Food Prices Lifted South Africa Inflation to 3.0% YoY in June

Bottom Line: Statistics South Africa (Stats SA) announced on July 23 that annual inflation rose to 3.0% YoY in June from 2.8% in May as food prices reached a 15-month high coupled with elevated restaurant and health services prices. The inflation is still within South African Reserve Bank’s (SARB) target range of 3% to 6% supported by lagged impacts of previous tightening, and a relatively stable ZAR. We think unpredictable outlook for the global economy, rising trade tensions, abrupt shifts in long-standing geopolitical relationships, domestic uncertainties and power cuts (loadshedding) will likely continue to pressurize prices in South Africa in H2 2025. We foresee average inflation will hit 3.4% in 2025.

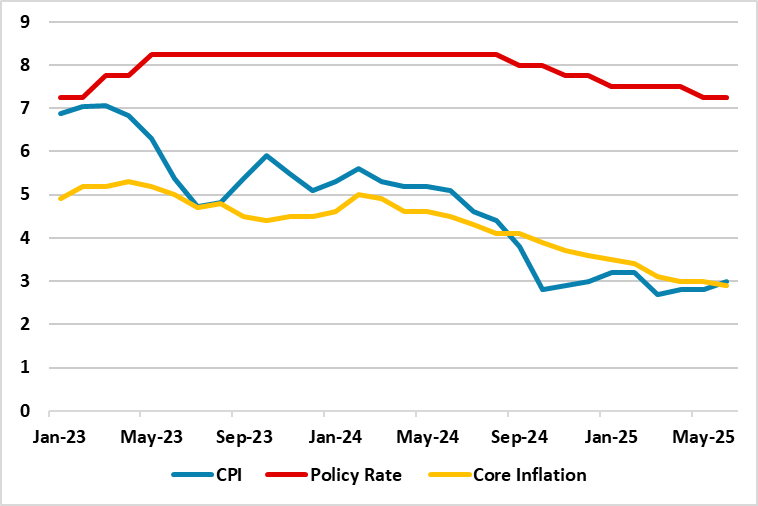

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – June 2025

Source: Continuum Economics

Hitting a four-month high in June, annual inflation increased to 3.0% in June from 2.8% in May led by higher food and non-alcoholic beverages (NAB) prices. According to Stats SA, the change in food & NAB prices was 5.1% YoY in June, following a 4.8% rise in May. The annual rate for health services prices increased to 4.6% in June from 4.4% in May. The prices of restaurants and accommodation services edged up by 2% YoY in June when compared with May’s 1.8%. On the other side of the coin, price growth slowed for housing and utilities (4.4% in June vs 4.5% in May) and for furnishings, household equipment and maintenance (1.1% in June vs 2% in May)

In MoM terms, inflation was at 0.3% in June from 0.2% in May. Annual core inflation rate softened to 2.9% in June from 3.0% in two previous months, hitting the lowest reading since April 2021. Despite inflation in June stood at the lower bound of SARB’s target range of 3% to 6%, we think hike in inflation in June signals the uncertainty over the inflation outlook in the upcoming months. We think unpredictable outlook for the global economy, coupled with rising trade tensions, abrupt shifts in long-standing geopolitical relationships, domestic uncertainties and loadshedding will likely continue to pressurize prices in H2 2025. Additionally, 12.7% tariff hike by Eskom for 2025/26, which came into force as of April 1, and recent spike in food and beverages are risks for the inflation outlook.

We feel a significant risk factor for the inflation trajectory is the power cuts. South Africa’s national electricity utility company, Eskom announced that Stage 2 loadshedding was implemented on May 13. The return of loadshedding remain worrisome since it continues to contribute to the inflation readings. (Note: Despite concerns, Eskom recently reported that the power system is showing resilience in meeting the winter electricity demand due to ongoing structural improvements in the generation fleet, and announced that there has been no loadshedding since 15 May 2025, with only 26 hours recorded between April 1 and July 17).

Speaking about the inflation trajectory, SARB governor Kganyago remained cautious stating last week that Chinese deflation, a weaker dollar and uncertainty about how nations will respond to Trump’s tariff blur inflation forecasting. Kganyago added that “There are things that we are not sure about. We do not know in which direction they would go.”

Under current circumstances, we foresee average inflation will hit 3.4% and 4.4% in 2025 and 2026, respectively, supported by lagged impacts of previous tightening, and a relatively stable ZAR. We believe the key for the inflation trajectory will be the global developments and government’s determination to address the electricity shortages and financing needs.