Bank Indonesia Delivers Surprise Second Rate Cut to Shield Growth

BI is opting for early stimulus while macro buffers remain strong—stable rupiah, low inflation, and manageable deficits. However, this window may close quickly if external risks materialise. Business leaders should expect a monetary pause in Q3, but prepare for moderate volatility if inflation or capital flows surprise on the upside.

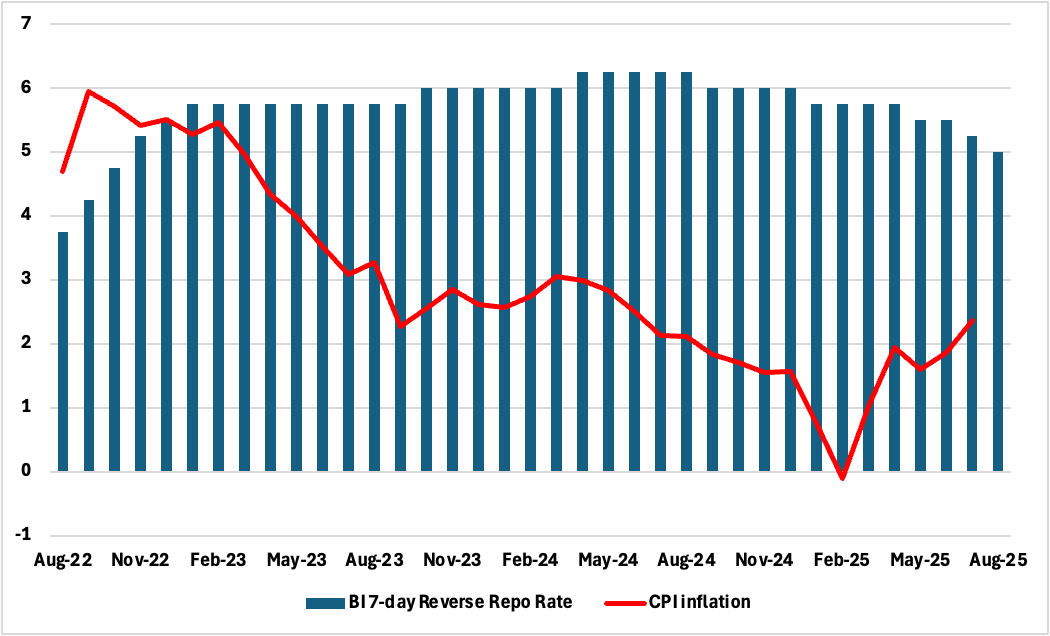

Bank Indonesia (BI) unexpectedly cut its benchmark 7-day reverse repo rate by 25 basis points to 5.00% at its August 19–20 policy meeting, marking its second successive monthly rate cut in 2025. The move surprised the market, which was anticipating a pause following the July easing. However, the decision underscores the central bank’s proactive stance in supporting domestic demand amid increasing global and domestic headwinds.

Figure 1: Indonesia CPI and Policy Rate (%)

The central bank justified its decision by highlighting three key factors. First, while headline GDP growth in Q2 surprised to the upside at 5.12% yr/yr, BI noted this was partly driven by front-loaded exports to the US ahead of new tariffs that came into effect in August. With a pullback in external demand expected in Q3, the central bank appears to be acting pre-emptively to cushion growth. Second, inflation remains comfortably within BI’s 2.5% ±1% target band. July CPI rose to 2.37% yr/yr, primarily due to a seasonal surge in food prices, but core inflation eased to a seven-month low of 2.32%, pointing to muted underlying price pressures. Third, the rupiah appreciated by 1.3% against the US dollar in August (as of the policy meeting), reflecting renewed currency stability that gave BI additional room to act without triggering capital flight.

The rate cut sets a new post-pandemic precedent, being the first back-to-back easing in over three years. Market reactions were muted, with bond yields easing and the rupiah holding steady—suggesting investor confidence in BI’s ability to maintain macroeconomic and financial stability. Importantly, BI retained its 2025 GDP growth forecast of 4.6–5.4%, but acknowledged downside risks stemming from weaker exports, uneven private consumption, and the delayed impact of previous tightening in global monetary conditions.

Looking ahead, the central bank is likely to pause in September to evaluate the impact of the recent cuts and assess evolving global dynamics, particularly the trajectory of US Federal Reserve policy. While another cut later in the year remains possible, it would require inflation to stay contained and the rupiah to remain resilient amid shifting external conditions. With 75 basis points of cumulative easing already delivered in 2025, the bar for additional action is rising.

Bank Indonesia’s decision signals a clear policy bias toward supporting domestic growth, even at the risk of diverging from the US Fed. For businesses and investors, the message is equally clear: monetary conditions will remain accommodative in the short term, but the window for further stimulus may narrow quickly if inflation or capital outflows re-emerge.