BCB Preview: 50bps Cut and Softer Forward Guidance

The Brazilian Central Bank is anticipated to cut the policy rate by 50bps, reaching 10.75%, amidst easing inflation and cautious market sentiment. The recent surge in food prices raises concerns, while the BCB is expected to abandon its usual forward guidance in favor of more data-driven decisions. Dissonant voices may emerge regarding the pace of cuts, but a continued contractionary monetary policy is likely until inflation targets are met.

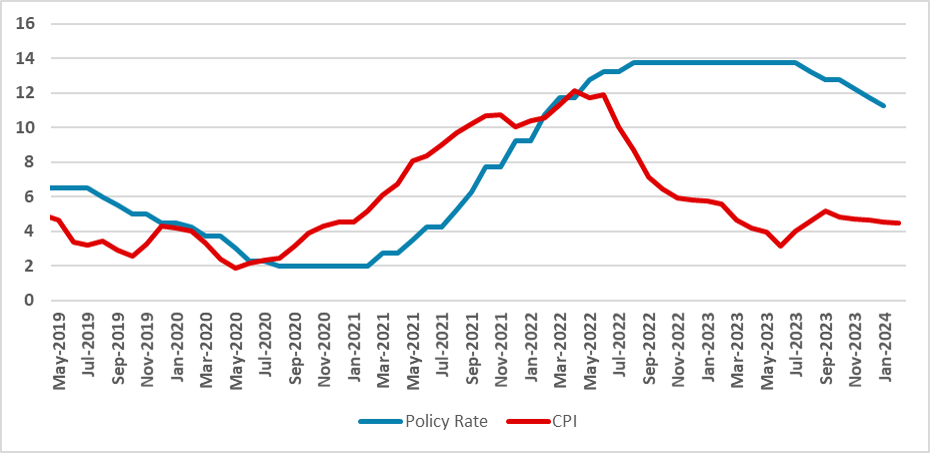

Figure 1: Brazil’s CPI and Policy Rate

Souce: IBGE and BCB

The Brazilian Central Bank will convene on March 20 to decide on the policy rate. As widely expected by the market and advanced in their last meeting, the BCB will likely cut the policy rate by 50bps, lowering it to 10.75%. The case for cutting the policy rate continues to be strong due to the easing of inflation, but we believe we will see some caution from the BCB in their communique. The recent surge in Food and Beverages indicates caution, although most of this shock is seen as temporary and should ease soon. El Niño could still affect food prices in the future. Additionally, consumption tends to be stronger this year.

We believe that due to the degree of cuts already made, the BCB will abandon their usual forward guidance of 50bps cuts, leaving the magnitude of the cuts open and to be decided according to the available data. We are no longer seeing the BCB applying any sort of pause as before. Core inflation is decreasing a bit faster than we expected, but we now see the BCB only slowing down the pace of cuts to 25bps.

Dissonant voices are likely to start to appear in the communique. In the last meeting, the decisions have been unanimous, but we believe some dissenting voices are likely to start to appear. The discussion to slow down the pace in the next meeting will not be unanimous among the BCB board, as some advocate for a quicker move towards neutral rates while others will be worried about fiscal policy and unanchored expectations. Needless to say, monetary policy will need to continue to be contractionary as inflation has not reached its target.

We believe the 25bps cuts are likely to be the winners in this dispute, meaning the policy rate is likely to end 2024 at 9.25%. There would still be some road to reach the neutral level, but the degree of monetary tightening is likely to diminish in 2024, which should at least diminish the headwinds from monetary policy in the Brazilian economy.