Trump Tariffs: Poker Face?

Our central scenario (but less than 50%) is towards a scenario of compromise, with some agreements in principle or trade framework deals, delays for most other negotiating in good faith but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be followed by higher product tariffs later in the summer after section 232 reports, with the most likely being pharmaceuticals with a delay to allow production to shift back to the U.S. This would still be consistent with an eventual average effective tariff rate of 13-15%, which we outlined in the June U.S. Outlook and means a softening of U.S. growth and a temporary rise in CPI/PCE inflation (here). However, the outcome is highly uncertain and we also highlight two other scenarios re the July 9 drama.

U.S. commerce secretary is talking about up to 10 trade deals by the July 9 deadline, while President Donald Trump is pressuring Japan and Canada. What will happen?

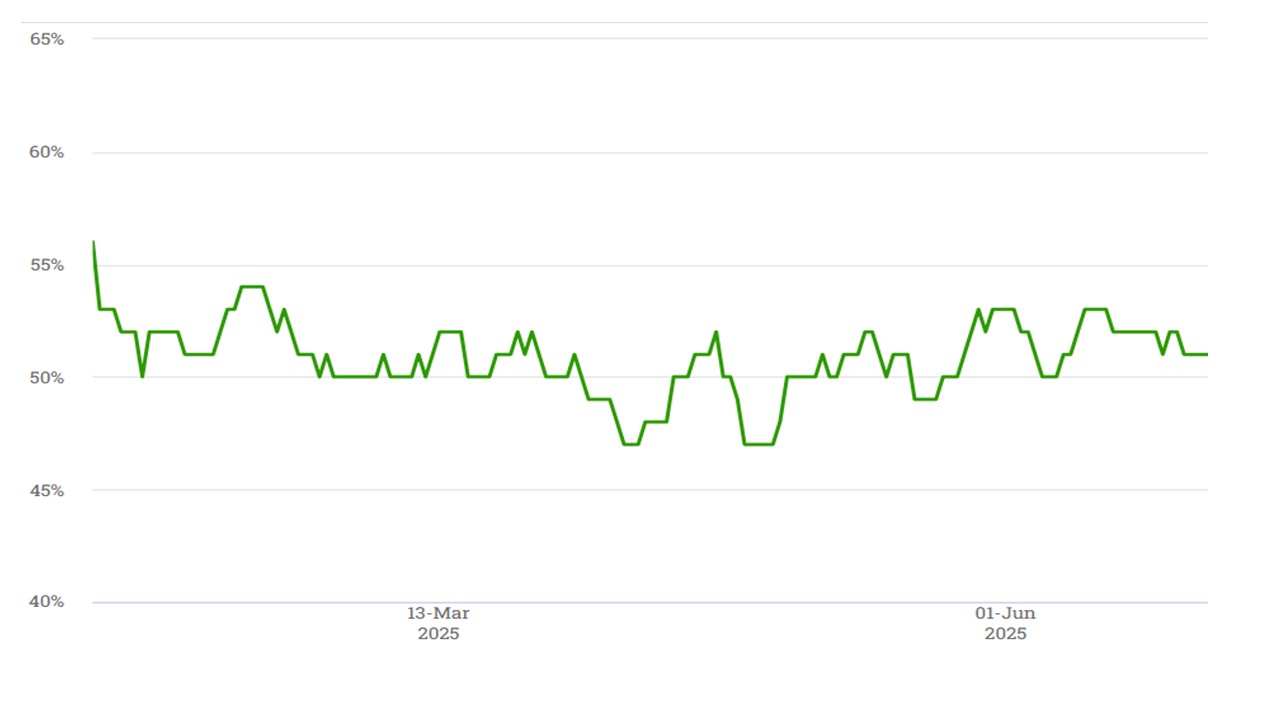

Figure 1: Trump Approval Ratings (%)

Source: Rasmussen

Normally we would do a specific scenario analysis for the tariff outcomes, but guidance is mixed and uncertainty high. The Trump administration would like to show more successful trade (framework) deals like the UK, but countries are either reluctant to accept U.S. terms or are concerned that they will concede to avoid higher reciprocal tariffs and then be hit by high product tariffs later in the summer (e.g. pharmaceuticals). We have three broad scenarios.

· U.S. compromise but with one/two country tariff rise. Reports (here) suggest that the Trump administration could have an interim step of an “agreement in principle” for avoiding higher reciprocal tariffs, with a trade “framework” deal then being finalized over the summer. This could be a few or half a dozen countries. This compromise could also involve some countries having a further 30-90 day delay in reciprocal tariffs, as they are negotiating in good faith or the Trump administration is not in advanced negotiations (e.g. smaller countries). Finally, the Trump administration could make an example of one or two countries and impose higher reciprocal tariffs, both to squeeze that country and also to provide an example for other countries. It looked like the EU would be the example, but the last week has seen U.S. commerce secretary Lutnick suggesting progress with the EU -- and also Canada over the weekend. Meanwhile, Trump has attacked Japan car imports and restrictions on US rice exports to Japan, while Japan has rejected U.S. demands to match Europe and spend 5% of GDP on defense (here). Japan could be made an example with 24% reciprocal tariffs after July 9. However, Japan is also a strategic military asset for the U.S. against China (here) and Japan also has an upper house election July 20. Spain (not signing up to 5% NATO commitment) or Vietnam (slow negotiating progress) could be more likely targets for Trump.

· Agreements or higher reciprocal tariffs. A harder approach from the Trump administration would be to impose higher reciprocal tariffs on a group of countries or all that are not negotiating in good faith. Trump has a flexible view on what negotiating in good faith means, which in the UK case was broadly fair for a framework deal but in other cases means benefitting the U.S. to reduce the bilateral trade deficit. Trump is also not under pressure, with the U.S. equity market having bounced back and his all important approval ratings having recovered from the April dip (Figure 1) – some other approval polls have been more volatile. Thus despite noises about trade deal progress from Bessant/Lutnick, Trump could still impose higher reciprocal tariffs on a group of countries. This could be at the April 2 rate or somewhere between 10% and the individual country rate. Moreover, it is possible for Trump to do this and then do a partial U turn in one or two weeks once he has made his point. This is high trade policy uncertainty for exporters and importers and a headwind for the U.S. economy.

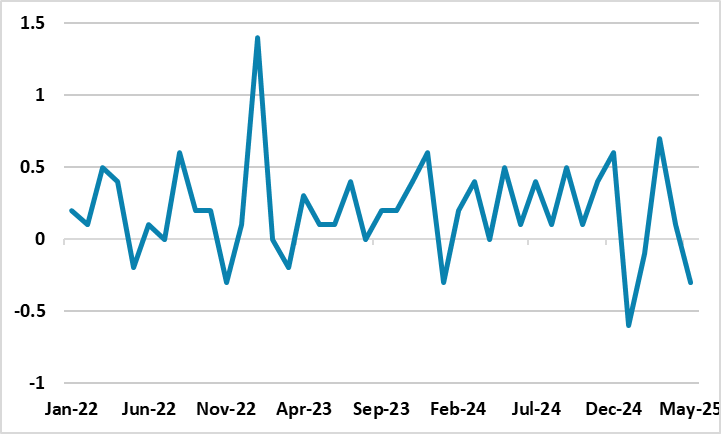

· Delay reciprocal tariffs again. A 3rd softer option is that Trump decides to delay the deadline for 30, 60 or 90 days, with the PR spin of some agreements in principle and positive negotiations on other countries. The economy is slowing, with real PCE becoming more volatile on a monthly basis (Figure 2) With the Supreme court having ruled that the Federal reserve is special and officials (e.g. Powell) cannot be sacked for political reasons, Trump’s repeated outburst to cut rates now perhaps also shows some concern about the economy behind the bravado.

Figure 2: Monthly U.S. Real PCE (%)

Source: Datastream/Continuum Economics.

Our bias is towards the 1st option of compromise, but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be followed by higher product tariffs later in the summer after section 232 reports, with the most likely being pharmacticals with a delay to allow production to shift back to the U.S. This would still be consistent with an eventual average effective tariff rate of 13-15%, which we outlined in the June U.S. Outlook and means a softening of U.S. growth and a temporary rise in CPI/PCE inflation (here).

For financial markets, the reaction to the July 9 reciprocal tariff drama will also be influenced by the final 10yr budget bill and incoming data (e.g. U.S. employment report and CPI). U.S. bonds are balanced to react, while the USD is less overvalued than April. We outlined our strategic views in the June Outlook for DM rates (here) and DM FX (here). Where we are concerned is the U.S. equity market that has now become clearly overvalued again on equity only and equity/bond valuations measures and would be vulnerable to any moderately bad news (see Equity Outlook (here)).