Indonesia CPI Review: CPI Inches Up, But BI Still Has Room to Ease

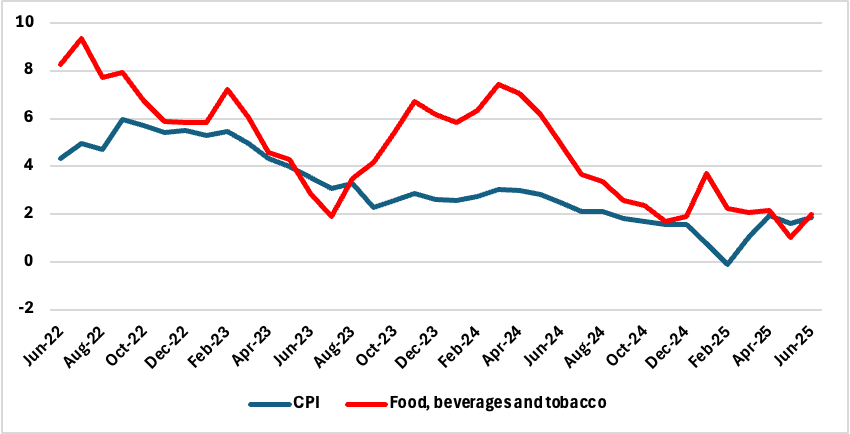

Indonesia’s inflation edged up to 1.87% yr/yr in June on higher food prices, but overall price pressures remain subdued. With CPI well within Bank Indonesia’s target range and growth momentum softening, the central bank retains room to cut rates again in the second half of 2025.

Indonesia’s consumer price index (CPI) inflation edged up to 1.87% yr/yr in June, from 1.60% in May, according to data released by Statistics Indonesia (BPS). The modest acceleration was primarily driven by higher food prices, while inflation across other categories remained benign. Despite the uptick, inflation remains well within Bank Indonesia’s (BI) 2.5% ±1% target band, reinforcing expectations that the central bank retains space to ease policy further in the second half of 2025.

Food prices were the key contributor to the rise in headline inflation. Annual food inflation increased to 1.99% yr/yr in June from 1.03% in May, accounting for roughly 0.6 percentage points (pps) of the overall CPI. This reflected seasonal pressures and supply-side factors, including volatility in horticultural items such as shallots, chilies, and tomatoes, though overall food price dynamics remain historically subdued.

Figure 1: Indonesia CPI and Food inflation (% yr/yr)

Outside of food, price pressures were muted. Categories such as household equipment and education registered lower inflation, exerting mild disinflationary pressure. In annual terms, personal care and other services also made a notable contribution to CPI (just under 0.6pps), followed by housing and utilities, which added around 0.25pps.

Core inflation remained stable in June, suggesting underlying demand-side pressures are contained despite a mild recovery in domestic consumption. With inflation expectations anchored and key price components tracking below historical norms, the latest print confirms that inflation is not a near-term constraint for monetary policy.

The June inflation reading further strengthens the case for additional monetary easing by Bank Indonesia in the coming months. BI has already cut rates twice in 2025—in January and May—bringing the policy rate to 5.50%. Given the subdued inflation backdrop and relative stability of the rupiah, a third rate cut in Q3 remains likely, particularly if GDP growth momentum continues to weaken. Real GDP growth slowed to 4.87% yr/yr in Q1 and is expected to remain below government forecasts for 2025. Domestic demand remains soft and external trade faces headwinds from tariff uncertainty, especially with the US. With real interest rates now elevated and inflation running near the lower end of the target band, monetary policy can afford to stay accommodative.

Looking ahead, inflation is expected to stay within the target range in 2025, supported by adequate food supply, anchored expectations, and contained global commodity prices. While BI is unlikely to move in July, we expect a further 25bp cut later in Q3, as the central bank seeks to support a sluggish recovery without compromising macroeconomic stability.