EM Central Banks

View:

August 21, 2025

Bank Indonesia Delivers Surprise Second Rate Cut to Shield Growth

August 21, 2025 5:10 AM UTC

BI is opting for early stimulus while macro buffers remain strong—stable rupiah, low inflation, and manageable deficits. However, this window may close quickly if external risks materialise. Business leaders should expect a monetary pause in Q3, but prepare for moderate volatility if inflation or

August 20, 2025

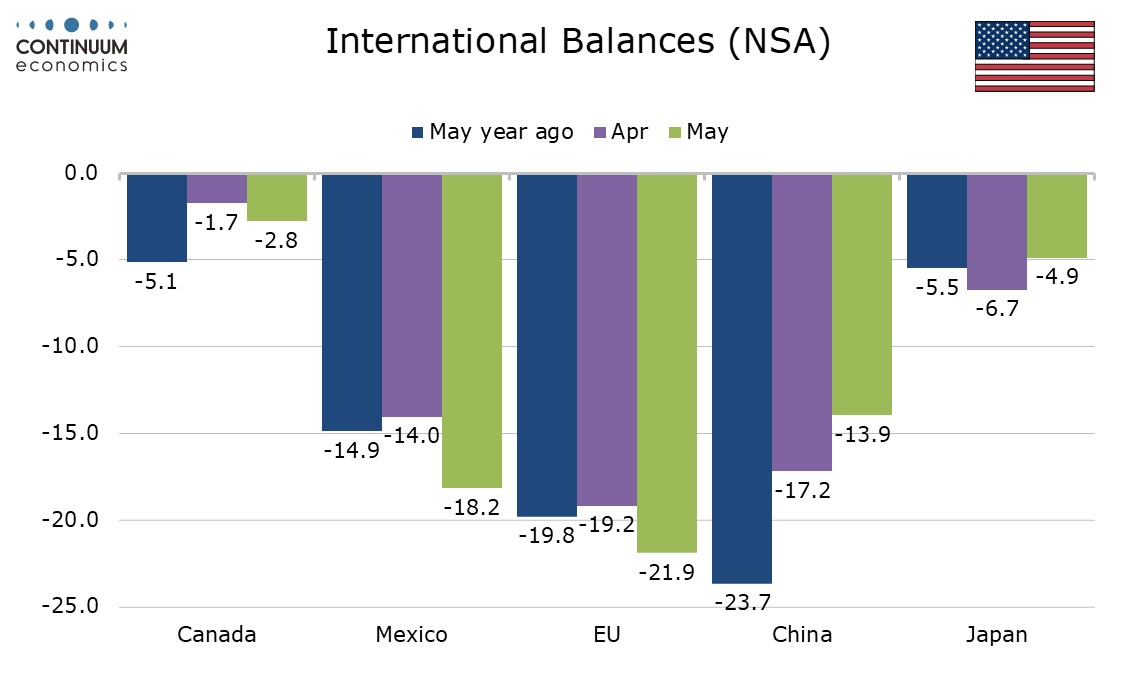

U.S./China Trade Deal: Slow Progress

August 20, 2025 10:25 AM UTC

· Overall, we would attach a 50% probability to a trade framework deal being announced in Q4, though this is unlikely to be comprehensive and could merely be a collection of measures. Even so, the risk also exists of trade negotiations dragging onto 2026 and then reaching a deal or fa

August 19, 2025

China Slow Diversification: Gold And Others

August 19, 2025 8:05 AM UTC

China’s diversification from U.S. Treasuries appears to be at a slow pace. Gold is the obvious alternative if geopolitical tensions were to rise or skyrocket in the scenario of a China invasion of Taiwan. However, Gold holdings are merely creeping higher and suggesting no urgency from China

Rate Hold Expected as Bank Indonesia Eyes H2 Trade Risks

August 19, 2025 6:26 AM UTC

With headline inflation still well-contained, core pressures softening, and the economy showing signs of resilience, Bank Indonesia is expected to keep rates on hold. Further easing may come later in H2—but only if external risks re-intensify or domestic growth falters.

August 15, 2025

China Slowdown In July

August 15, 2025 7:03 AM UTC

• Retail sales sluggishness reflects households cautious due to the hit to housing wealth and uncertainty over jobs and wage growth. Investment softness reflects not only residential property weakness, but also a slowdown in government infrastructure. This weakness could see a top up fi

August 13, 2025

China: Echoes of Japan?

August 13, 2025 8:05 AM UTC

Overall, some of China’s private businesses and households are suffering from Japan’s style balance sheet recession. Combined with slowing productivity and a shrinking workforce, this points to slower trend growth in the coming years. However, fiscal stimulus and the clean-up of Loca

August 08, 2025

Mexico: Further 25bps Cuts Ahead

August 8, 2025 6:44 AM UTC

Banxico forward guidance, plus trade policy risks with the U.S. now see us forecasting an end 2025 policy rate at 7.25% with two 25bps cuts in September and December. We now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rat

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

August 06, 2025

No Rush to Ease: RBI Flags External Risks, Holds Policy Steady

August 6, 2025 4:39 PM UTC

The RBI held the policy rate at 5.5% in its August 2025 meeting, opting for a strategic pause after front-loading 100bps of cuts earlier this year. While inflation has dropped sharply, global trade risks and sticky core prices argue against further easing for now. The central bank’s neutral stance

August 05, 2025

Indonesia Q2 GDP Beats Expectations

August 5, 2025 9:45 AM UTC

Q2’s outperformance gives Indonesia’s economic planners breathing space. Investment recovery is a strong positive signal, but sustaining growth in H2 will depend on policy agility, export resilience, and keeping domestic consumption robust.

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

August 03, 2025

Indonesia’s Trade Surplus Widens Sharply in H1 2025 Despite Tariff Headwinds

August 3, 2025 4:43 PM UTC

Indonesia’s June trade numbers reflect a strong first-half export performance, bolstered by frontloading ahead of US tariffs. The 62-month surplus streak highlights ongoing resilience, but softer trade momentum in H2 is anticipated as the tariff impact begins to filter through.

Indonesia’s July CPI Rises on Food Prices, But BI Still Has Room to Ease

August 3, 2025 3:27 PM UTC

Despite a food-driven uptick in July CPI, Indonesia’s inflation remains comfortably within Bank Indonesia’s target range. BI retains room to cut rates further in H2—though global uncertainty, particularly around US trade policy and Fed moves, may temper the pace of easing.

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 31, 2025

SARB Cuts Key Rate to 7.0% Given Subdued Inflation; Lower CPI Goal Announced

July 31, 2025 3:32 PM UTC

Bottom Line: Despite the uncertainty around United States tariffs and rising domestic food inflation, South African Reserve Bank (SARB) reduced the policy rate by 25 bps to 7.0% during the MPC on July 31 as annual inflation hit 3.0% YoY in June coupled with eased core inflation, and a relatively sta

July 29, 2025

China/U.S. Trade Talks Into the Autumn

July 29, 2025 8:20 AM UTC

· Our baseline (Figure 1) remains that a U.S./China deal will be reached (most likely in Q4), but a moderate probability exists of no deal being done this year and China being stuck with 30% tariffs – the worst-case scenario of still higher tariffs is now less likely with Trump in a

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 25, 2025

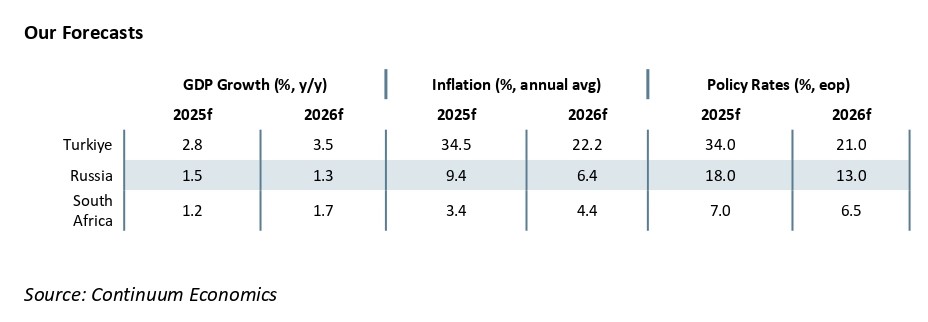

CBR Reduced its Key Rate to 18% as Inflation Softens

July 25, 2025 11:41 AM UTC

Bottom Line: As we expected, Central Bank of Russia (CBR) reduced policy rate by 200 bps to 18% on July 25 taking into account that inflation slowed to 9.4% in June from 9.9% in May; MoM price growth marked the lowest hike after August 2024; and the inflation expectations declined to 13% in June fro

July 24, 2025

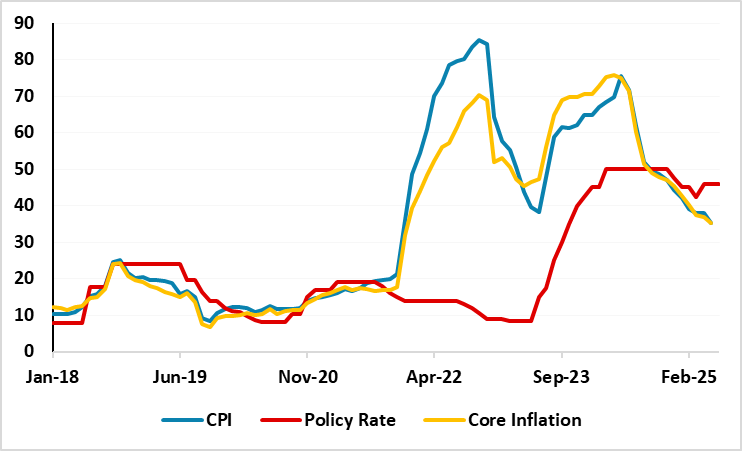

Easing Cycle Restarts: CBRT Reduced the Key Rate to 43% on July 24

July 24, 2025 2:15 PM UTC

Bottom Line: As we expected, Central Bank of Republic of Turkiye (CBRT) reduced the policy rate by 300 bps to 43% during the MPC meeting on July 24 taking the deceleration trend in inflation and relative TRY stability in June into account. CBRT highlighted in its written statement that the underly

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

July 23, 2025

Trump Deals: Japan, Philippines and Indonesia

July 23, 2025 8:26 AM UTC

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadlin

July 17, 2025

Trump’s Tariffs and Markets

July 17, 2025 12:00 PM UTC

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely

July 15, 2025

China: GDP Resilient in Q2, But

July 15, 2025 7:30 AM UTC

• We do see H2 weakness relative to H1, as exports to the U.S. will slow again and the effects of the government consumption trade in programs fades. However, H1 has been higher than our forecasts and thus we are revising 2025 GDP growth to 4.8% v 4.4% previously. We keep 2026 GDP growt

July 14, 2025

Tariffs: Seeking a Trigger for the TACO Trade

July 14, 2025 4:28 PM UTC

It has been fairly clear for some time that 10% represented a likely floor for the eventual Trump tariff regime. However, expectations that Trump would not be willing to go dramatically above that are being tested. A rate in the mid-teens still looks the most likely outcome, as the economic damage t

July 04, 2025

China: Housing Still A Headwind

July 4, 2025 9:00 AM UTC

Last October, China’s government support package has helped turn residential property less negative and our baseline is that residential property will likely deduct around 0.75% from 2025 growth and 0.5% from 2026. However, the risks for the economy could turnout worse than our baseline view on

July 03, 2025

Indonesia CPI Review: CPI Inches Up, But BI Still Has Room to Ease

July 3, 2025 8:12 AM UTC

Indonesia’s inflation edged up to 1.87% yr/yr in June on higher food prices, but overall price pressures remain subdued. With CPI well within Bank Indonesia’s target range and growth momentum softening, the central bank retains room to cut rates again in the second half of 2025.

July 01, 2025

Trump Tariffs: Poker Face?

July 1, 2025 12:55 PM UTC

Our central scenario (but less than 50%) is towards a scenario of compromise, with some agreements in principle or trade framework deals, delays for most other negotiating in good faith but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be fol

June 30, 2025

U.S. and Asia Defense Partners

June 30, 2025 7:30 AM UTC

· Japan, S Korea and Australia could eventually agree to some extra commitment to increase (self) defence spending in the next 5-10 years though perhaps not targets like NATO countries. This could come as part of the trade deal negotiations currently underway. Japan and S Korea

June 27, 2025

Mexico: Back Toward Neutral Policy Rates

June 27, 2025 6:56 AM UTC

Banxico has cut by 50bps to 8.00%, while also signalling in its statement that further easing will now be data dependent. Our forecast is for easing to move to a 25bps pace and to come once a quarter – most likely in September and December. Some improvement in the monthly inflation trajectory woul

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Asia/Pacific (ex-China/Japan) Outlook: Slower Trade, Softer Inflation, and Looser Policy

June 24, 2025 9:24 AM UTC

· Asia’s growth profile in 2025 reflects a region navigating structural transition amid external strain. Investment-led economies like India are benefitting from infrastructure spending, industrial policy momentum, and political continuity. In contrast, trade-reliant markets such as V

EMEA Outlook: Global Uncertainties and Domestic Dynamics Continue to Dominate

June 24, 2025 7:00 AM UTC

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.4% in 2025 and 2026, respectively, despite upside risks to inflation such as power cuts (loadshedding), tariff hikes by Eskom, spike in food prices, and global uncertainties. We see growth to be 1.2% and 1.7%

June 23, 2025

Iran: Measured Next Steps?

June 23, 2025 3:17 PM UTC

A measured or modest Iran retaliation could be used by the U.S. to seek a path back towards negotiation. Israel would likely want to continue to degrade Iran nuclear and military facilities, but the U.S. could eventually pressure Israel to stop. This is our baseline, though the military attac

June 19, 2025

Hawkish Stance Maintained: CBRT Held the Key Rate Stable at 46% Despite Softening Inflation

June 19, 2025 7:49 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) held the policy rate unchanged at 46% during the MPC on June 19 despite inflation continues to ease. CBRT highlighted in its written statement that the tight monetary stance will be maintained until price stability is achieved via a sustained decline in in

June 16, 2025

China: Retail Sales Reasonable

June 16, 2025 7:25 AM UTC

• Retail sales in May was helped by government trade in programs, but the overall retail sales momentum is reasonable. The industrial production slowdown looks to have been driven by the U.S. tariff chaos in April/May, which has become less adverse after the Geneva trade truce with the U.

BI Likely to Keep Rates Unchanged Amid Global Volatility

June 16, 2025 5:41 AM UTC

Bank Indonesia is expected to hold rates at 5.50% in June after two cuts earlier this year, opting for a pause amid global uncertainty. Subdued inflation and a stable rupiah provide policy space, but the central bank is likely to wait for clearer signals from the Fed. A fresh rate cut remains likely

June 12, 2025

Trump Tariffs: China and July 9 Reciprocal Deadline

June 12, 2025 7:17 AM UTC

We attach a 65% probability to a U.S./China reaching a new trade deal that reduces the minimum overall tariff to 15-20% imposed by the U.S., most likely agreed in Q4 2025 and to be implemented in 2026. However, a 35% probability exist of no deal and this could eventually mean higher tariffs (Fig

June 10, 2025

U.S. Deficit and Government Debt Concerns

June 10, 2025 9:00 AM UTC

The large U.S. budget deficit has helped push up 10yr real yields to 2% in 2024/2025, but both the budget deficit (heavy issuance) and government debt trajectories (sustainability and rating concerns) are key going forward if the 10yr budget bill passed is similar to the House Bill. Foreign acco

June 09, 2025

China Disinflation Rather than Deflation

June 9, 2025 7:27 AM UTC

May China CPI remains negative Yr/Yr, but the breakdown is consistent with disinflation rather deflation. Deflation could end up as a drag on the economy, but while growth remains close to the 5% target and CPI is regarded as disinflation rather than deflation, further policy easing will be slow.

June 06, 2025

Surprising Move: CBR Reduced Key Rate to 20% from 21%

June 6, 2025 1:10 PM UTC

Bottom Line: Despite predictions were centered around no change, Central Bank of Russia (CBR) cut policy rate on June 6 for the first time after September 2022 citing easing in inflationary pressures, including core inflation. CBR indicated in its written statement that CBR will maintain monetary co

June 04, 2025

Indonesia CPI Review: CPI Moderates Making Room For Rate Cut

June 4, 2025 9:55 AM UTC

Indonesia’s inflation slowed further in May, while the country’s trade surplus narrowed to its lowest level in five years, deepening expectations that Bank Indonesia (BI) could pursue additional rate cuts later this year to cushion slowing domestic growth.

China Banking Problems

June 4, 2025 8:32 AM UTC

China is suffering a credit demand problem from households overexposed to property and private businesses that are cautious. Meanwhile, the latest IMF banking stress tests shows sections of the banking system remain weak and this is restraining lending. We remain watchful of money and credit tre

June 03, 2025

Nato Summit 5% Target and Trump

June 3, 2025 10:48 AM UTC

Trump’s natural instincts will likely see extra pressure applied on Europe in the coming weeks to commit to 5%, but we do not see existential threats from Trump. In the end, our baseline is that NATO will agree a “soft” aim of 5% (3.5% hard military spending and 1.5% infrastructure/cybersecu

June 02, 2025

Trump’s 50% Steel And Aluminum: Negotiating Leverage?

June 2, 2025 7:42 AM UTC

• President Donald Trump increase in steel and aluminum tariffs from 25% to 50% is not just about boosting the steel and aluminum industry. It also a demonstration that Trump remains in control of tariffs and can aggressively change tariffs to increase negotiating leverage. It is a mess

May 29, 2025

SA MPC Review: SARB Cuts Key Rate to 7.25% on May 29 Given Subdued Inflation

May 29, 2025 4:03 PM UTC

Bottom Line: South African Reserve Bank (SARB) reduced the policy rate to 7.25% during the MPC on May 29 highlighting that annual inflation remained below SARB’s target range of 3%-6% hitting 2.8% YoY in April coupled with eased core inflation in April and a stronger Rand. We think the recent with

Court Stops Trump Reciprocal and Fentanyl Tariff

May 29, 2025 7:18 AM UTC

• The Trump administration will likely follow a multi-track response by appealing the judgement but also fast-tracking section 232 product tariffs for pharmaceuticals and semiconductors. The administration could also consider section 301 or 122 tariffs (the latter 15% for 150 days against c

May 23, 2025

BI Cuts Rates to Cushion Growth Slowdown as Inflation Stays Benign

May 23, 2025 10:23 AM UTC

Bank Indonesia cut its benchmark rate by 25bps to 5.50% in May, citing subdued inflation and stabilising currency conditions. With Q1 growth slowing to 4.87%, the central bank has shifted focus to supporting domestic momentum, signalling potential for further easing in the second half of 2025.

Turkiye Inflation Report: CBRT Keeps Its End-Year Inflation Forecast at 24%

May 23, 2025 6:28 AM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released its second quarterly inflation report of the year on May 22, and kept its inflation forecast constant for 2025 at 24%. CBRT governor Karahan signalled to maintain a tight stance until a permanent decline in inflation is sustained and price stabili