Tariffs: Seeking a Trigger for the TACO Trade

It has been fairly clear for some time that 10% represented a likely floor for the eventual Trump tariff regime. However, expectations that Trump would not be willing to go dramatically above that are being tested. A rate in the mid-teens still looks the most likely outcome, as the economic damage to the U.S. of tariffs above 20% would be significant, but Trump needs to be persuaded of that, either by data or markets.

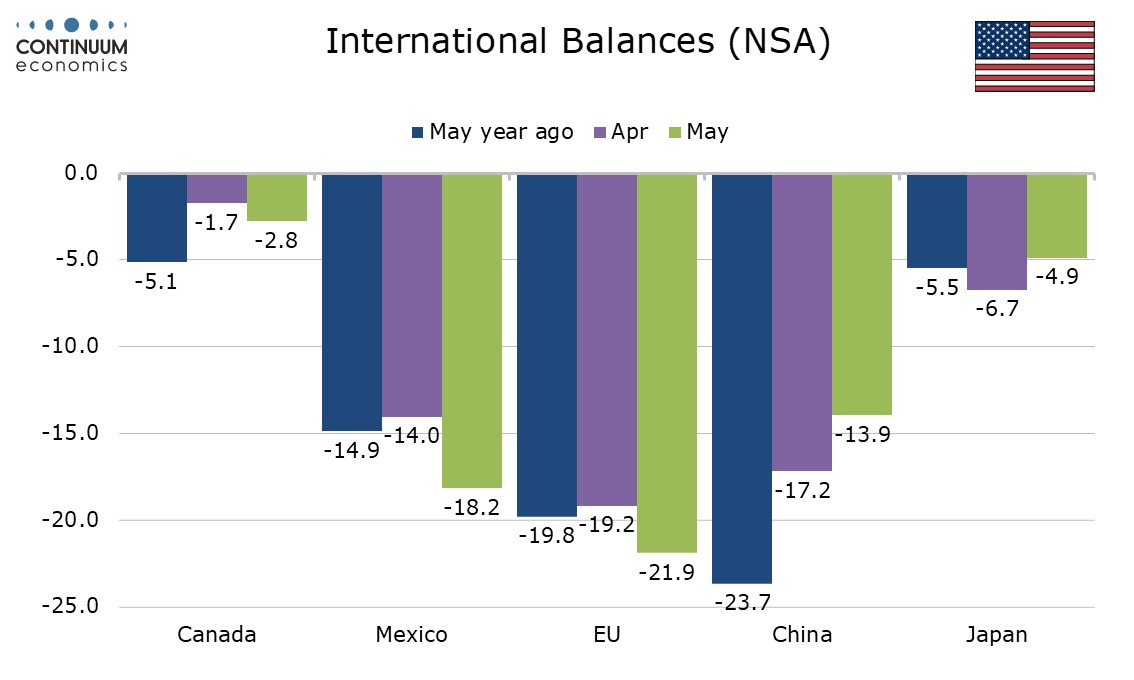

Trump has struggled to achieve trade deals in the three months since the April 2 tariffs were lowered to 10%, achieving only a de-escalation with China, and deals with the UK and Vietnam, with the latter under some doubt given disagreements on what exactly was agreed. Some key partners, notably Japan and South Korea at 25% are facing tariffs near April 2 levels, while Trump has gone beyond April 2 levels with a threatened 30% tariff on the EU. Canada and Mexico are partially shielded by expectations for USMCA-compliant trade, but close to half of trade with those countries now faces steeper tariffs of 35% and 30% respectively. These are all due to be implemented on August 1.

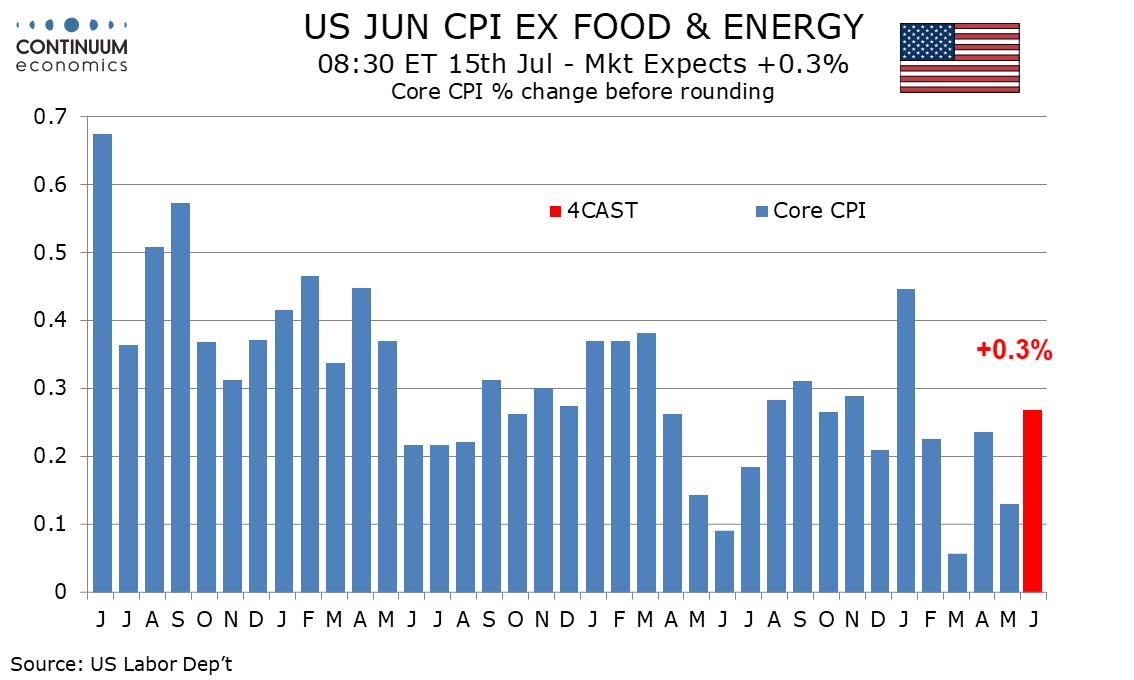

We expect that a tariff rate in the mid-teens would bring a moderate slowdown in U.S. GDP growth to near 1.0% and would keep core PCE prices close to 3% rather than returning to the 2% target. Tariffs above 20% could push GDP growth to near zero, sufficient to noticeably lift unemployment even with slower labor force growth, and could lift core PCE prices to near 4%. Trump could be persuaded to back down by adverse economic data, which would probably appear first in inflation figures. At the moment however he appears comforted by relatively subdued inflation data for April and May despite the fears of many that tariffs would feed through quickly. We expect slightly firmer data for June tomorrow, though many companies might be delaying price decisions to August in hopes for a clearer picture then. Economic data that persuades Trump to back down may be slow to arrive.

A quick Trump climb down would require pressure from the markets, most likely equities, with Trump’s past climb downs on the April 2 tariffs, as well as with Canada and Mexico, generating what is known as the TACO trade (Trump Always Chickens Out). If Trump follows the pattern seen earlier, a climb down would be seen in early August, shortly after the current deadline passes and markets deliver their verdict. However now the TACO trade has become widely discussed it is likely to make Trump more reluctant to climb down. A Trump climb down may not arrive until late August this time. Before then, there is risk of a cycle of escalation if some countries decide to retaliate. Trump could be pressured either by falling equites or rising bond yields. However he may blame the later on Fed Chairman Powell rather than his own policies. Attempts to force Powell out have gained momentum through attempts to create a scandal out of an expensive refurbishment to Fed buildings.

In the near term, neither a market collapse or a Trump climb down looks likely barring a shocker from June’s CPI. There is plenty competing for Trump’s attention, with his base in rebellion over his support for Attorney General Pam Bondi’s handling of the Jeffrey Epstein case. That Trump is reviving support for Ukraine and threatening secondary sanctions towards Russia may dissuade the EU into any near term retaliation. Market anxieties may even be eased in the if Trump achieves a deal with a significant trading partner such as India. However we appear to be heading for a dangerous August for markets, with risks to the US and global economies extending well beyond that.