CBRT Kept Its End-Year Inflation Forecast at 24%, and Announced Its New Interim Targets

Bottom Line: Central Bank of Turkiye (CBRT) released its third quarterly inflation report of the year on August 14, and kept its inflation forecast constant at 24% for 2025, 16% by the end of 2026 and 9% by end-2027. CBRT governor Karahan said the regulator decided to separate the targets from its inflation forecast ranges in a new strategy, and added that the CBRT set new interim targets as the inflation is currently projected to be between 25% and 29% in 2025, and between 13% and 19% in 2026. We believe this is good step towards consistency and accountability which will be helpful in better observing and assessing any deviations from inflation targets. Despite this, we continue to foresee the road to bringing inflation back down to single-digit levels will be very bumpy since the inflation remains sticky, and the inflation falling down to 9% by end-2027 is unlikely under current circumstances.

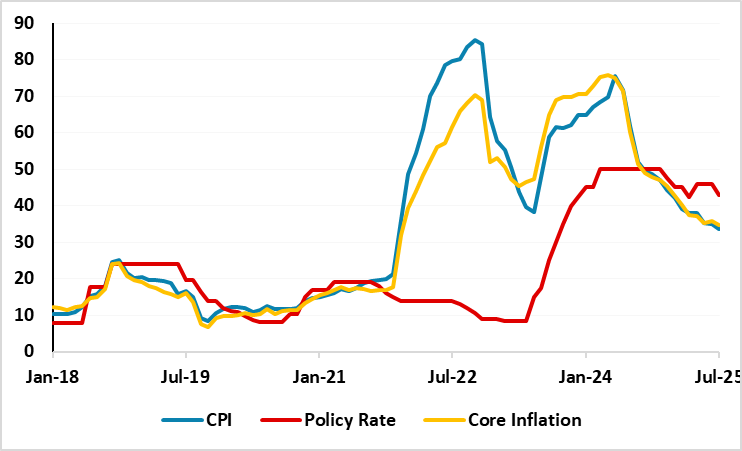

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – July 2025

Source: Continuum Economics

CBRT released the third quarterly inflation report of the year on August 14, and maintained its end year-end inflation forecast at 24%. Inflation forecast was set at 16% for 2026, 9% for 2027, and the inflation report mapped out a gradual path toward its medium-term objective of 5% inflation.

On a more important note, CBRT governor Karahan highlighted that the regulator decided to separate the targets from its inflation forecast ranges in a new strategy, and added that the CBRT set new interim targets as the inflation is currently projected to be between 25% and 29% in 2025, and between 13% and 19% in 2026. We believe this is good step towards consistency and accountability which will be helpful in better observing and assessing any deviations from inflation targets.

Karahan also emphasized during the press conference that "We have decided to change the framework for presenting medium-term forecasts. We will present interim targets that will not be changed unless extraordinary circumstances occur between report periods. The year-end interim targets will serve as a commitment and anchor." Karahan added that "We will maintain our tight monetary policy stance to achieve our interim targets, and determine the steps to be taken in a way that will ensure the tightness required to reach the targets."

According to third quarterly inflation report, the disinflation trend continues in Turkiye since tight monetary policy has been gradually reducing inflationary pressures, with domestic demand showing a continued slowdown. Despite this, the inflation path has been negatively influenced by persistent pressures in the services sector, particularly in categories such as rent, hotels, cafes and restaurants. Talking about the inflation trajectory, Karahan mentioned that as inflation expectations continue to decline and price pressures in the services sector ease, the underlying trend in inflation is expected to keep falling through the rest of 2025.

Despite this, we continue to feel the stickiness of services inflation, deteriorated pricing behaviour, food and commodity price volatility, and adverse geopolitical impacts will likely lead to average headline inflation to stand at 31.9% in 2025, which is above CBRT’s expectations. We think the road to bringing inflation back down to single-digit levels will be very bumpy since the inflation remains sticky, and the inflation falling down to 9% in 2027 is unlikely under current circumstances.