Turkiye’s Inflation Slightly Eased to 35.1% YoY in June

Bottom line: Turkish Statistical Institute (TUIK) announced on July 3 that the inflation softened to 35.1% y/y in June from 35.4% y/y in May driven by lagged impacts of previous monetary tightening, tighter fiscal measures and suppressed wages. Despite moderate fall, inflationary risks remain tilted to the upside and we believe deteriorated pricing behaviour, the stickiness of services inflation particularly in housing rentals, and education prices coupled with hike in natural gas prices by Energy Market Regulatory Authority (EPDK) as of July 1 will likely lead to average headline inflation to stand at 34.5% in 2025.

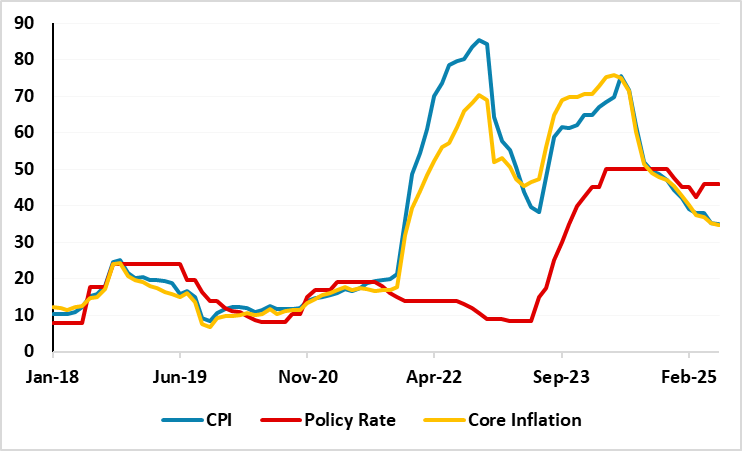

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – June 2025

Source: Continuum Economics

The deceleration trend in inflation moderately continued in Turkiye in June, and inflation rate softened for thirteen consecutive months. CPI cooled off to 35.1% y/y June from 35.4% in May with education and housing prices leading the rise in the index. MoM inflation rose by 1.4% in June, lower than 1.5% MoM inflation the previous month. Core inflation rose by 1.8% MoM, bringing the annual rate down to 34.6%. PPI rose 2.5% MoM in June for an annual rise of 24.5%, TUIK data showed. We think lagged impacts of the tightening cycle, relative slowdown in credit growth, and tighter fiscal stance helped relieve the price pressure in June.

Education prices recorded the highest annual increase with 73.3% YoY followed by housing prices were up by 65.5% YoY. Prices rose at a slower pace across a number of categories, such as footwear and clothing, which came in at 14.5% YoY in June.

It is worth noting that Energy Market Regulatory Authority (EPDK) announced on July 1 that natural gas consumption prices in residential housing increased by 24.6%, in force as of July 2. We think this will also pressurize prices in H2.

Despite risks, Central Bank of Turkiye (CBRT) predicts end year-end inflation to stand at 24%. We expect the slowdown to continue, but with a slower pace in H2 while the extent of the decline will be determined by TRY volatility, food inflation, energy prices and administrative price adjustments such as wages. On the upside, falling headline inflation in H2 could feed into backward-looking inflation expectations, easing price pressures. We envisage it will be difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation becomes stickier requiring high interest to remain for some time.

We continue to think key concern remains service sector inflation, particularly in housing rentals, and education prices. We believe deteriorated pricing behaviour, the stickiness of services inflation, and adverse geopolitical developments coupled with hike in natural gas prices as of July 1 will likely lead to average headline inflation to stand at 34.5% in 2025. Despite the CBRT predicts inflation will soften to 24% at the end of 2025, the road will be very bumpy due to risks.