Turkiye MPC Preview: CBRT will Likely Restart its Easing Cycle on July 24

Bottom Line: After Central Bank of Turkiye (CBRT) held its key policy rate stable at 46% on June 19, we believe CBRT will likely reduce the policy rate by 150-250 bps during the MPC meeting scheduled for July 24 considering the deceleration trend in inflation in June beat forecasts and reinforced expectations for a rate cut. Cautious CBRT could also keep the rate constant since inflationary risks are tilted to the upside due to political instability, global economic uncertainties and geopolitical risks, which is not our major scenario. Our end year key rate prediction remains at 34.0% for 2025.

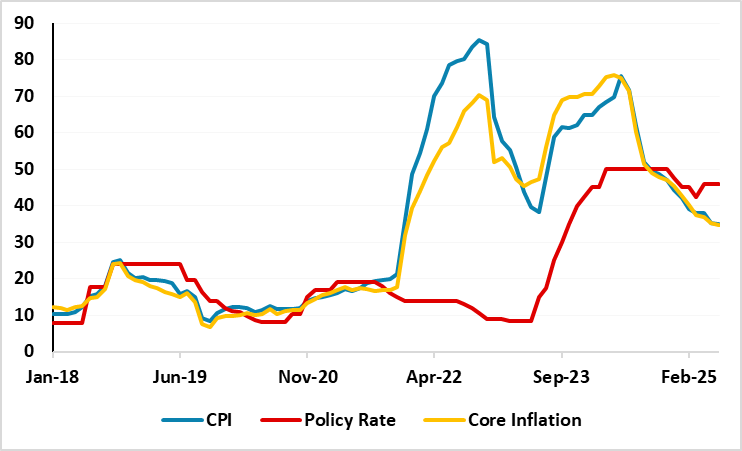

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – June 2025

Source: Continuum Economics

After the deceleration trend in inflation continued in June with 35.1% y/y, supported by lagged impacts of previous monetary tightening and tighter fiscal measures, we believe this has left with some room of choice for the CBRT during the next MPC meeting scheduled for July 24. (Note: CPI cooled off to 35.1% y/y June from 35.4% in May with education and housing prices leading the rise in the index. MoM inflation rose by 1.4% in June, lower than 1.5% MoM inflation the previous month).

We believe CBRT will likely consider reducing the policy rate by 150-250 bps during the MPC meeting scheduled for July 24 lead by moderate fall in MoM inflation and relative TRY stability in June. Of course, cautious CBRT could also keep the rate constant on July 24 since inflationary risks are tilted to the upside due to political instability, global economic uncertainties and geopolitical risks, which is not our major scenario. (Note: The bank last cut was in March before pausing as assets and the TRY fell sharply after arrest of late March).

It appears business people and exporters are also expecting the CBRT to start rate cuts as soon as possible. Speaking about the CBRT’s prospective rate cuts, Burhan Ozdemir, the head of the Independent Industrialists and Businessmen Association (MUSIAD) said last week that "We believe that a 350-400 bps interest rate cut in July would be appropriate, and it would be too late if in September instead of July". Ozdemir added that the value of the TRY is not at the level exporters would want it to be, noting that the current real interest rate was too high relative to the exchange rate.

CBRT governor Fatih Karahan emphasized last week that the regulator is closely monitoring TRY deposits held by local savers, viewing trends in these accounts as a key indicator for monetary policy, according to Bloomberg. This can be seen as a signal of the CBRT’s cautious stance on resuming interest rate cuts, suggesting that the state of local deposits will have an impact on potential interest-rate cuts decisions.

It is worth noting that key concern for the inflation trajectory remains service sector inflation, particularly in housing rentals, and education prices. We believe deteriorated pricing behaviour, adverse geopolitical developments coupled with hike in natural gas prices as of July 1 will likely lead to average headline inflation to stand at 34.5% in 2025, despite the CBRT predicts inflation will soften to 24% at the end of 2025.

Under current circumstances, CBRT will have to proceed carefully on interest-rate adjustments on a meeting-by-meeting basis given domestic inflationary risks and unpredictable outlook for the global economy. Our end year key rate prediction remains at 34.0% for 2025, and we feel Mth/Mth inflation readings will continue to be key in H2 as CBRT will want to avoid reigniting inflation with too aggressive rate normalization as deceleration trend in inflation and relative TRY stability still enable CBRT to restart cuts again on July 24.