Norges Bank Review: Coming (Very) Late to the Party

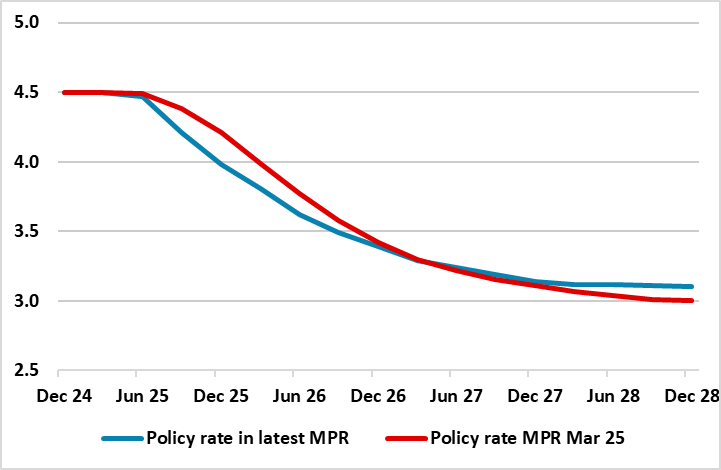

Although we thought the Norges Bank would not start to ease until its next (Aug) meeting, we think the surprise 25 bp policy rate cut (to 4.25%) announced today is very much warranted, as are the further cuts (Figure 1) being flagged in the updated Monetary Policy Report (MPR) – ie two more such moves by end year. What is notable is that the Board actually upgraded its economic outlook, albeit largely a result of the strong Q1, which showed broad and far from aberrant gains. However, the Norges Bank is trying to suggest that it is merely reducing current policy restrictiveness, but it is clear that recent downside surprises in CPI data have changed the Board’s mindset, possibly helped by an array of its own survey data suggesting somewhat more spare capacity in the Norwegian economy than assumed in the previous Report. We see up to three moves this year and around a full ppt more in 2026!

Figure 1: Earlier and Faster Easing?

Source: Norges Bank (%)

The Norges Bank was the first DM central bank to start hiking and is now the last to start easing. The hawkish line being pursued by the Norges Bank – at least hitherto –still only helps bring inflation in its view back to target only 2-3 years hence. Obviously, it has been swayed by better CPI data (see below) and by a more stable exchange rate, and perhaps a realization that amid the downside risks facing the European economies it is better to take out policy insurance sooner than later.

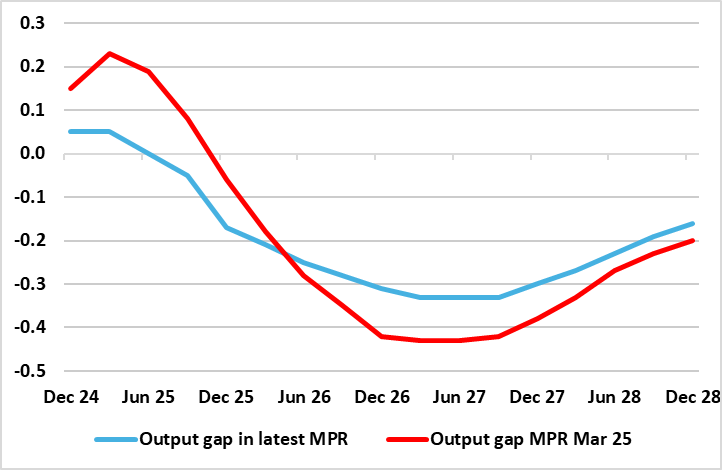

Regardless, as for inflation, we think that the Norges Bank is still being too cautious, even though we would not disagree materially with its upgraded 1.6% and 1.4% GDP projections for the year and next rate. Even so, it does seem as if the Board now echoes our thinking in seeing a larger and earlier output gap (Figure 2). Indeed, we think the latter is partly responsible for the marked fall in inflation seen of late – admittedly unwinding the overshoot of the early part of 2025. Notably, May data shows that core inflation (CPI-ATE) fell 0.2 ppt to 2.8%, well below (again) Norges Bank thinking (it expected 3.1%). Looking at the details some of this softening may be calendar related but over the past couple of months, CPI inflation has been two to three tenths lower than Norges Bank’s expectations. Indeed, CPIF and core inflation (ie the former ex food) are running nearer zero on an adjusted and smoothed m/m basis.

Figure 2: Earlier and Larger Output Gap?

Source: Norges Bank, % GDP

As for the policy outlook, the Board is trying too hard in suggesting risks on both sides. It notes that The uncertainty surrounding the outlook is greater than normal. An escalation of conflicts between countries and uncertainty about future trade policies may result in renewed financial market turbulence and could impact both Norwegian and international growth prospects. If the economy takes a different path than currently envisaged, the policy rate path may also differ from that implied by the forecast. If prospects suggest that wage and price inflation will remain elevated for longer than projected, a higher policy rate than currently envisaged may be required. If inflation falls faster than projected, or unemployment rises more than projected, the policy rate may be reduced faster. We lean toward this latter view.