BCB Review: 50Bps Cut Maintained

The Brazilian Central Bank (BCB) maintained a widely expected 50bps cut in the policy rate, bringing it down to 11.25% from 11.75%. The BCB's neutral communique highlighted caution in emerging economies amid global monetary tightening. The domestic scenario, aligned with contractionary policies, saw a deceleration and disinflation in line with BCB projections. While 2024 expectations are slightly above the 3.0% target, the BCB looks ahead to 2025. Modest fiscal comments emphasize pursuing a 0% target, and the unanimous decision suggests committee convergence. The BCB emphasizes maintaining the interest rate on contractionary terrain, indicating a measured approach despite external uncertainties.

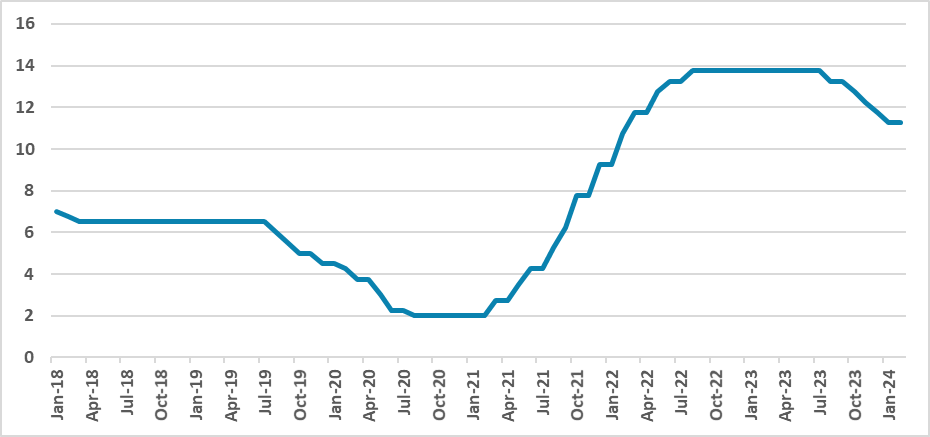

Figure 1: Brazil’s Policy Rate (%)

Source: BCBThe Brazilian Central Bank (BCB) has convened to decide on the policy rate. In a decision widely expected by the markets, the BCB has maintained the 50bps cut from the previous meetings. Therefore, the policy rate fell to 11.25% from 11.75%. The BCB communique had a neutral tone. Regarding the foreign markets, the BCB stated that in a situation where global monetary conditions are generally tighter, emerging economies need to be cautious regarding their own monetary policy.

On the domestic front, the BCB stated that the recent deceleration is in line with the anticipated scenario due to the lagged effects of the contractionary monetary policy. Additionally, the disinflationary process also occurred in line with the BCB projections. Expectations for 2024 are standing at 3.8%, a bit above the 3.0% BCB target, but at the moment, the BCB is already looking towards 2025. Expectations for inflation for this year are standing at 3.2%, much closer to the 3.0% BCB target. This should give some confidence for the BCB to start cutting.

Regarding the fiscal situation, the BCB's comments were modest. They only stated that it is important to pursue the current target, which at the moment stands at 0%, which we believe is not achievable for end-2024. Interestingly, neither comment was made regarding the new industrial policy, which we believe has a certain impact on monetary policy as it tends to increase subsidized credit, reducing monetary policy power. Whether the impact of the four directors indicated by the government is starting to impact BCB communication is yet to be seen. However, it is important to note that the decision was unanimous, indicating some convergence of thought in the committee.

We will have more information when the minutes come out, but the communique advanced the importance of keeping the interest rate on contractionary terrain, which justifies maintaining the cuts at the 50bps rate. There is no rush in bringing the policy rate closer to the neutral levels, as the outlook demands serenity, but the risk of needing some pause in the middle of the cutting cycle could be fading away, at least according to the BCB communication. For the moment, internal conditions are speaking louder than the external ones.