Shipping Freight Cost Jump and Inflation – Some Perspectives

Bottom Line: The attacks on Red Sea shipping have already triggered a marked rise in freight costs, and more broadly than just for the Red Sea route. Thus has led to some worries about the possible fresh upside risks to what have recently been sharply falling CPI inflation rates. These worries are so far contained and we think this makes sense, as the freight price rises are purely supply driven and may not persist for more than few more months. Thus they are in no way similar to the surge in freight seen during and after the pandemic. Even with these considerations in mind, it is very difficult to estimate the possible size and persistence of any inflationary impact. Regardless, below we assess the factors to bear in mind and juxtapose these against the well-known but largely illustrative estimates made by the IMF two years ago which suggest a doubling in freight costs that lasts a year would add 0.7 ppt to global inflation. With the current surge more contained to the Red Sea and likely to last only a few months we see a much smaller inflation impact being likely, not least given weak global demand.

Figure 1: Freight Cost Surge in Perspective

Source: DataStream

How Long?

Houthi rebels have been attacking some ships in the Red Sea in recent weeks. The key question is how long this will last? One line of thinking is that the Houthi attacks are part of Iran axis of resistance alongside attacks on the U.S. in Iraq and intermittent missile exchanges between Hezbollah and Israel. However, the Houthi relations with Iran have been more pragmatic and less about command and control from Tehran. Iran’s primary objective also remains letting the U.S. ease out of the region and pivot to Asia, while a major escalation from Iran or its axis of resistance would do the opposite. A second explanation is that the Houthi attacks are in solidarity with Palestinians in Gaza and will likely decrease as the war in Gaza comes to an end – most likely by the spring. Additionally, too intense attacks by Houthis in the Red Sea would risk money from Saudi Arabia as part of the Yemen peace deal that had been getting to an advanced stage. This deal is designed to bring peace, partially by funneling oil revenues from the south to the north, where Houthi rebels are based. Thus on balance we see the Houthi attacks in the Red Sea continuing for a couple of months, but then decrease into the spring.

Differences From the Pandemic

In shipping terms, the reverberations from the shock of the pandemic are still very fresh in most memories, as the sea freight industry (almost 90% of global trade is conducted on a maritime basis) and faces another possible storm in the Red Sea. This time around as terrorist attacks have persuaded many shipping companies to divert away from using the Red Sea. But the shock is purely supply driven and seemingly limited to a narrow channel of trade worth only some 10-15% of the global aggregate and where the repercussions are hitherto restricted to higher costs of shipping rather than restricting the actual amount of potential exports. In contrast, the pandemic accentuated supply chains problems; ports lost dockers who were sick or locked down while ship crews couldn’t cross borders because of public health restrictions. All of this against came a backdrop of pent-up demand from huge fiscal stimulus support programs, all a contrast to the more subdued demand backdrop of late.

As a result, the cost of shipping increased over seven-fold in the 18 months following March 2020, far more than the doubling that has occurred of late (Figure 1). Notably, the current cost surge is fairly broad geographical and not restricted to the Red Sea shipping channel (but where the costs surge for the latter is the most marked). This we think is a reflection of the fact that diverting ships around the Cape instead would effectively reduce shipping capacity as it would add considerably to the length of shipping journeys and where effective insurance costs will have risen markedly too.

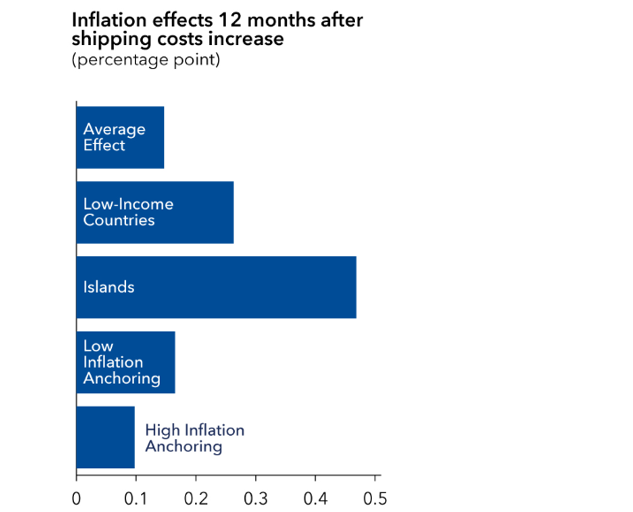

Figure 2: A Doubling in Costs – Illustrative Impact

Source: IMF, The impact of shipping cost shocks on measures of national inflation (percentage points)

Inflation Repercussions

This doubling in shipping costs coincides with the benchmark study from the IMF in assessing the impact on CPI inflation. This study found that shipping costs are an important driver of inflation around the world: when freight rates double and that this jump lasts a full year, inflation picks up by about 0.7 percentage point. However, the pass-through to inflation is less than that associated with fuel or food prices—which account for a larger share of consumer purchases—shipping costs are much more volatile. The study also notes that while higher shipping costs hit prices of imported goods at the dock within two months, and quickly pass through to producer prices, the impact on the consumer prices is more gradually, hitting its peak after 12 months, a much slower process than what is seen after a rise in global oil prices.

Figure 3: A Doubling in Costs – A Varying Impact

Source: IMF

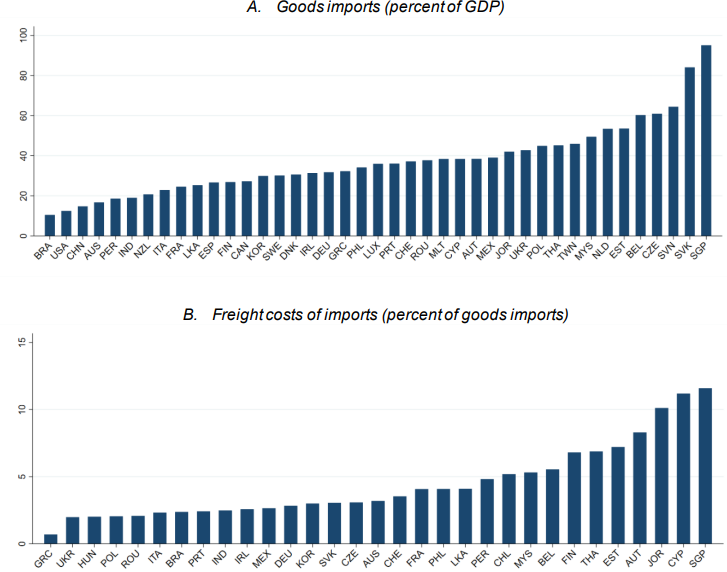

Notably, higher shipping costs affect inflation in a far from uniform way across countries. Several factors play a part: the share of imports relative to GDP; how integrated economies are into global supply chains; how land-locked they are and the degree of economic development (Figure 3).

Overall, the IMF estimate makes sense and to us embodies a whole array of factors that affect the speed, size and breadth of how a rise in freight costs spill over into higher consumer prices. Some of the imponderables include the initial level of freight costs and the initial level of CPI inflation, with a key issue (known as non-linearity) being whether larger shocks tend to result in higher and/or faster rates of pass-through to consumer prices. Overall, the impact can be assessed to reflect the aggregation of four key factors; size of jump in freight costs; the share of global trade; the shipping costs share of import costs; and the import share of GDP (Figure 4), all of which vary markedly over time and across countries

Regardless, the IMF study is a useful benchmark, suggesting as it does that a doubling in freight costs that lasts a year would add 0.7 ppt to global inflation. With the current surge more contained to the Red Sea and likely to last only a few months we see a much smaller inflation impact being likely, not least given weak global demand.

Figure 4: National Import Intensities and Spending on Freight

Source: IMF