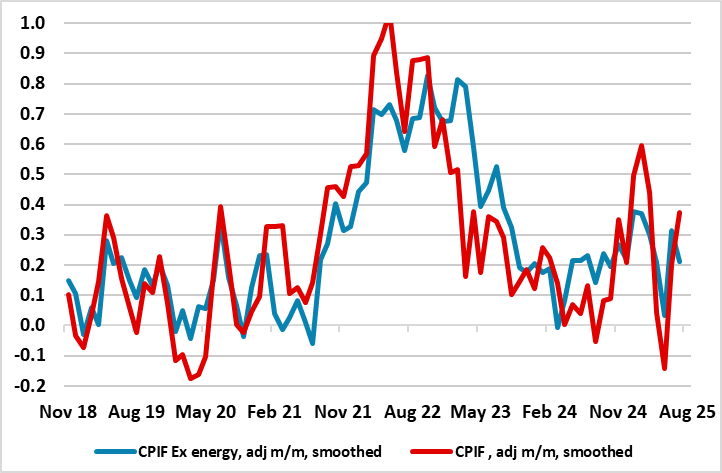

Figure 2: Core Inflation Running Near Zero?

Source; Stats Sweden, Riksbank, CE – smoothed is 3 mth mov avg

Against this backdrop and outlook, it is not surprising that inflation seems to be buckling afresh, with adjusted core m/m numbers now near zero (Figure 2). To us, this very much necessitates a fresh assessment of the inflation outlook and risks that we think will occur next week (and beyond), this justifying the projected 25 bp rate cut and the risk of the Board actually flagging possible further moves beyond, although our base case remains the likely 1.75% outcome persisting into 2027!