South Africa Inflation Stayed Unchanged in May 2.8% YoY

Bottom Line: Annual inflation stayed stable at 2.8% in May after April as food prices rose, remaining below the lower bound of South African Reserve Bank’s (SARB) target range of 3% to 6%. We think unpredictable outlook for the global economy, and return of power cuts (loadshedding) pressurized domestic prices in May.

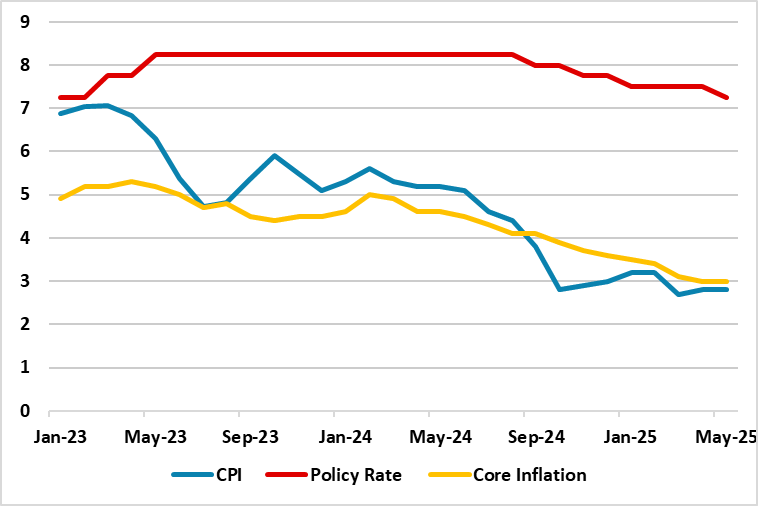

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – May 2025

Source: Continuum Economics

Annual inflation stayed stable at 2.8% in May after April, due to higher food prices. According to Stats SA, food & non-alcoholic beverages (NAB) was the only category that contributed to the monthly increase in the CPI. The monthly change in food & NAB was 1.1%, following a 1.3% rise in April. The annual rate for the category increased to 4.8% from 4.0% in April, the highest print since March 2024 when the rate was 5.1%. Fuel prices dropped by 1.1% between April and May, pulling the annual rate down to ‑14.9%. This is the largest annual decrease for fuel since October 2024 when the rate was -19.1%.

We think unpredictable outlook for the global economy, and loadshedding partly contributed to the domestic prices in May. In MoM terms, inflation was at 0.2% in May from 0.3% in April. Annual core inflation rate stayed unchanged at 3% in May and April, the lowest since July 2021. Inflation in May remained below the lower bound of SARB’s target range of 3% to 6%. (Note: The SARB MPC signaled a potential shift towards a lower inflation target of 3% on May 29, down from the current midpoint objective of 4.5%).

We feel a factor fueled inflation was the power cuts. South Africa’s national electricity utility company, Eskom announced that Stage 2 loadshedding was implemented on May 13. The return of loadshedding remained worrisome since it continues to contribute to the inflation readings. We foresee further power disruptions are likely, particularly with the onset of winter when energy demand rises.

In addition to this, 12.7% tariff hike by Eskom for 2025/26, which came into force as of April 1, coupled with spike in food prices lifted CPI in May. It was positive to see that previously proposed 1% increase in Value Added Tax (VAT) was cancelled, and the National Assembly adopted the fiscal framework, which was an important step in completing the adoption of Budget 3.0.

Under current circumstances, we foresee average inflation will hit 3.4% and 4.4% in 2025 and 2026, respectively, supported moderately by lagged impacts of previous tightening, and a relatively stable ZAR. (Note: SARB also revised its end-year inflation forecast for 2025 from 3.6% YoY to 3.2% YoY on May 29). We believe the key for the inflation trajectory will be the global developments and government’s determination to address the electricity shortages and financing needs. Another risk factor is the U.S. additional tariffs. South Africa has formally requested that the 30% reciprocal tariff on South Africa stays suspended, but it remains unclear what the U.S. decides in that regard.