Deceleration in Inflation Resumes in Russia: 8.8% YoY in July

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data on August 13, inflation stood at 8.8% YoY in July after hitting 9.4% YoY in June, ignited by higher non-food and services prices. Despite inflation eased for a fourth straight month, we foresee inflation will continue to stay higher than Central Bank of Russia’s (CBR) 4% target in 2025. Our 2025 average headline inflation projection stays at 9.4% due to an overheated economy.

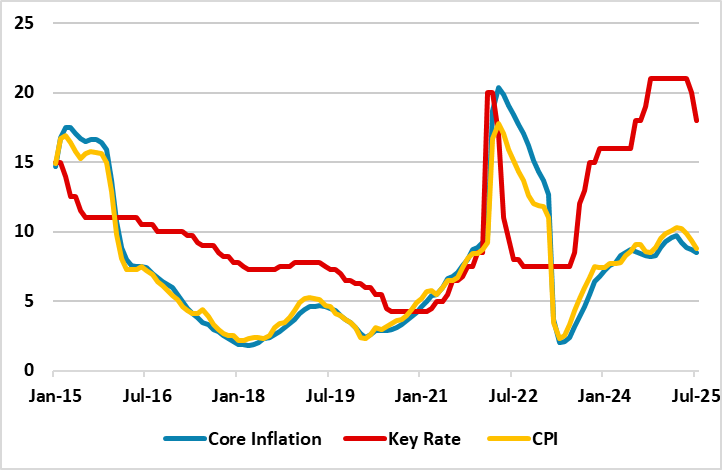

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – July 2025

Source: Continuum Economics

According to Rosstat figures, inflation slowed to 8.8% YoY in July after hitting 9.4% YoY in June. Rosstat announced that food prices softened by 0.6% in July MoM, and up by 10.8% YoY, while non-food prices surged by 0.2% MoM, and 4.1% YoY. Prices for services grew by 2.7% MoM and by 11.9% YoY, respectively. MoM price growth fastened to 0.6% in July over the previous month, after 0.2% hike in June.

In addition to decelerating trend in inflation, we think there are some signs of moderate economic cooling. The pass-through of the earlier RUB weakening to prices, which increased in Q1, partly soothed after May. RUB gained about 4% of its value against the USD between May 1 and July 31. The inflation expectations also declined in June to 13% from 13.4% the prior month.

Despite inflation eased for a fourth straight month, we foresee inflation will continue to stay higher than CBR’s 4% target in 2025. The inflation risks are still tilted to the upside over the medium-term as the fiscal policy is making a big contribution to domestic demand. High military spending, global uncertainties, and rising wages do not signal a significant permanent inflation slowdown in the horizon yet despite we expect the deceleration trend will moderately continue the rest of 2025. Our 2025 average headline inflation projection stays at 9.4% due to an overheated economy. (Note: CBR highlighted in its written statement on July 25 that it will maintain a level of monetary policy tightness necessary to bring inflation back to target by 2026).

Speaking about the course of inflation, President Putin underscored on July 12 that the recent decline in inflation in Russia is an important achievement, and added that "By the end of the year, surges in consumer prices may already be within 6%-7%, which is below previous forecasts."

We continue to believe reaching CBR’s 4% target in 2026 will be tough since cooling off inflation will take longer than CBR anticipates. A peace deal in Ukraine would be key to ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a full-scale peace deal in Ukraine is still unlikely in 2025. The meeting between Putin and Trump on August 15 in Alaska could be determinant for building the peace in Ukraine while we do not expect a major acceleration in the peace process.