SA Inflation Preview: Inflation Will Likely Slightly Rise in April

Bottom Line: Despite inflation stood at 2.7% YoY in March, the lowest reading since June 2020, we foresee annual inflation will slightly accelerate to 2.8-2.9% in April, which will be announced on May 21. We feel unpredictable outlook for the global economy, return of power cuts (loadshedding), and volatility of ZAR particularly in April pressurize domestic prices. It is not going to be surprising if South African Reserve Bank (SARB) deters easing cycle during the MPC scheduled on May 29 given plenty of upside risks to inflation. We think the decision will still be a close call taking into account the recent withdrawal of the (inflationary) VAT increase and fall in global oil prices.

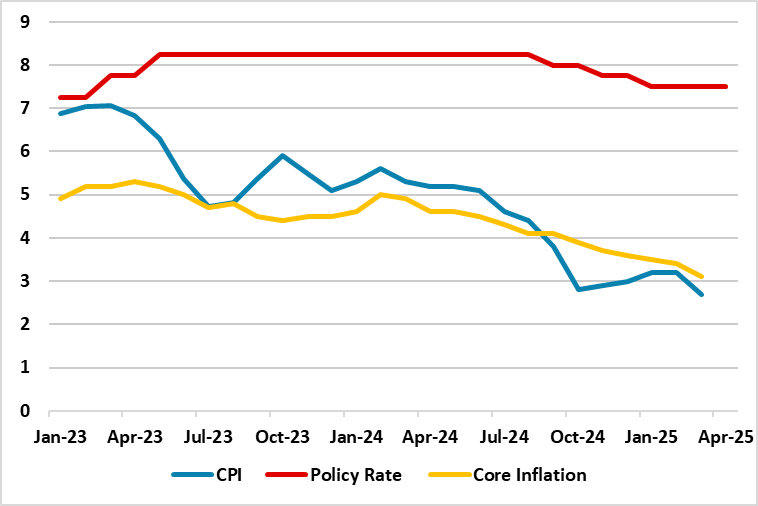

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – April 2025

Source: Continuum Economics

Despite inflation stood at 2.7% YoY in March, the lowest reading since June 2020, we foresee annual inflation will slightly accelerate to 2.8-2.9% in April, which will be announced on May 21. We feel unpredictable outlook for the global economy, return of loadshedding, and volatility of ZAR particularly in April pressurize domestic prices.

First, we feel the inflation print will be under pressure by the return of power cuts. South Africa’s national electricity utility company, Eskom announced on April 24 with little notice that Stage 2 loadshedding would be implemented, which suggested serious issues. (Note: May 13 also saw a Stage 2 loadshedding). Despite the Energy Availability Factor (EAF) was just below 57% for the year to date late April, the return of loadshedding remains worrisome since it will contribute to the inflation readings. (Note: According to BER’s weekly report on May 9, electricity production fell by 2% QoQ amid a return of load-shedding).

We think April inflation outlook will be negatively impacted by the volatility of ZAR in April, which hovered around 18.5-19.5 against the USD. (Note: The peak was on April 7 when ZAR hit 19.56 against the USD due to concerns related to Trump’s additional tariffs).

When it comes to food inflation, data released by the Pietermaritzburg Economic Justice and Dignity (PMBEJD) in its April 2025 Household Affordability Index showed that the price of a basic food basket increased by almost ZAR100 MoM. In April, consumers had to fork out ZAR5,420.30 to fill up a basic food basket, which means the average cost of the Household Food Basket increased by ZAR90.94 (1.7%), from ZAR5,329.36 in March 2025. This partly demonstrates we could see a higher food inflation on May 21.

On the downside, National Treasury issued a press statement on April 24 indicating that the proposed 1%pts increase in VAT over the next two years will not be implemented while the Minister of Finance also withdrew Budget 2.0. Additionally, the economy could be supported by the fall in global oil prices, which may positively impact food prices in the short run since the easing of oil prices comes at harvest time for key crops in the agricultural sector in May-June through cutting costs in freight and transport.

Despite March inflation print backed rate cut bets during the next MPC meeting scheduled for May 29 as the inflation remained below the central bank's midpoint target of 4.5%, we feel unpredictable global and domestic outlooks will be the major hinder. South African economy is still buffeted by uncertainty caused by the Trump administration’s tariff tantrum and rising concern about local political instability following disagreement on budget.

In this respect, we consider SARB will closely monitor recent economic developments as they could significantly impact inflation forecasts. Under current circumstances, we envisage cautious SARB proceeds carefully on interest-rate adjustments, and likely hold the key rate constant on May 29 since unpredictable outlook for the global economy, return of power cuts, and volatility of ZAR pressurize domestic prices. We think the decision will still be a close call taking into account the withdrawal of the (inflationary) VAT increase and recent fall in global oil prices.