Sweden: Riksbank Cuts and Flags Possible Further Move?

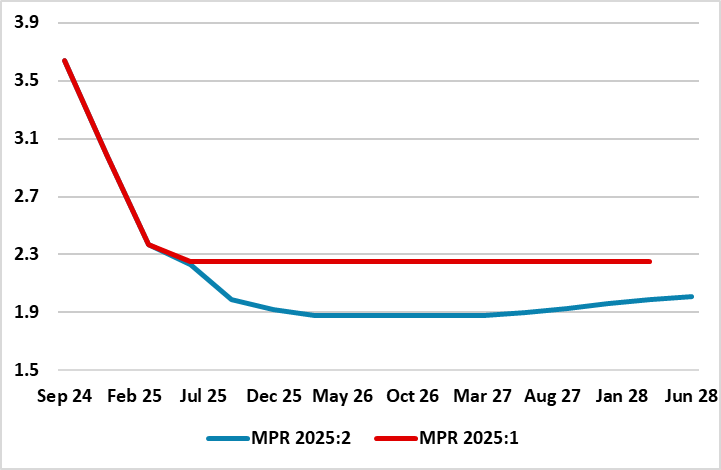

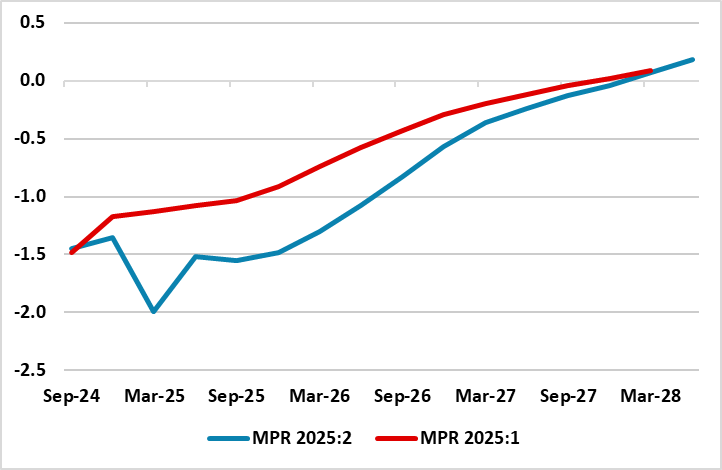

As widely expected, the Riksbank cut its policy rate by a further 25 bp to a new cycle low of 2.0%. Moreover, as we hinted at, the Board even then suggest that a further move is possible (Figure 1). Given that even with substantial paring back of its growth forecast in its updated Monetary Policy Report (MPR) and with an ensuing revision that now sees an output gap of almost 2% of GDP (Figure 2) we are puzzled that there was no appreciable downgrade to the inflation outlook. Instead, while we see CPIF inflation falling below target by next year we think the economy will under-perform the 1.2% and 2.4% GDP projections for this year and next and that this will make the Riksbank have to react and deliver the half-hearted rate cut it is flagging, probably next quarter, to 1.75% which we then see staying in place into 2027. Weakness in the economy has been evident both in official data as well as, a Riksbank business survey which now suggest that what green shoots had appeared have fizzled out while the latest CPI numbers suggest an absence of inflation.

Figure 1: Riksbank Revised Policy Rate Outlook

Source; Riksbank, %

A weak first quarter and revised national account numbers back for several years have prompted a marked downgrade to even our below consensus thinking, especially for this year. But, despite what seems to more of neutral fiscal policy but coming alongside Riksbank rate cuts, the growth outlook still seems weak – NB monetary policy easing should bite relatively quickly in Sweden given that mortgages are still largely flexible rate driven. Indeed, we now point to a below-consensus 2025 GDP outlook of 0.9% (0.6 ppt below what we envisaged three months ago) and only a moderate further pick-up to 1.8% next year, both partly a result of the U.S. tariffs that will very likely hit all EU countries. This may mean an even larger output gap emerges than Riksbank envisages now (Figure 2)

Figure 2: Riksbank Revised Output Gap Outlook

Source; Riksbank, % of GDP

These are clearly below Riksbank thinking, even after its recent downgrades. Moreover, we feel that outlook still comes with downside risks which encompass a consumer recovery next year that may be very feeble reflecting labor market uncertainty based around a clearly rising jobless rate which may even approach 9% into 2026. There is also what is already a sustained rise in household savings and also the fact that 2022-23 Riksbank tightening still seems to be biting given the continued marked and nominal fall in bank lending. Indeed, we think that the latter is a reflection of Riksbank policy also biting unconventionally as its balance sheet reduction, which had caused a marked drop in bank deposits (now only partly repaired) and where this weakness is still affecting banks willingness/ability to lend.