LatAm Central Banks

View:

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

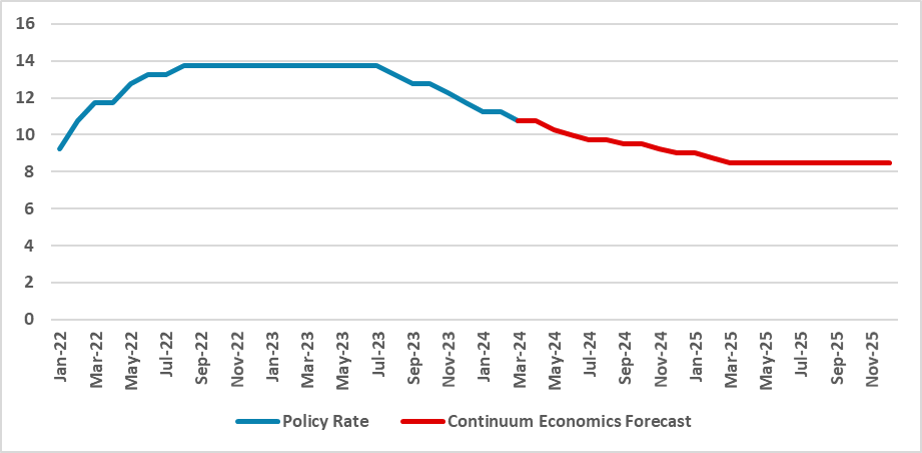

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

March 26, 2025

EMFX Outlook: Divergence versus the USD

March 26, 2025 9:16 AM UTC

EM currencies will be helped by the ongoing USD downtrend against DM currencies, but prospects also depend on relative inflation differentials versus the USD and starting point in terms of valuations. The Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR) should all make modest s

March 25, 2025

BCB Minutes: Caution Rather than Optimism

March 25, 2025 10:51 PM UTC

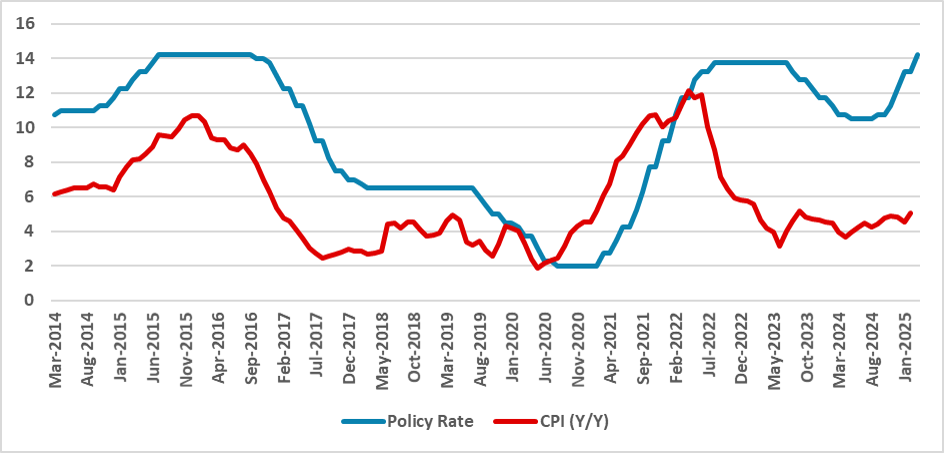

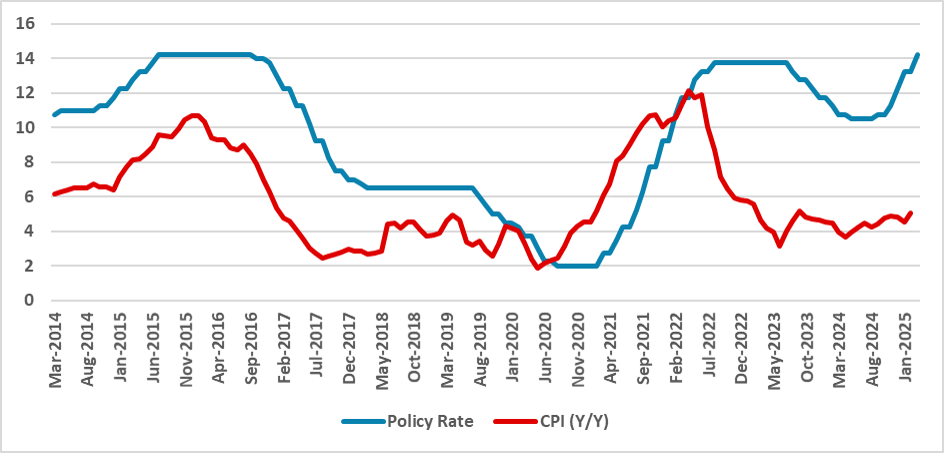

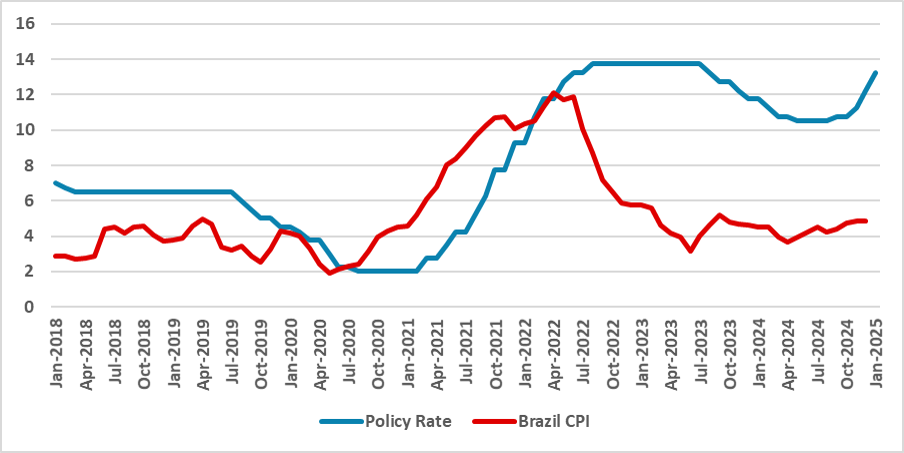

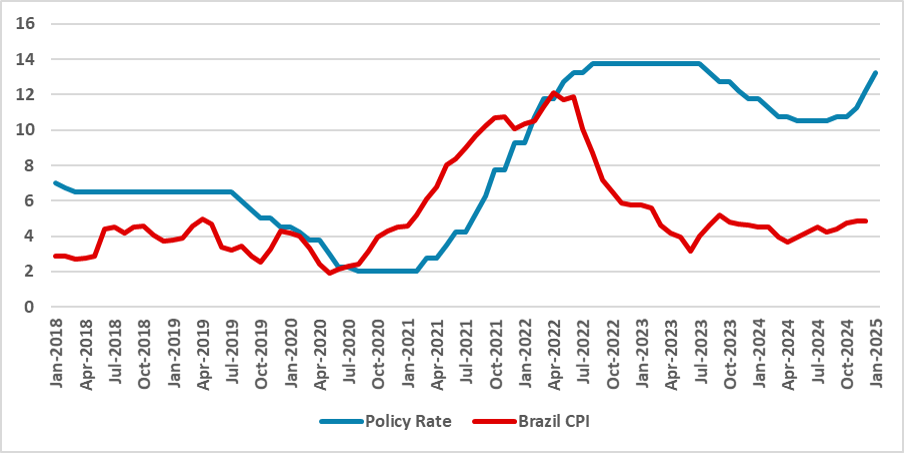

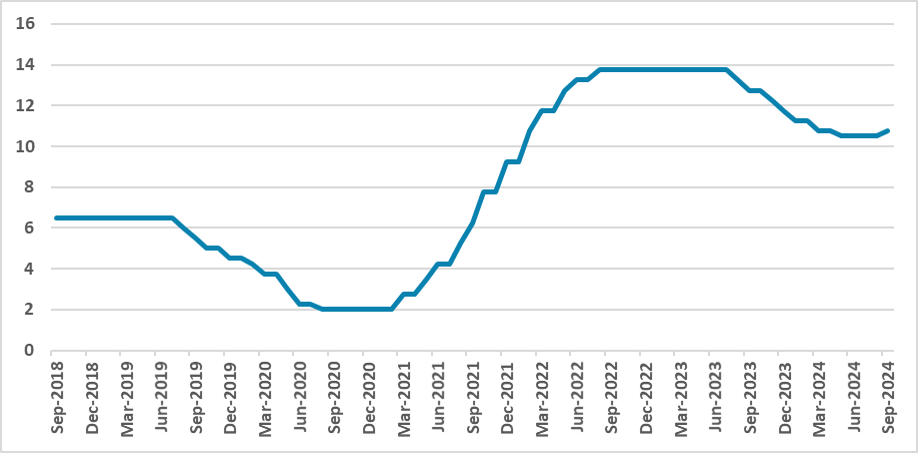

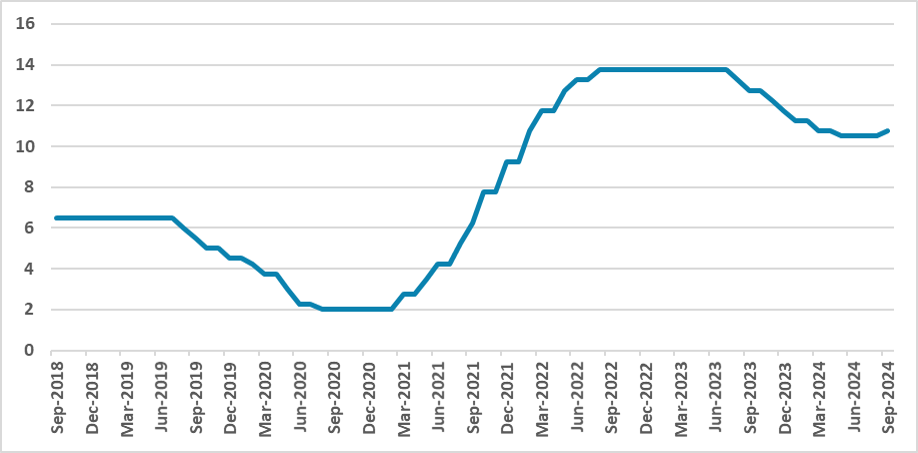

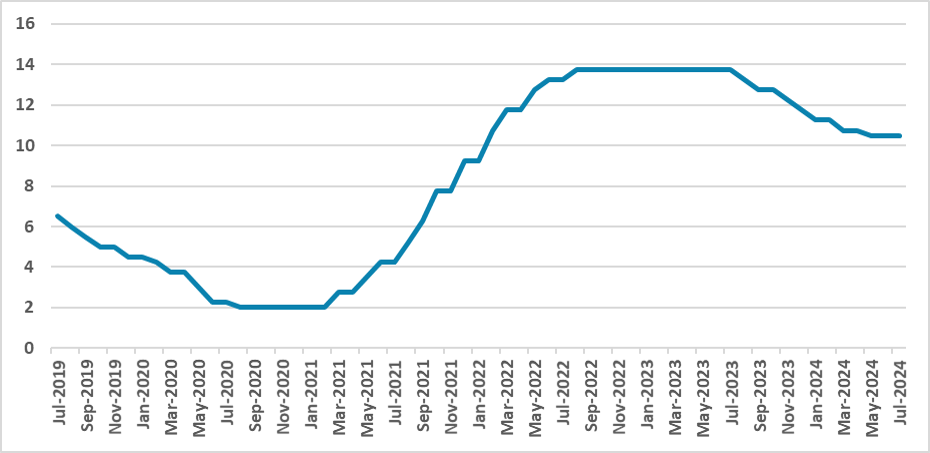

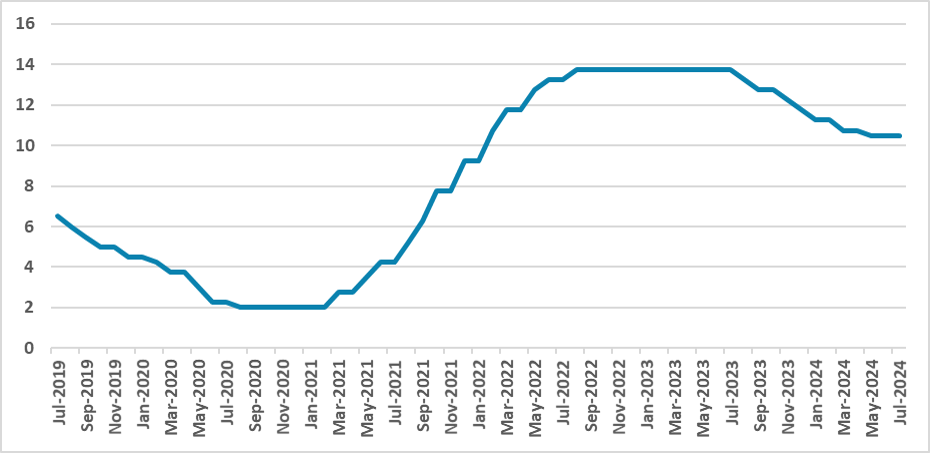

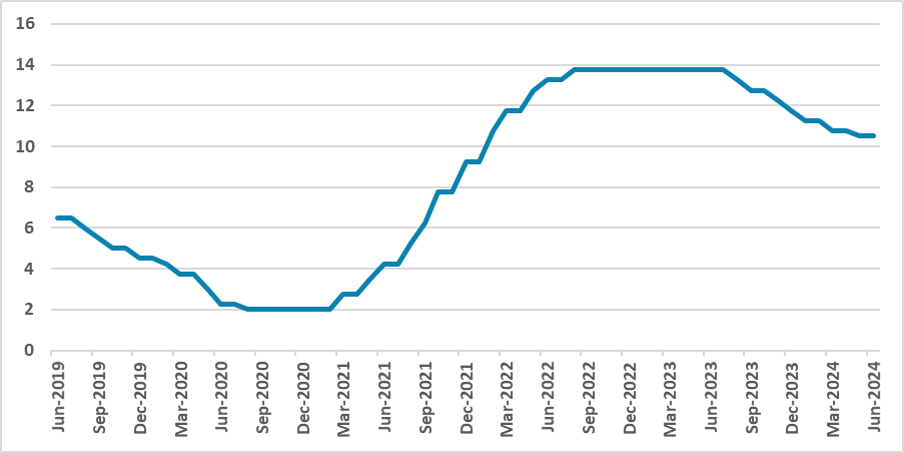

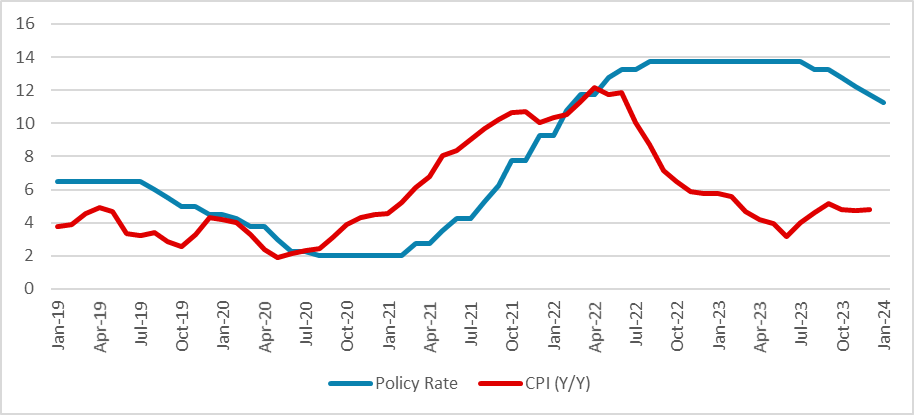

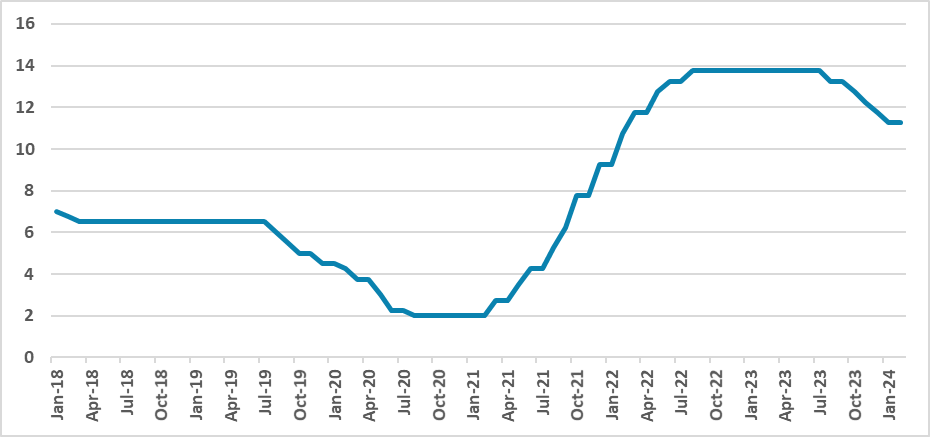

The Brazilian Central Bank (BCB) raised the policy rate by 100bps to 14.25% amid signs of economic deceleration, including slower growth, job creation, and consumption. The BCB highlighted external uncertainties, such as U.S. trade policy, and domestic challenges with rising inflation. It emphasized

March 19, 2025

BCB Review: Confirming More Hikes

March 19, 2025 10:38 PM UTC

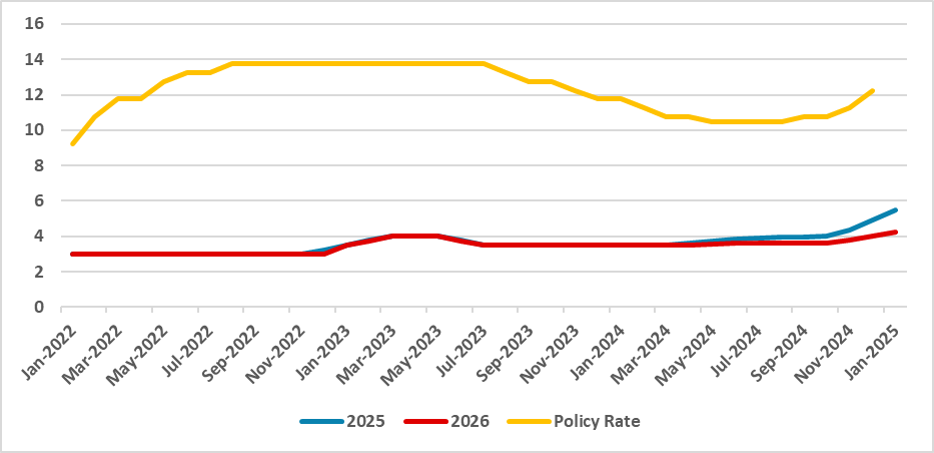

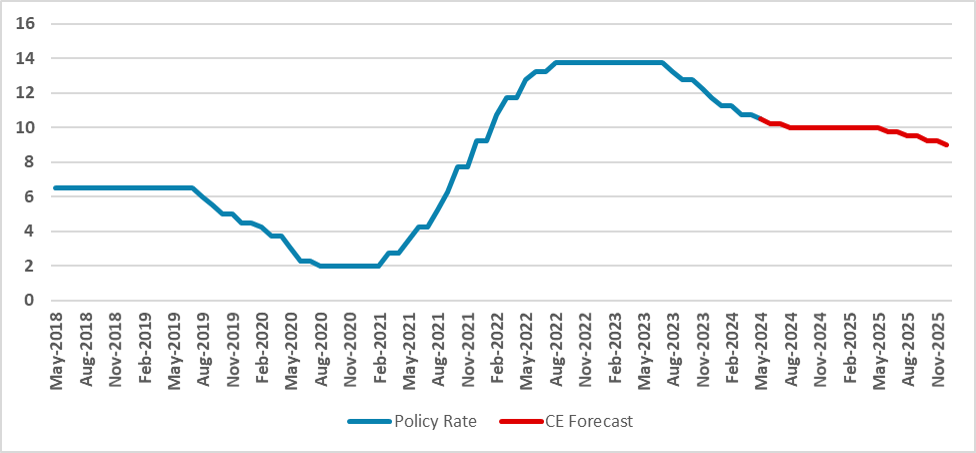

The Brazilian Central Bank (BCB) raised the policy rate by 100 bps to 14.25% and signaled further hikes, likely reaching 15.0% by May, potentially ending the current tightening cycle. The BCB emphasized inflation concerns and strong economic activity, suggesting a hawkish stance. Fiscal policy was n

February 04, 2025

BCB Minutes: Detailing the Deterioration

February 4, 2025 6:29 PM UTC

The BCB raised rates by 100bps to 13.25%, signaling another hike in March. External uncertainty remains, but domestic risks worsened, with inflation expectations rising. The BCB stressed fiscal-monetary coordination and warned about policy distortions. Despite markets pricing a 15% rate, we expect s

January 30, 2025

BCB Review: Maintaining the Course

January 30, 2025 6:09 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate by 100bps to 13.25%, signaling another hike in March while monitoring economic data. The statement had a neutral-to-dovish tone, with inflation risks stemming from services CPI, unanchored expectations, and fiscal policy. Market projections see

January 27, 2025

BCB Preview: 100bps Hike Will Buy Some Time

January 27, 2025 7:09 PM UTC

The Brazilian Central Bank is expected to maintain its course with two 100bps hikes, reaching 14.25% by March. Inflation forecasts for 2025 exceed the target, necessitating a firm policy stance. Despite market concerns, new President Gabriel Galípoli is likely to act decisively. The Real’s recent

January 20, 2025

Brazil Risk Premia and EM Debt

January 20, 2025 8:15 AM UTC

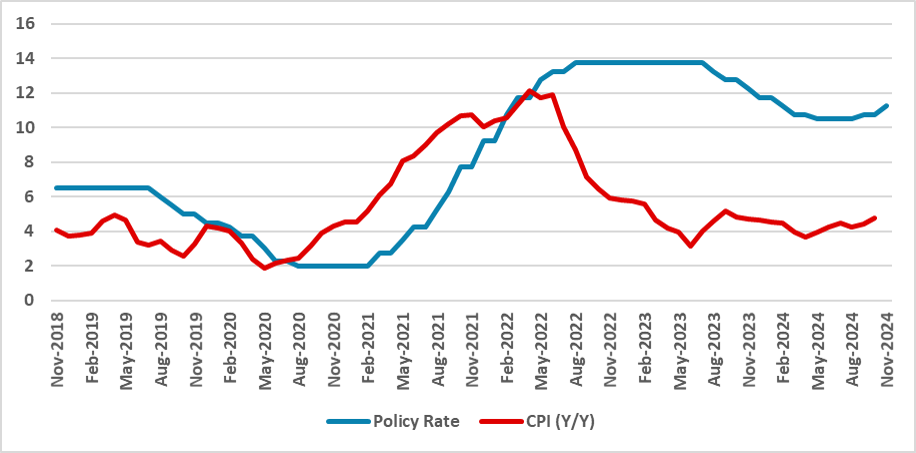

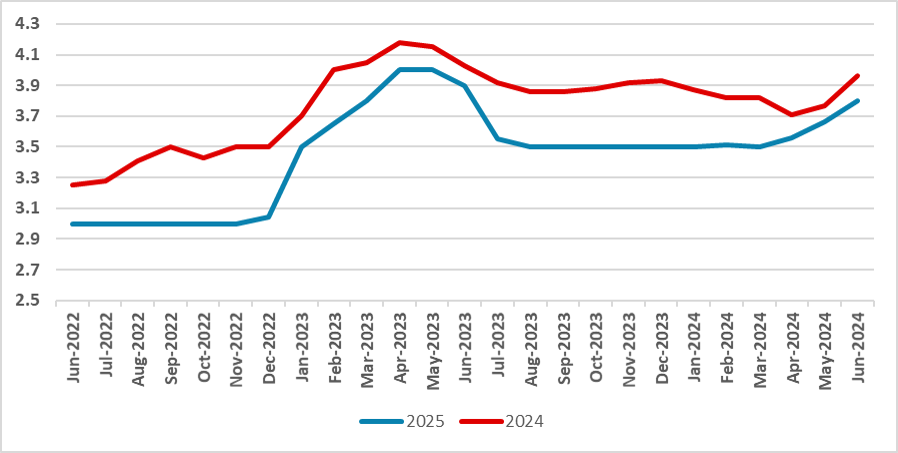

Brazil debt market has two domestic crises rather than a spillover from the U.S. in the form of inflation and fiscal policy. Very restrictive BCB policy can help produce some disinflation and we forecast 4.1% for 2026, which some allow some rate cuts in H2. Brazil risk premium will likely be reduced

January 02, 2025

EM Government Debt: BRICS Divergence

January 2, 2025 8:05 AM UTC

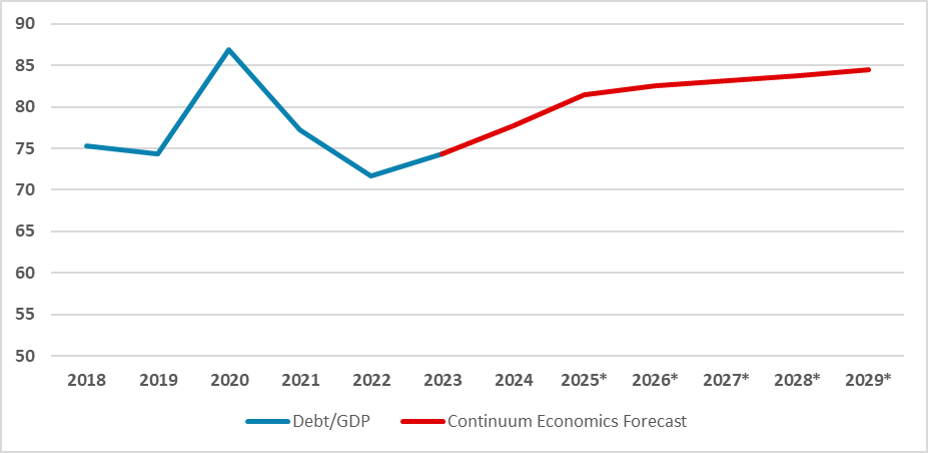

Brazil and South Africa suffer from debt servicing costs outstripping nominal GDP, which will remain a concern unless a consistent primary budget surplus is seen – though S Africa enjoys a much longer than average term to maturity than Brazil. India and Indonesia, in contrast, enjoy nominal

December 20, 2024

EMFX Outlook: Hit From Tariffs, Before Divergence

December 20, 2024 10:00 AM UTC

· EM currencies on a spot basis will remain on the defensive in H1 2025, as we see the U.S. threatening and then introducing tariffs on China imports – 30% against the current average of 20%. China’s response will likely include a Yuan (CNY) depreciation to the 7.65 area on USD/CN

December 12, 2024

BCB Review: Shock 100bps Hike

December 12, 2024 10:12 AM UTC

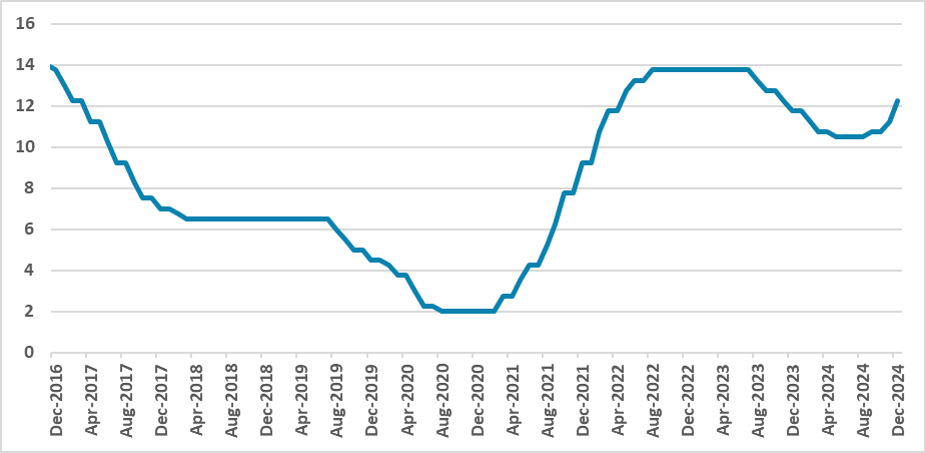

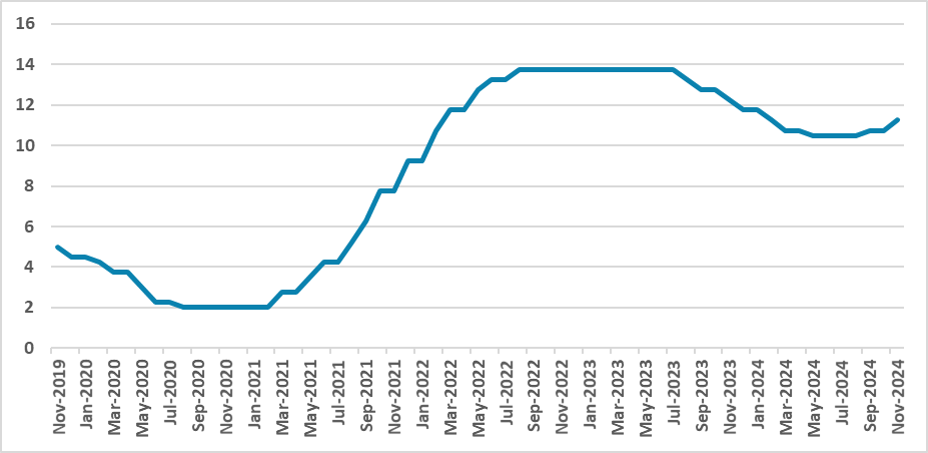

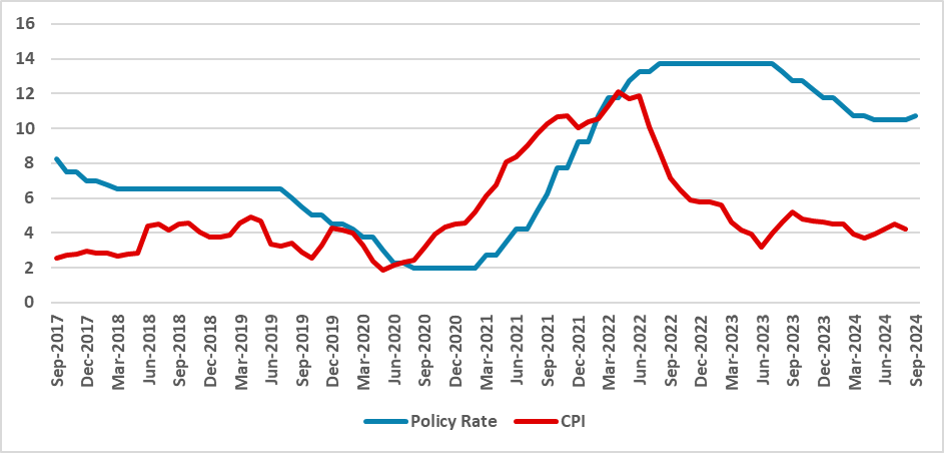

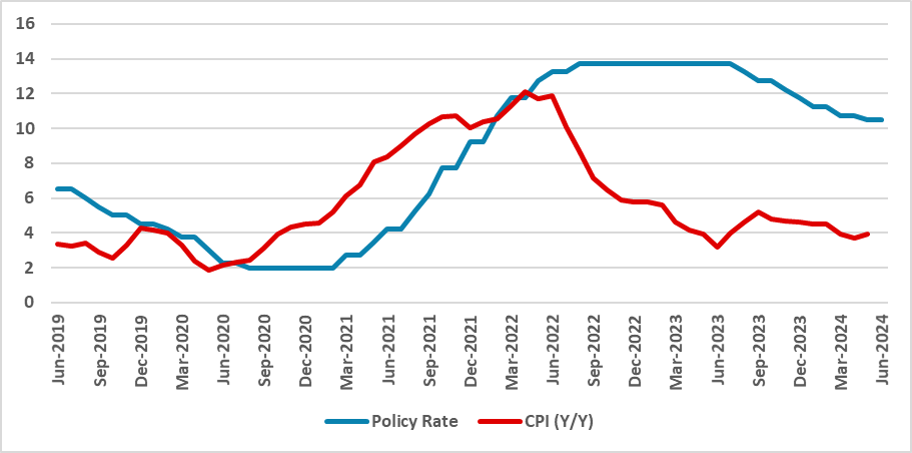

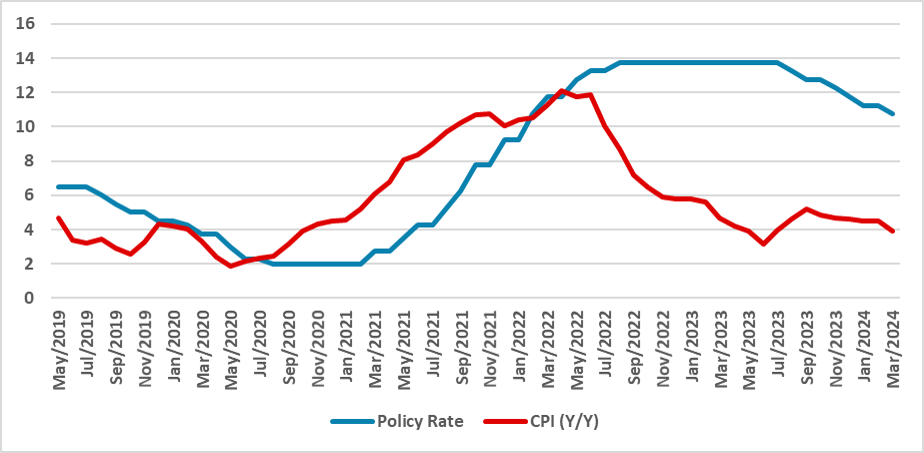

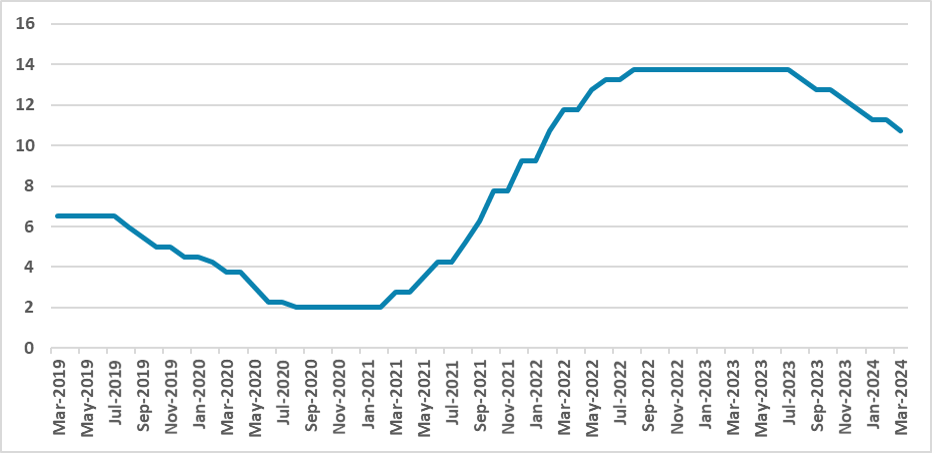

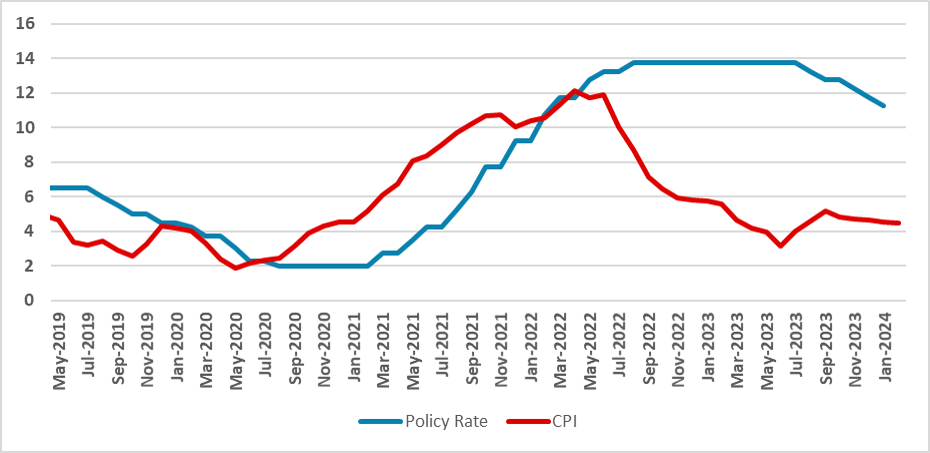

The Brazilian Central Bank raised the policy rate by 100bps to 12.25%, with plans for two more 100bps hikes, reaching 14.25% by early 2025—the highest in 18 years. The decision reflects fiscal concerns, inflation risks, and a 10% depreciation of the Real. The BCB aims to curb inflation and protect

November 12, 2024

BCB Minutes: Hawkish and Indicating Hikes

November 12, 2024 2:49 PM UTC

The Brazilian Central Bank (BCB) remains hawkish, raising rates by 50 bps to 11.25% amid resilient domestic growth and unanchored inflation expectations. Key concerns include rising uncertainty in the fiscal landscape and exchange rate volatility, prompting cautious monetary policy. The BCB signals

November 07, 2024

BCB Review: Unanimous 50bps Hike

November 7, 2024 2:19 PM UTC

The Brazilian Central Bank raised its policy rate by 50 basis points to 11.25%, signaling heightened concerns over inflation risks driven by domestic dynamics and global uncertainties. While noting external volatility and fiscal policy impacts, the BCB emphasized that persistent inflation requires a

November 04, 2024

BCB Preview: 50bps Hike and More to Come

November 4, 2024 8:05 PM UTC

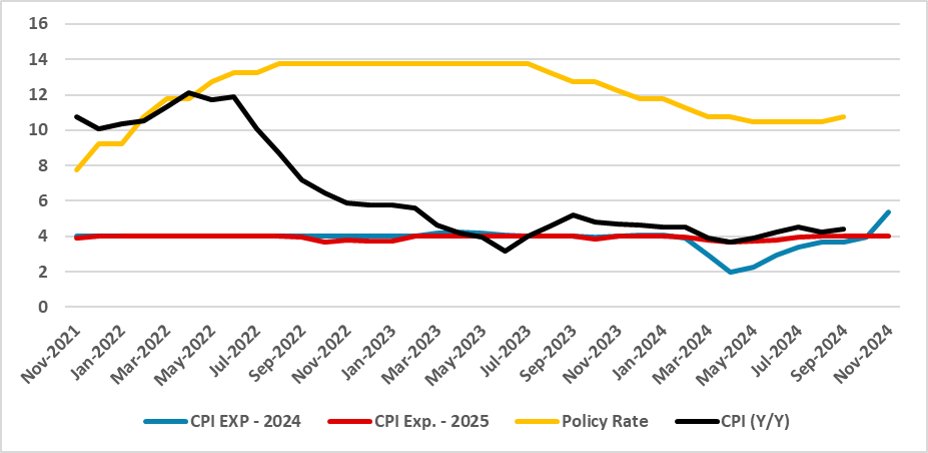

The Brazilian Central Bank (BCB) is expected to raise rates by 50bps in November to curb rising inflation, which could exceed the 4.5% upper limit if inflationary shocks persist. Market concerns focus on food prices, a strong labor market, and external exchange rate pressures. The new BCB President,

October 25, 2024

Brazil: High Expenditure Levels Challenge Fiscal Stability

October 25, 2024 5:40 PM UTC

Brazil’s fiscal data through August shows a primary deficit of 2.3% of GDP, with expenditure growth outpacing revenue gains despite efforts to increase government income. Social transfers and unemployment benefits contributed to rising expenditures, now at 20.2% of GDP. The Central Bank’s recent

October 17, 2024

Brazil: Demand and Imported Prices Lead Inflation Rise

October 17, 2024 6:33 PM UTC

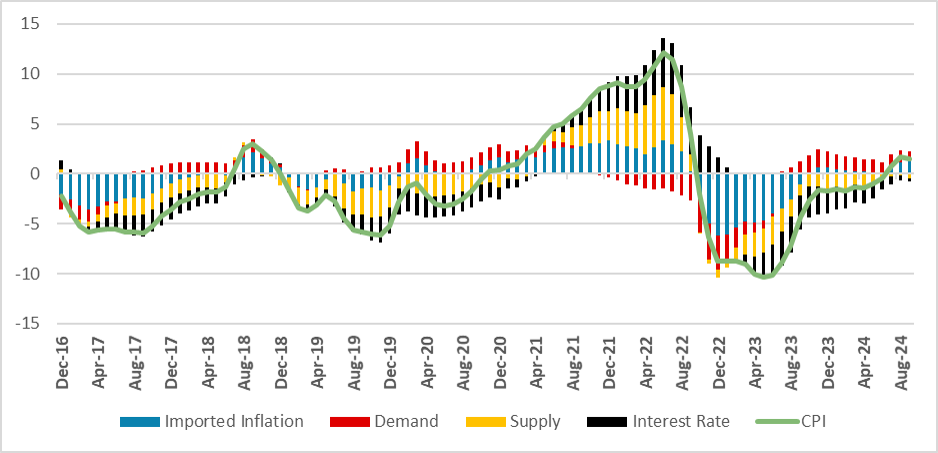

Our updated model shows that stronger-than-expected demand and BRL depreciation are driving Brazil’s inflation higher, while supply remains stable. Despite recent rate hikes, inflation expectations have risen, loosening monetary policy. We expect the BCB to implement two more 50 bps hikes before p

October 01, 2024

Brazil: Quarterly Inflation Report Shows BCB Worries

October 1, 2024 2:10 PM UTC

The Brazilian Central Bank's latest report highlights stronger-than-expected economic growth of 1.4% in Q2 and a positive output gap, raising inflation risks. While non-core inflation decreased, core measures like services inflation remain sticky. Credit growth continues to be robust, but fiscal pol

September 26, 2024

EM FX Outlook: Fed Easing Helps but Divergent Trends

September 26, 2024 8:00 AM UTC

USD strength is ebbing across the board, which provides a positive force for most EM currencies on a spot basis. However, where inflation differentials are large, the downward pressure will remain in 2025 e.g. Turkish Lira (TRY). Where inflation differentials are modest against the U.S., but

September 25, 2024

BCB Minutes: Adding Some Hawkishness to the Communique

September 25, 2024 1:44 PM UTC

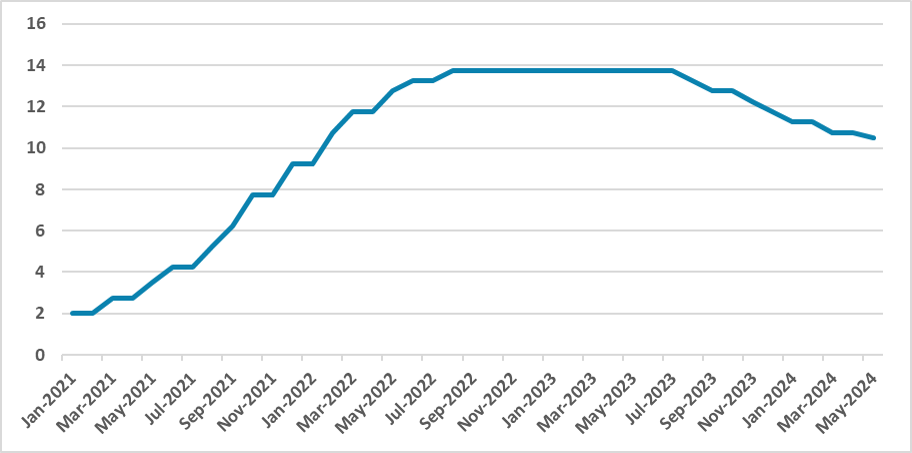

The Brazilian Central Bank raised the policy rate by 25 bps to 10.75%, citing stronger-than-expected economic activity and deteriorating inflation expectations. The committee highlighted rising inflationary pressures, especially in wages and credit growth. While future rate hikes are likely, no forw

September 19, 2024

BCB Review: Switching Back to Hikes

September 19, 2024 12:50 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate to 10.75%, signaling more hikes due to domestic pressures, including stronger economic activity and de-anchored inflation expectations. Despite global uncertainties, the decision reflects concerns about Brazil's positive output gap and fragile

August 14, 2024

EM Markets Divergence with China Harder Landing Concerns

August 14, 2024 3:35 PM UTC

Global market turbulence has had a spillover impact into EM, but also some EM assets have benefitted from rotation away from the U.S. What are the prospects in the coming months?

We see scope for a 2nd wave of U.S. equity and Japanese Yen (JPY) correction, which are a mixed influence for EM assets

August 06, 2024

BCB Minutes: Hawkish and Consideration over Hikes

August 6, 2024 2:55 PM UTC

The Brazilian Central Bank kept the policy rate at 10.5%, emphasizing a hawkish stance amidst global uncertainties and risk aversion. Inflation is projected at 3.2%, above the 3% target. The board remains cautious, with potential rate hikes if the economic situation worsens. A rate cut may be possib

August 01, 2024

BCB Review: A Hawkish Tweak

August 1, 2024 1:45 PM UTC

The Brazilian Central Bank (BCB) kept the policy rate unchanged at 10.5%, with a hawkish tone highlighting risks. Strong domestic growth and employment data persist despite monetary tightening. Inflation expectations for 2024 and 2025 are at 4.1% and 4.0%, respectively, above the 3.0% target. Fiscal

July 01, 2024

EM After the Elections: Fiscal Focus and Inflation Questions

July 1, 2024 8:05 AM UTC

Enhancing fiscal credibility is key post-election in India and S Africa, but also for Brazil. India, will do this in the 3 week of July, but S Africa needs to move from ANC/DA led coalition optimism to reality quickly. Brazil needs to stop the vicious circle of sentiment building up on fiscal slip

June 27, 2024

Brazil: Adoption of Continuous Targeting Means Not Much Change

June 27, 2024 1:28 PM UTC

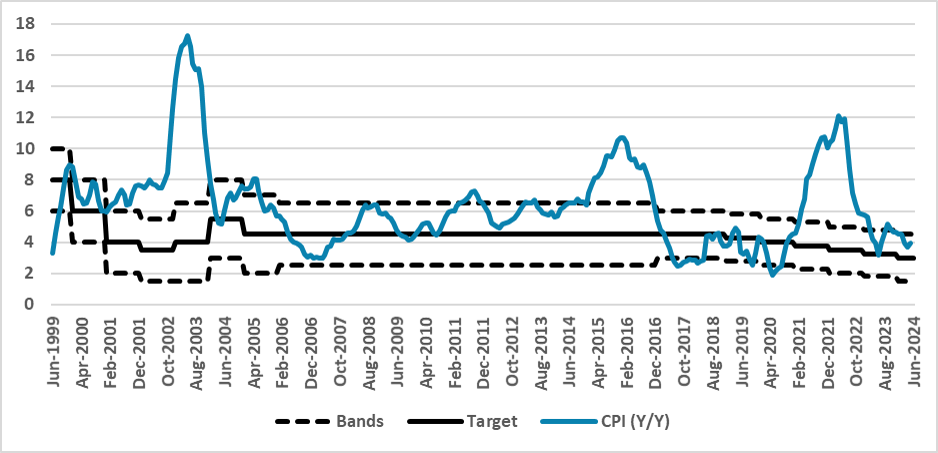

The Brazilian government has revised the BCB's inflation targeting framework, effective January 2025, to a continuous target system. If inflation exceeds the target bands for six consecutive months, the BCB must explain the discrepancy. The 3.0% target with 1.5% bands remains unchanged, alleviating

June 26, 2024

BCB Minutes: Deterioration of the Scenario Requires Higher Rates

June 26, 2024 1:32 PM UTC

The Brazilian Central Bank maintained the SELIC rate at 10.5%, emphasizing a unanimous, hawkish stance on inflation. Markets question BCB's inflation control with upcoming leadership changes. External uncertainties, domestic consumption surprises, and rising inflation expectations were highlighted.

June 25, 2024

EMFX Outlook: USD Strength to Ebb with Different EM Impact

June 25, 2024 8:05 AM UTC

We see Fed rate cuts from September starting to soften USD strength into year end and 2025. Beneficiaries will include currencies with inflation moving towards target and high real rates or, alternatively, undervalued currencies. This should benefit the Brazilian Real (BRL) and Indonesian Rupiah

June 19, 2024

BCB Review: A Pause in the Cutting Cycle

June 19, 2024 10:17 PM UTC

The Brazilian Central Bank kept the policy rate at 10.5%, citing economic uncertainty and a need for caution. Inflation expectations for 2025 are 3.8%, above the 3.0% target. Political interference concerns persist, but the unanimous decision indicates a technical approach. The BRL's depreciation ma

June 17, 2024

BCB Preview: A Pause Amid the Risks

June 17, 2024 2:34 PM UTC

The Brazilian Central Bank (BCB) is expected to maintain the SELIC rate at 10.5% amid external sector volatility, stubborn service inflation, and deteriorating inflation expectations. A hawkish majority on the board suggests a pause despite potential for cuts. Risks include rising food prices post-f

May 14, 2024

BCB Minutes: Worsening Conditions Demand Caution

May 14, 2024 2:35 PM UTC

The Brazilian Central Bank's latest meeting revealed a shift in forward-guidance, reducing the cut from 50bps to 25bps. While no immediate actions were taken, the minutes highlighted worsening conditions in three key areas: External Environment, Fiscal, and Economic Activity. Despite split votes on

May 09, 2024

BCB Review: 25bps Cut, No Additional Guidance

May 9, 2024 1:11 PM UTC

The Brazilian Central Bank convened, opting against a 50bps cut, reducing it to 25bps, lowering the policy rate to 10.5%. A split vote ensued, with 25bps winning 5x4. The communique, vague possibly due to board division, noted labor market and economic activity surpassing expectations. Foreign marke

May 06, 2024

BCB Preview: 25bps or 50bps cut?

May 6, 2024 1:02 PM UTC

The Brazilian Central Bank (BCB) convenes on May 8 to set the policy rate. Previous forward guidance hinted at a 50bps cut in May, but recent statements from BCB President Roberto and some weakness in the BRL have shifted expectations to a 25bps cut. However, we anticipate the BCB maintaining a 50bp

May 03, 2024

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

March 26, 2024

BCB Minutes: Doors Opens to Diminish the Cuts Pace in June

March 26, 2024 1:11 PM UTC

The Brazilian Central Bank has released the minutes of their last minutes. The minutes highlighted the uncertainty, labour market pressures and unanchored expectations. They decided to reduce the horizon of the 50bps ace to the May meeting which indicates a prospective reduction to diminish the pace

EM FX Outlook: Domestic Drivers Key

March 26, 2024 9:01 AM UTC

In terms of spot EM FX projections domestic drivers remain critical, with a desire to avoid appreciation versus the USD for some countries. Fed easing in H2 2024 should however help EMFX more broadly and allow some recovery in spot rates (e.g. Indonesian Rupiah (IDR), South African Rand (ZAR)

March 21, 2024

BCB Review: Forward Guidance Kept but Chance to be Taken Out Soon

March 21, 2024 12:50 PM UTC

The Central Bank (BCB) slashed the policy rate by 50bps to 10.75%, with further cuts anticipated. Medium-term easing hinges on inflation dynamics and economic factors. The BCB's forward guidance suggests a potential shift in communication and cut magnitude by June, changing the cut pace to 25bps fro

March 18, 2024

BCB Preview: 50bps Cut and Softer Forward Guidance

March 18, 2024 4:48 PM UTC

The Brazilian Central Bank is anticipated to cut the policy rate by 50bps, reaching 10.75%, amidst easing inflation and cautious market sentiment. The recent surge in food prices raises concerns, while the BCB is expected to abandon its usual forward guidance in favor of more data-driven decisions.

February 22, 2024

EMFX: Carry and Domestic Fundamentals Rather Than the USD

February 22, 2024 10:00 AM UTC

Bottom Line: Most major EMFX currencies have performed better than the Euro or the Japanese Yen against the USD in 2024 (Figure 1). This is due to carry trades in Latam, but elsewhere reflects global equity love on Indian equities or domestic fundamentals. This resilience for Brazilian Real/Indi

February 06, 2024

BCB Minutes: Caution within the Easing Cycle

February 6, 2024 1:22 PM UTC

The BCB released minutes detailing the 50bps cut to SELIC, shedding light on monitored risks. Despite a unanimous vote, differences in language emerged, especially regarding variables. Notably, new government-appointed members were present. Internationally, the board noted minimal impact from Fed de

February 01, 2024

BCB Review: 50Bps Cut Maintained

February 1, 2024 2:36 PM UTC

The Brazilian Central Bank (BCB) maintained a widely expected 50bps cut in the policy rate, bringing it down to 11.25% from 11.75%. The BCB's neutral communique highlighted caution in emerging economies amid global monetary tightening. The domestic scenario, aligned with contractionary policies, saw

January 29, 2024

BCB Preview: 50 bps Cut to Be Kept but Caution in the Communique

January 29, 2024 8:51 PM UTC

The Brazilian Central Bank is expected to continue cutting interest rates on January 31, aiming to address the overly contractionary policy rate of 11.75%. In the face of persistent inflation around 4%-5%, concerns include El Niño's impact on food prices and uncertainties in services inflation. Fis

January 26, 2024

Climate Change: 2025-30 Rather than Long-Term Impacts

January 26, 2024 4:15 PM UTC

Bottom Line: In the 2half of the 2020’s GDP in DM economies will benefit from climate change investment, though the net positive impact will likely be modest on an annual basis. The impact on EM economies will be more mixed, as lack of fiscal space restrains the scale of green investment and some

January 09, 2024

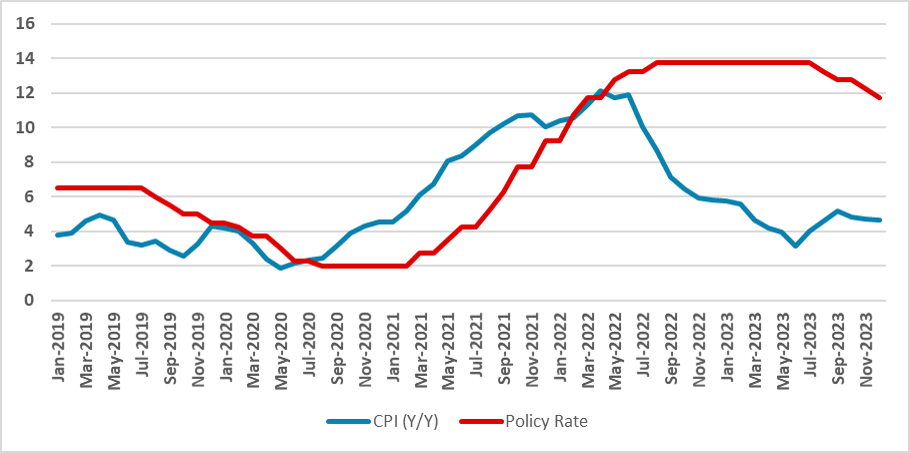

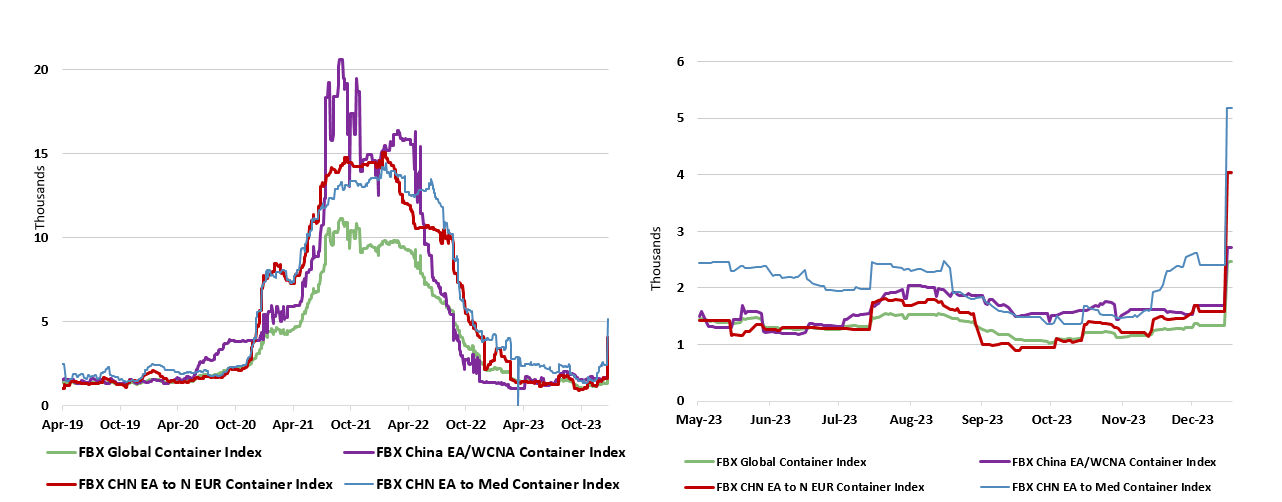

Shipping Freight Cost Jump and Inflation – Some Perspectives

January 9, 2024 2:24 PM UTC

Bottom Line: The attacks on Red Sea shipping have already triggered a marked rise in freight costs, and more broadly than just for the Red Sea route. Thus has led to some worries about the possible fresh upside risks to what have recently been sharply falling CPI inflation rates. These worries a

January 03, 2024

AI and Technology Impact on Growth and Inflation

January 3, 2024 10:30 AM UTC

Bottom Line: The full benefits of the latest AI wave will likely not kick in until the late 2020/early 2030’s.However, 5G over the last couple of years has been enabling more connectivity via the Internet of Things and allowing more big data analysis, including AI tools and algorithms. In the 2hal

November 16, 2023

November 01, 2023

AI and Technology Impact on Growth and Inflation

November 1, 2023 10:01 AM UTC

Bottom Line: The full benefits of the latest AI wave will likely not kick in until the late 2020/early 2030’s.However, 5G over the last couple of years has been enabling more connectivity via the Internet of Things and allowing more big data analysis, including AI tools and algorithms. In the 2ndh

October 16, 2023

Climate Change: 2025-30 Rather than Long-Term Impacts

October 16, 2023 2:15 PM UTC

Bottom Line: In the 2ndhalf of the 2020’s GDP in DM economies will benefit from climate change investment, though the net positive impact will likely be modest on an annual basis. The impact on EM economies will be more mixed, as lack of fiscal space restrains the scale of green investment and som