Norges Bank Preview (Aug 14): Amid Very Restrictive Stance, A Policy Pause – Already?

Although surprised, we thought the Norges Bank’s unexpected easing in June was very much warranted, as are the further cuts being flagged in the Monetary Policy Report (MPR) that came alongside – ie two more such moves by end year. We actually envisage up to three more moves this year and around a full ppt more in 2026, but accept that the Board is unlikely to surprise markets again with a cut at the looming policy verdict on Aug 14, especially given the fresh weakness in the currency since that surprise cut. This is in spite of more downside inflation surprises (Figure 1). However, there are no formal forecast updates at this month’s decision, in which the tariff threat could be better assessed, leaving other considerations for markets to ruminate over, not least just how restrictive the current policy rate actually is, something we discuss at this juncture (Figure 2).

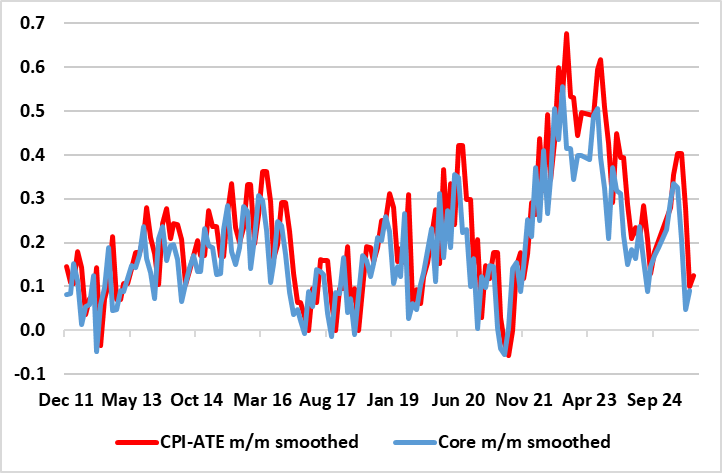

Figure 1: Adjusted CPI – What Inflation?

Source: Stats Norway, CE - seasonally adjusted % chg

The Norges Bank was the first DM central bank to start hiking and is now the last to have started easing. The hawkish line being pursued by the Norges Bank – at least hitherto –still only helps bring inflation in its view back to target only 2-3 years hence according to its updates MPR. Obviously, it has been swayed by better CPI data and by what was then, a more stable exchange rate, and perhaps a realization that amid the downside risks facing the European economies it is better to take out policy insurance sooner than later. Admittedly, Norway is at least in a better situation than some other economies regarding the U.S. tariff threat. It now faces a 15% tariff but did not cave in to pressures regarding (vague) promises to both invest in the U.S. and purchase goods. Partly this reflects the fact that only about 3.5% of its total exports go to the US market, mostly in the form of fish and other seafood, petroleum and chemical products, metals, machinery and furniture. Instead two-thirds of Norway’s trade is with the EU.

Regardless, as for inflation, we think that the Norges Bank is still being too cautious, even though we would not disagree materially with its upgraded 1.6% and 1.4% GDP projections for the year and next rate. Even so, it does seem as if the Board now echoes our thinking in seeing a larger and earlier output gap. Indeed, we think the latter is partly responsible for the marked fall in inflation seen of late – admittedly unwinding the overshoot of the early part of 2025. Notably, June data shows that despite targeted inflation (CPI-ATE) rising 0.3 ppt to 3.1%, chiming with Norges Bank thinking, looking at the details, CPIF and core inflation (ie the former ex food) are running nearer zero on an adjusted and smoothed m/m basis (Figure 1).

How Restrictive?

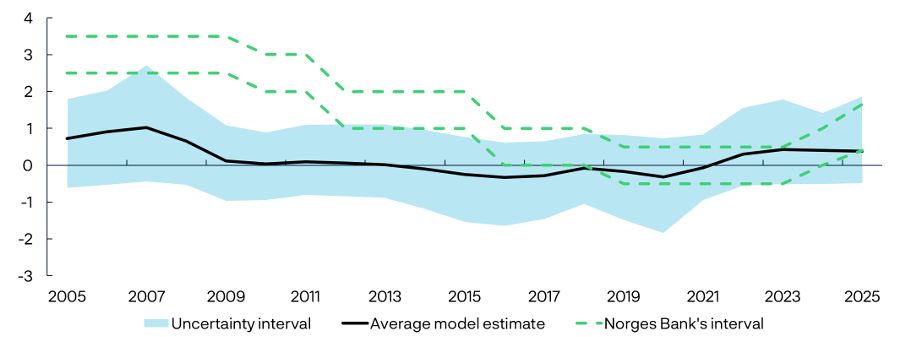

But regardless of the output gasp, to what degree has this fall back in inflation, to rates actually below that consistent with the 2% remit, reflected policy action. In this regard, it is helpful to look at neutral rates, albeit with the proviso that looking purely at policy rates can be misleading. Regardless, the Norges Bank has published a most likely interval for the neutral rate. During the past two years, the Bank has revised up the assessed interval of r∗. but this still leaves its estimate of the neutral real policy rate between 0.25% and 1.5%. All its models estimate that the neutral rate has risen above zero, but that the average estimate of the neutral rate is around 0.4 percent, which indicate that an assumed inflation on target backdrop would mean policy is very restrictive, by almost two full ppt!

Figure 2: Norges Bank Estimate of the Neutral Real Money Market Rate?

Source: Norges Bank

As for the outlook, the Bank thinks that the negative influence of certain headwinds has diminished in recent years but obviously accepts, considerable uncertainty surrounds the future path given the likely net effect of innovation, climate transition, fiscal dynamics, and demographic change being so unclear. Looking ahead, factors such as technological innovation, particularly advancements in artificial intelligence and the transition to a low-carbon economy may influence the future trajectory of the neutral interest rate.

And as for immediate policy, the Board is trying too hard in suggesting risks on both sides. It notes that The uncertainty surrounding the outlook is greater than normal. An escalation of conflicts between countries and uncertainty about future trade policies may result in renewed financial market turbulence and could impact both Norwegian and international growth prospects. If the economy takes a different path than currently envisaged, the policy rate path may also differ from that implied by the forecast. If prospects suggest that wage and price inflation will remain elevated for longer than projected, a higher policy rate than currently envisaged may be required. If inflation falls faster than projected, or unemployment rises more than projected, the policy rate may be reduced faster. We lean toward this latter view.