China Banking Problems

China is suffering a credit demand problem from households overexposed to property and private businesses that are cautious. Meanwhile, the latest IMF banking stress tests shows sections of the banking system remain weak and this is restraining lending. We remain watchful of money and credit trends, but remain concerned that money supply growth is insufficient to achieve 5% real GDP growth and we still look for 4.2% GDP growth.

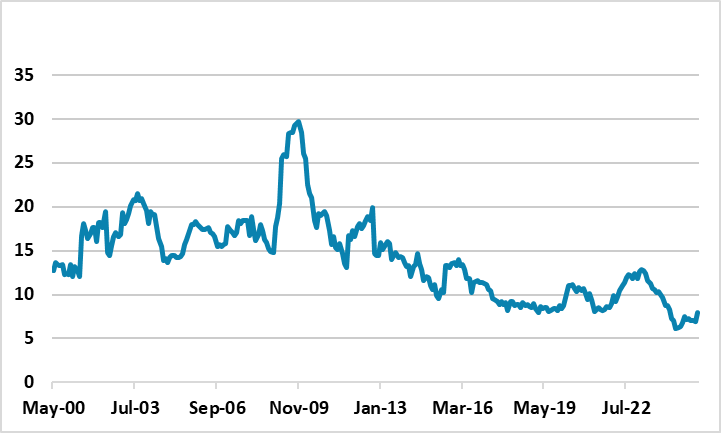

Figure 1: China M2 (Yr/Yr %) Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

China M2 growth has picked up recently (Figure 1), as the residential property market has become less adverse; the government has injected Yuan500bln equity capital into the largest state owned banks and the government has provided a 5 year Yuan10trn debt swap for local government and LGFV’s. However, we would prefer to see close to 10% M2 growth to be confident of 5% real GDP growth, given the normal relationship between M2 and real GDP.

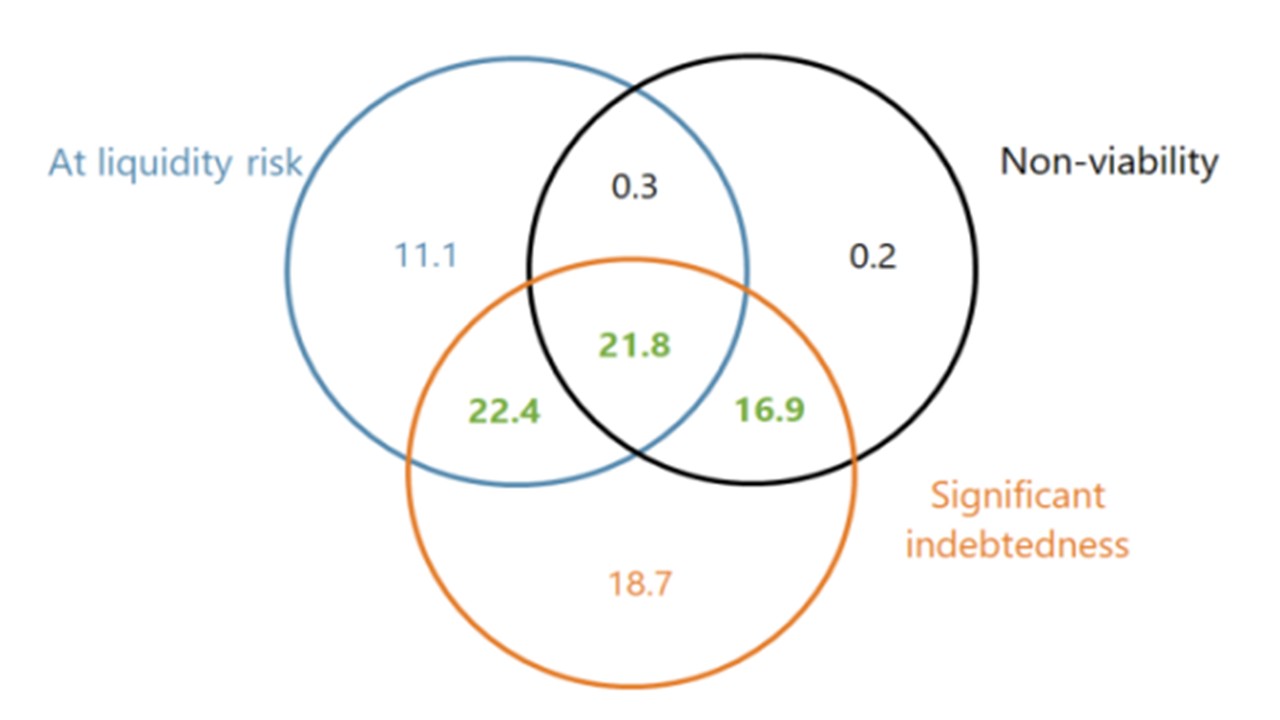

China has a credit demand problem. Firstly, though the situation is becoming less acute in the housing sector, sentiment is still weak with a multi-year overhang of property; declining house prices and shaken confidence in builders. This will take year to repair, alongside household overall desire to not increase debt burdens. Secondly, private sector companies are less willing to invest than the 1990-2019 period, both due to economic volatility and a lingering sense that China authorities do not favor the private sector – the 2021-22 crackdowns are fading, but the authorities are still not fully pro-business. Thirdly, LGFV’s weak debt is massive due to poor investment decisions. The latest IMF FSAP in April 2025, estimated that 39-45% of debt was in trouble (Figure 2). The IMF has not taken account of the Yuan10trn government debt swap that largely deals with the weak LGFV problems, but this scales in over 5 years and weak LGFV’s may not quickly switch from paying debt down to new normal borrowing.

Figure 2: Debt of Financial Weak LGFV’s (% of total LGFV debt)

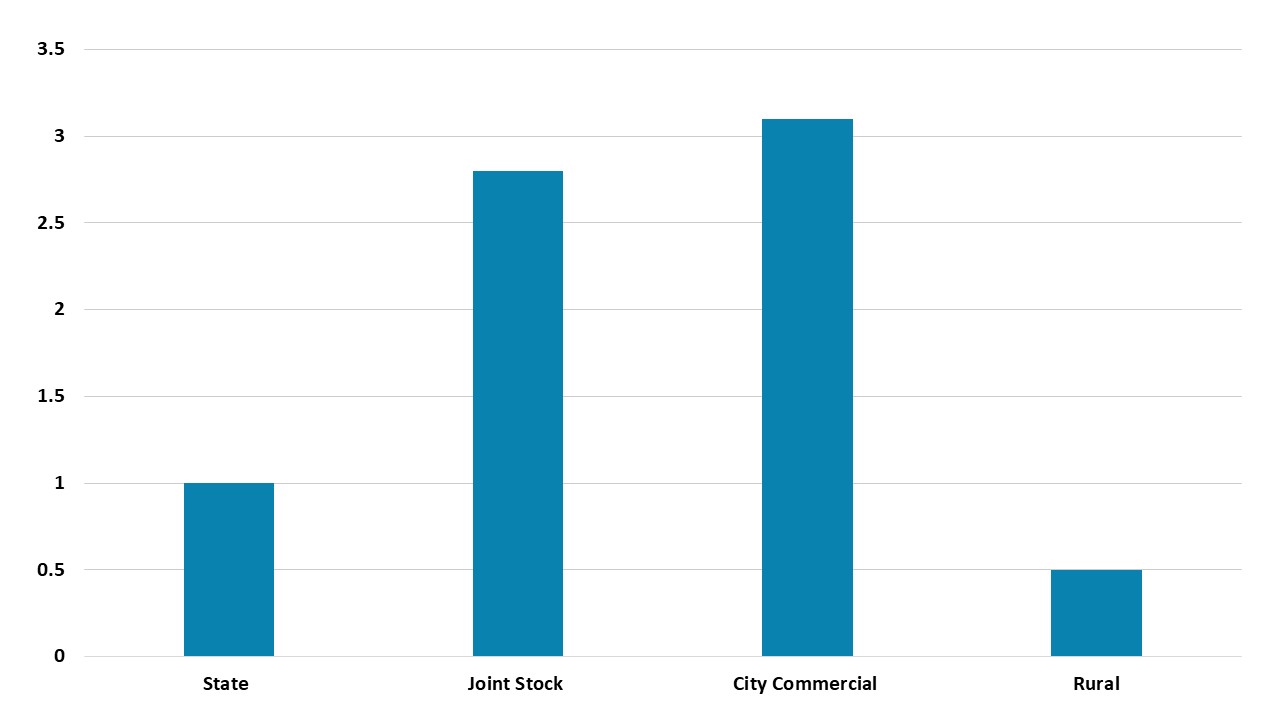

China also has a partial credit supply problem as well. The state banks are making up for weakness elsewhere in the banking system, especially the rural banks that have less diversified profit sources; liquidity and capital. However, it was interesting that the IMF FSAP April 2025 stress test (Figure 3) also raised some concerns about the weaker joint stock and city commercial banks, which appear to have more emphasis than the PBOC 2024 financial stability report (here). China authorities have fiscal space to fill this equity shortfall if an adverse scenario occurs e.g. sub 3% GDP growth. Rescues and forced takeovers will also continue in the coming years. However, weakness in sections of the banking system act as a headwind for some households and businesses.

Figure 3: Total Capital Shortfall (% of Risk Weighted Assets 2023)

Overall, we remain watchful of money and credit trends, but remain concerned that money supply growth is insufficient to achieve 5% real GDP growth and we still look for 4.2%