Trump Tougher Posture with Russia

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agree a face saving set of new peace talks or more moderate tariffs directly on Russia. An extra trade tax on India is possible, but not certain.

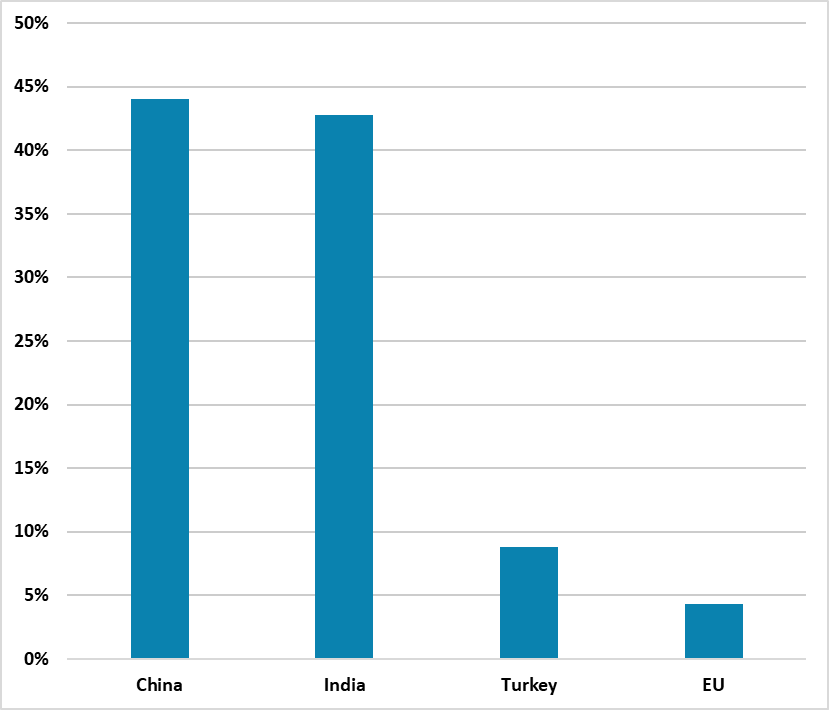

President Donald Trump is taking a hard line on Russia, but will it lead to secondary sanctions on Russia oil buyers? Figure 1: Russian Crude Oil Exports (%)

Source: CREA June 2025 (here)

Source: CREA June 2025 (here)

Trump has effectively set a deadline of August 8 for Russia to agree a ceasefire with Ukraine, which is highly unlikely to happen given President Putin reluctance. It is still possible that Putin could launch new peace talks that provide an opportunity for Trump to claim success and de-escalation then occurs over the remainder of August. Reports suggest that U.S. special envoy Witkoff may travel to Moscow to meet Putin August 6 or 7. We would view the shifting of two U.S. nuclear submarines as posturing.

However, Trump could decide that he needs to act tough with Russia and impose new sanctions on Russia. One option is reciprocal tariffs, which has not yet been imposed on Russia. However, this would be largely symbolic, given the small direct U.S. trade with Russia. An aggressive approach would be to impose secondary sanctions of all goods from countries that buy Russia oil (Figure 1) at a supplementary rate of say 25% or 50%. This is disruptive if it includes China as it would go back to the April freeze in U.S./China trade and the reduction in China rare earth minerals exports from China. Trump and his team have also been signaling a desire to do a trade deal with China and extend the August 12 deadline (here). The EU oil purchases are solely Hungary and Slovakia and Trump is friendly with their leaders. Turkey is the 3rd main purchaser of Russian crude oil, but Trump has a good and close relationship with Turkey’s president.

This leaves India where the Trump/Modi relationship was close, but the U.S. has not been able to agree a trade deal and has punished India with a 25% reciprocal tariff (here) and also threatened an extra trade tax as it is a large buyer of Russian oil. However, it is not clear whether this is classic Trump negotiating threat or whether he will follow-through. Trump is confident in threatening and actually announcing tariffs, as it has produced some major framework deals (here). However, Trump approval rating has been deteriorating in recent weeks, which is partially due to the Epstein saga but also growing concern that Trump has not brought inflation down and a deteriorating rating on healthcare. This could make Trump cautious in aggressively following through on tough talk with Russia, especially if it ends up boosting U.S. gasoline prices. Though aggressive action could provide a further distraction for Trump world over Epstein, we suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil. An extra trade tax on India is possible, but not certain and would like come with a delayed implementation date to allow India/U.S. trade negoications to move towards a trade deal.