Turkiye Inflation will Slightly Soften in July: Tax Adjustments and Gas Price Hike in July Will Limit the Fall

Bottom line: After easing to 35.1% annually in June, we expect Turkiye’s consumer price index (CPI) will continue to soften moderately in July to 34.1%-34.3% as tax adjustments and energy price hikes in July will limit the downward trend. Despite tight monetary policy and moderately falling demand helped relieving the price pressure in Q2, July inflation will likely be impacted by 25% increase in natural gas prices by Energy Market Regulatory Authority (EPDK) and hikes in special consumption tax. July print will be announced on August 4.

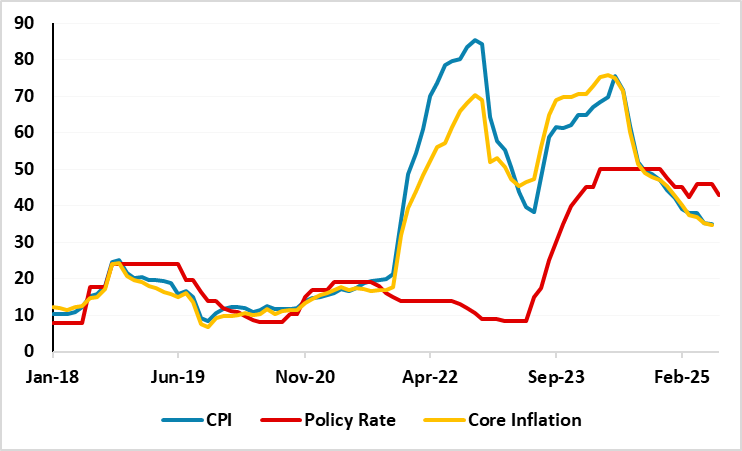

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – June 2025

Source: Continuum Economics

The deceleration trend in inflation continued in Turkiye in June, and inflation cooled off to 35.1% y/y with education and housing prices leading the rise in the index. We expect consumer price index will continue to soften moderately in July to 34.1%-34.3% as tax adjustments and energy price hikes in July will limit the downward trend. (Note: July print will be announced on August 4). We foresee MoM inflation in July will stand at 2.2%-2.3%.

As mentioned, EPDK announced on July 1 that natural gas consumption prices in residential housing increased by 24.6%, in force as of July 2. Besides, Turkiye hiked the special consumption tax (OTV) on electric vehicles, raising the lowest OTV bracket from 10% to 25% through a presidential decree published in the Official Gazette on July 24. (Note: In line with our expectations, Central Bank of Turkiye (CBRT) emphasized in its last MPC statement on July 24 that it anticipates a temporary rise in monthly inflation in July due to one-off factors).

Looking on the positive side, the inflation expectations of consumers and companies decelerated in July, a survey of market participants by the CBRT showed on July 21. The CBRT survey demonstrated that markets see inflation 12 months from now edging down to 23.4%, which is a fall from 24.6% in the June survey. Inflation is forecast to soften to 29.7% as of the end of the year, is down from 29.9% expectation in June and 30.4% forecast in May. According to July survey, the real sector reduced its projection to 39%, a 0.8-point decrease when compared with the previous month. Household expectations rose by 1.5 percentage points from June, raising their forecast to 54.5% for the next 12 months, marking a significant discrepancy between the expectations of the households and the real sector.

It is worth noting that CBRT predicts end year-end inflation to stand at 24%, with an upper band of 29%. We also expect the slowdown in inflation to continue, but with a slower pace in H2 while the extent of the decline will be determined by energy prices, TRY volatility, food inflation, tax and administrative price adjustments such as wages. On the upside, falling headline inflation in H2 could feed into backward-looking inflation expectations, easing price pressures. We envisage it will be difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation becomes stickier requiring high interest to remain for some time.

Despite inflation continues to soften thanks to tightened monetary policy and relative TRY stability underpinning the inflation relief, we still think the road to bringing inflation back down to single-digit levels will be very bumpy, and the inflation getting there before 2027 remains unlikely.