Nato Summit 5% Target and Trump

Trump’s natural instincts will likely see extra pressure applied on Europe in the coming weeks to commit to 5%, but we do not see existential threats from Trump. In the end, our baseline is that NATO will agree a “soft” aim of 5% (3.5% hard military spending and 1.5% infrastructure/cybersecurity). The target date could be 2032 or later. In economic and financial terms, a U.S./Europe agreement at the NATO summit would remove an event risk. However, military spending would still take a long time to scale up outside of Germany, both given fiscal constraints and voters anti-military bias in southern Europe.

NATO is working on a plan of 3.5% of GDP hard military spending and 1.5% infrastructure/cybersecurity to meet Trump’s 5% ambition. Could Trump still cause an upset before or at the June 24 NATO summit?

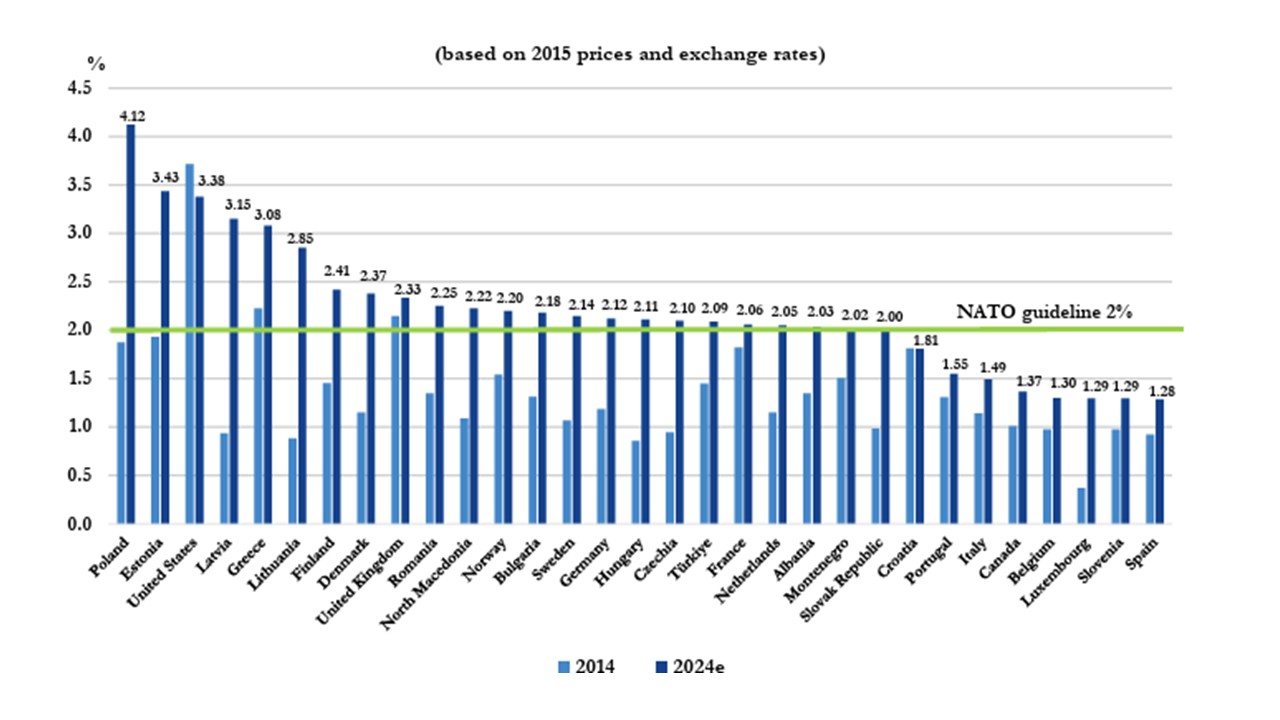

Figure 1: Military Spending to GDP (%)

Source: NATO

European politicians have been working on a plan for 5% of GDP spending on defense to meet the ambitions of president Trump and avoid renewed threats from Trump. This consists of 3.5% of GDP hard military spending and 1.5% on infrastructure and cybersecurity. Since most European countries already meet the 1.5% on infrastructure the real aim is 3.5% of GDP, with NATO Mark Rutte wanting this to be by 2032.

However, reports suggest that Spain has been a hold out in agreeing to this aim (here), given the Spanish population anti-military legacy from the fascist era. This could make the 2032 target tough and argue for a later date. Additionally, the 3.5% appears to be a soft aim rather than a hard target. Politically, European governments can aspire to spending this amount, but fiscally this is difficult for some, if not most, key European countries. This is not just Italy, but also France given the fractured parliamentary situation that is unlikely to be resolved before the 2027 presidential election. Notably, additional EU military spending as part of ReArm is partly to be financed by relaxed EU fiscal rules allowing the use of national escape clauses for up to 1.5% of GDP per year for defence purposes, allegedly enabling additional spending of about EUR 650 billion (4.3% of euro area GDP) over the next four years. But to date only a third of EU member states have signed up due to fiscal constraints, and with the exception of Germany, this that have applied compose smaller economies, suggesting less than two-thirds of the EU will be making any use of this initiative! Meanwhile, the UK defense review on Monday (here) also set an ambition to hit 3% of GDP on defense spending, but will likely wait until the October budget at the earliest before a specific date is committed. European politicians are good at making aspiration aims and will still likely try to make a “soft” aim for 3.5% hard military spending and 1.5% infrastructure/cybersecurity by 2032 or later to meet Trump 5% ambition.

Normally such an agreement would be enough for U.S. leaders, but Trump could still make renewed demands before or at the June 24 summit. Firstly, Trump wants to keep pressure on the EU to do a trade deal on terms that are favorable to the U.S. This could involve demands for protection payment by Europe NATO members to the U.S. like Japan and S Korea. Secondly, the Trump administration could also announce the reduction in U.S. troops from the 20k Biden surge in 2022, which is widely expected and U.S. reports have suggested that the Pentagon is looking at a 10k reduction in eastern Europe. This would focus politicians in Europe. An existential threat from Trump is less likely e.g. withdrawal from NATO, as Trump regards the Article 5 commitment to support other countries under attack as dependent on which country was being attacked and not a commitment to go to war.

In economic and financial terms, a U.S./Europe agreement at the NATO summit would remove an event risk. However, the fiscal spending would still take a long time to scale up outside of Germany, both given fiscal constraints and voters anti-military bias in southern Europe.