U.S./China Trade Deal: Slow Progress

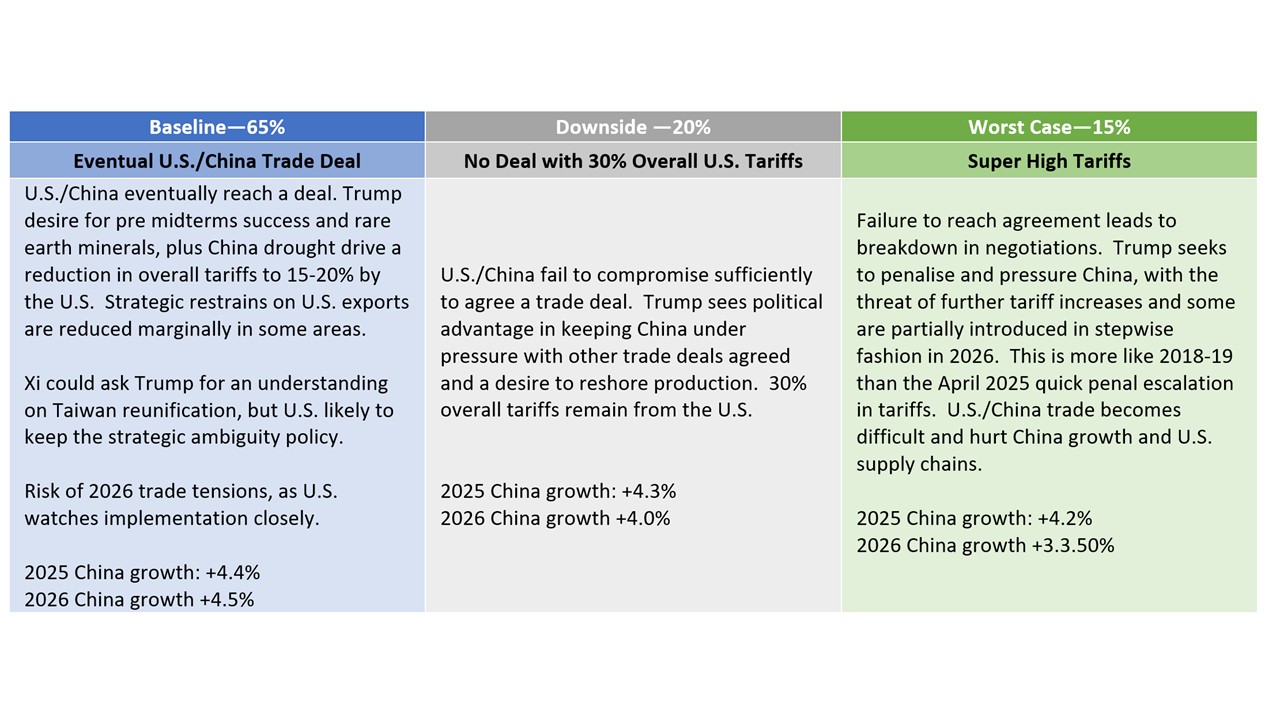

· Overall, we would attach a 50% probability to a trade framework deal being announced in Q4, though this is unlikely to be comprehensive and could merely be a collection of measures. Even so, the risk also exists of trade negotiations dragging onto 2026 and then reaching a deal or failing (Figure 1). Taiwan and China desire for concessions could prove sticking points.

Figure 1: U.S./China Trade Scenarios

Source: Continuum Economics

The second extension of the U.S./China trade truce to November 10 stands in sharp contrast to the 50% tariffs on Brazil and India and the 30% tariff on S Africa in terms of recent actions (here). The threat of secondary tariff over Russian oil is also receding for now, though it is noticeable that the U.S. is more interested in punishing India more on this matter. China is however still operating with 30% across the board tariff. What are the prospect of a U.S./China trade deal?

On balance, we still attach a 65% probability to a U.S./China trade deal being reached, though the odds of a Q4 deal are now down to 50%. U.S. President Trump is keen to reach a trade deal with China, both to show success before the November 2026 mid-terms elections and also given China control over rare earth minerals and magnets that Trump is particularly sensitive too. Trump has also softened strategic export controls in the shape of allowing Nvidia to start exporting high end semiconductor chips to China. Finally, large investment in the U.S. like the EU or Japan/S Korea trade deal are reported not to be required by the U.S. negotiating team. For now, the U.S. team wants to smooth the way towards a trade framework deal potentially by the expected bilateral meeting between President Trump and Xi at the APEC meeting October 30/November 1 in S Korea.

However, substantive talks are yet to agree on targets for U.S. imports into China or what China will do to open up to U.S. imports. Secondly, the Fentanyl issue has not been comprehensively addressed, though China has made some moves to reduce the flow of raw materials for Fentanyl. Reports in China also suggest that their negotiators are not in a hurry to conclude a trade deal, given their leverage over the U.S. over rare earth minerals. However, Trump can pivot from trade friendly to foe quickly, as India have found out. Overall, we would thus attach a 50% probability to a trade framework deal being announced in Q4, though this is unlikely to be comprehensive and could merely be a collection of measures.

Even so, the risk also exists of trade negotiations dragging onto 2026 and then reaching a deal or failing (Figure 1). China could drag the discussion out to extract more trade concessions from an impatient Trump. Alternatively, President Xi could ask Trump for an understanding that the U.S. would not become involved if China decided it need to take Taiwan by military force and hence ending the U.S. strategic ambiguity policy towards Taiwan. Xi knows that now is the time to ask for this understanding, rather than after a trade deal has been done and before the 2028 U.S. presidential election campaign gets underway in 2027. On balance, we feel that Trump would likely reject such a request and keep the strategic ambiguity policy on Taiwan, but this could lead to a delay in trade deal negotiations or a breakdown in talks.