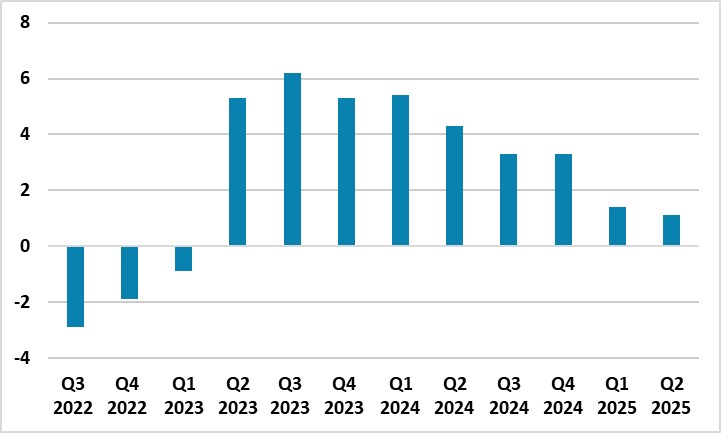

Russian Economy is Slowing: GDP Growth Continued to Lose Steam in Q2 2025

Bottom Line: According to Russian Federal Statistics Service (Rosstat) figures, Russia's GDP expanded by 1.1% YoY in Q2, the slowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, investments, higher wages and fiscal stimulus. We think Central Bank of Russia’s (CBR) previous monetary tightening to fight against stubbornly high inflation continue to hamper economic growth prospects in 2025 while sanctions, supply side constraints and price pressures also remain restrictive. We envisage growth to hit 1.5% YoY in 2025.

Figure 1: GDP Growth (%, Annual), Q3 2022– Q2 2025

Source: Rosstat

After GDP growth stood at 1.4% in Q1 2025, Russia's GDP expanded by 1.1% YoY in Q2, the slowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, investments, higher wages and fiscal stimulus. According to Rosstat, Q2 growth arose from annual increase in manufacturing (+3.7%), construction (+2.4%), retail trade (+1.6%), and agriculture (+1.4%). The softening of growth figures demonstrates previous monetary tightening, sanctions, supply side constraints and price pressures remain restrictive.

Speaking about the GDP trajectory, CBR governor Elvira Nabiullina recently emphasized that “The labor market is cooling, and weaker demand is expected to help ease inflation pressures which has dropped from over 10% in December and continues to fall faster than expected.” (Note: According to Rosstat data on August 13, inflation stood at 8.8% YoY in July after hitting 9.4% YoY in June, ignited by higher non-food and services prices). Despite moderate fall in inflation, Nabiullina warned that the economy reached the edge of capacity, while economy minister Reshetnikov also highlighted that the country has been on the verge of a transition to recession. Taking into account that CBR has cut the rates by 300 bps in the last two months to bring sticky inflation down, the current discussion is centered around whether the recent sharp fall in GDP growth demonstrates that Russia economy is entering a recession or merely cooling.

The Ministry of Economic Development of Russia projects annual growth of 2.5% for 2025, while the central bank offers a more cautious outlook, predicting growth between 1% and 2%. (Note: The CBR envisages a slowdown to 1.6% in Q3, and between 0%-1% in Q4). The World Bank (WB) recently revised upward its forecasts for GDP growth next year in the June report expecting to see the economic growth by 1.4% in 2025 (up 0.2 ppt against January data), and by 1.2% in 2026. WB considers the slowdown of Russian economic growth is related to toughening of monetary policy of the country. According to the IMF, Russia’s economy is now expected to expand by 0.9% this year, compared with its previous view of 1.5% growth.

We envisage growth to hit 1.5% and 1.3% in 2025 and 2026, respectively. The recent easing cycle by CBR could slowly reignite growth but this will take time while all will depend on how Ukraine war will go. A peace deal in Ukraine would be key to ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a full-scale peace deal in Ukraine is still unlikely in 2025. The meeting between Putin and Trump on August 15 in Alaska could be determinant for building the peace in Ukraine while we do not expect a major acceleration in the peace process.