BCB Minutes: Caution within the Easing Cycle

The BCB released minutes detailing the 50bps cut to SELIC, shedding light on monitored risks. Despite a unanimous vote, differences in language emerged, especially regarding variables. Notably, new government-appointed members were present. Internationally, the board noted minimal impact from Fed decisions. Labor market paragraphs highlighted wage responsiveness. The BCB remains cautious, anticipating resilience in consumption amid ongoing cuts.

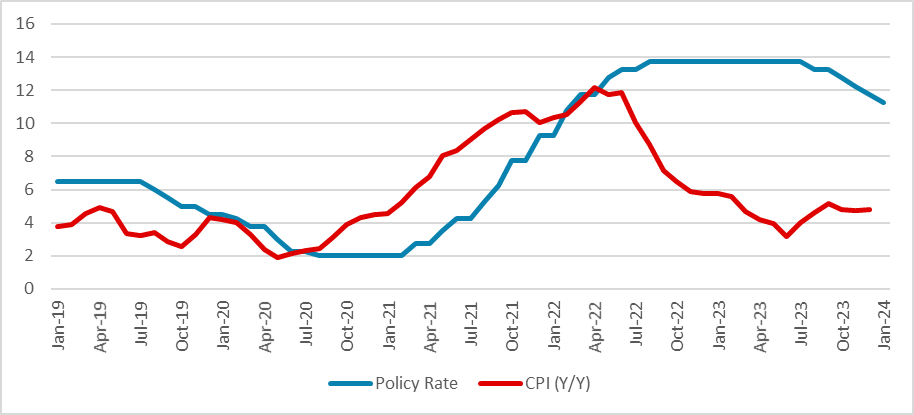

Figure 1: Brazil’s Policy Rate and CPI (%) Source: IBGE and BCB

Source: IBGE and BCB

The Brazilian Central Bank (BCB) has released the minutes of its last meeting, during which it cut the policy rate (SELIC) by 50bps to 11.25%. The minutes offer interesting insights into the main risks that the BCB is monitoring. Although the vote for the 50bps cut was unanimous, the language of the minutes differed somewhat from previous ones, especially in terms of the detail of the variables they are examining. It is important to remember that this was the first meeting for new members appointed by the government. At the moment, 5 of the 9 members had already been appointed by the new government.

Regarding the international scenario, the board stated that the situation remains uncertain. However, they also added that there is no direct synchronization between domestic and foreign levels, which basically translates to the recent decision by the Fed having little effect on the policy rate. Indeed, rather than the external level of interest rates, the gap with the policy rate is still significant, warranting some buffer for the internal interest rate. The general impact on the exchange rate has been low, resulting in lesser inflationary impact.

Additionally, some paragraphs related to the labor market were added. Wages have recently responded, indicating that the labor market is tighter than previously thought. Although this does not directly translate into higher inflation, it could indicate more demand pressures. The BCB stated that they will remain cautious in this scenario. Furthermore, the recent deceleration of the economy was mostly in line with the BCB's scenario. According to the BCB, the next data will show some resilience in consumption due to higher wages and social transfers, while investments are expected to be weaker.

The BCB stated that they have already incorporated higher food prices into their scenario due to El Niño but seemed little worried about a broad inflationary impact. According to them, disinflation is occurring as expected, but they stated that in a situation of growing salaries and unanchored expectations, it will be important to maintain the policy rate at contractionary levels. They announced they will continue cutting at a 50bps pace in the next meeting, but the situation going forward will mostly depend on the data and the disinflation process. From this, it is mostly clear that the cuts will not accelerate, but some slowing down or a pause is not yet discarded. We will maintain our view that a pause is likely to be applied in May, although we are diminishing this probability for the moment.