BCB Preview: 50 bps Cut to Be Kept but Caution in the Communique

The Brazilian Central Bank is expected to continue cutting interest rates on January 31, aiming to address the overly contractionary policy rate of 11.75%. In the face of persistent inflation around 4%-5%, concerns include El Niño's impact on food prices and uncertainties in services inflation. Fiscal challenges further complicate the situation, with a likely pause in rate cuts anticipated by May 2024.

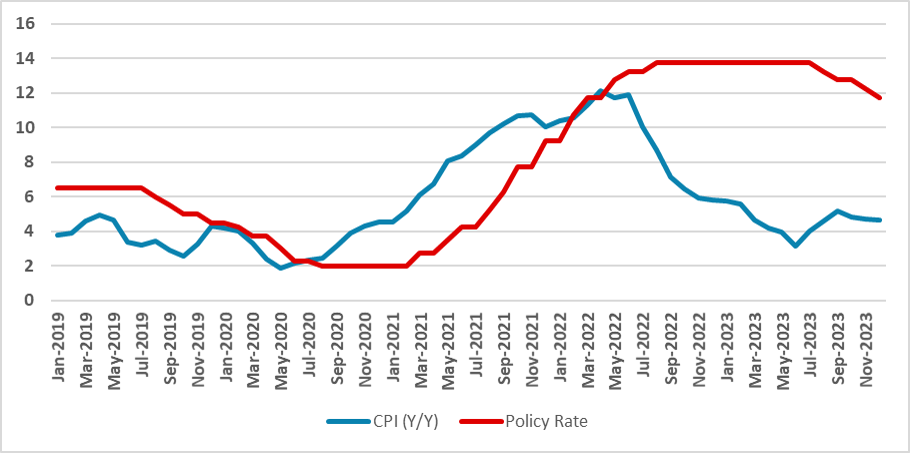

Figure 1: Brazil CPI and Policy Rate Source: BCB and IBGEThe Brazilian Central Bank (BCB) will convene on January 31 to decide the policy rate (SELIC). It is widely expected that the BCB will continue to cut interest rates by 50 bps, as they have usually done in their latest meetings. At the moment, the policy rate stands at 11.75%, while the inflation rate stands at 4.6%. In the latest months, inflation has been showing some persistence around the 4%-5% mark. Still, the policy rate is excessively contractionary at the moment, and the main question for 2024 is by how much the cuts will bring the policy rate down.

Source: BCB and IBGEThe Brazilian Central Bank (BCB) will convene on January 31 to decide the policy rate (SELIC). It is widely expected that the BCB will continue to cut interest rates by 50 bps, as they have usually done in their latest meetings. At the moment, the policy rate stands at 11.75%, while the inflation rate stands at 4.6%. In the latest months, inflation has been showing some persistence around the 4%-5% mark. Still, the policy rate is excessively contractionary at the moment, and the main question for 2024 is by how much the cuts will bring the policy rate down.

One of the risks the BCB is monitoring is both the risk of El Niño on food prices, over which the BCB has little control, and services inflation. In January, it is clear that food prices will accelerate above the 1% margin (m/m). Although on an annual basis, food inflation is low, there is a possibility that food prices will consistently rise in the next months. In services, the impact will be straightforward in January due to readjustments in health services and in some rents. However, the impact on the upcoming months is still dubious; the Brazilian economy is clearly decelerating, but services prices are somewhat sticky.

It will also be interesting to see whether there will be some comments around the fiscal situation. The fiscal deficit has increased strongly in 2023, and although the government stated they will stick with the 0% deficit (here), we believe this target will be clearly unreachable in 2024. Additionally, the government announced a new industrial policy (here). Different from the past, a large part of the credits offered by this policy will not be subsidized, which indeed does not have the same past potential to interfere with the monetary policy mechanism. We expect some warning comments from the BCB on these two facts.

The path moving forward is not 100% clear. The BCB will need to decide whether they will stop or reduce the pace of cuts. We believe there is no room to accelerate the cuts' pace due to the food and services CPI aligned with a worse fiscal situation. We maintain our call that in May, the BCB is likely to announce a pause in the