Trump Deals: Japan, Philippines and Indonesia

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadline is August 12. With Trump relaxing some NVADIA chips sales into China, an opportunity exists for China to reach a reasonable deal with Trump more focused on trade than strategic restraint of China. However, August 12 could be too early and our baseline remains for agreement in Q4.

Japan is reported to have reached a deal of 15% for reciprocal tariffs, but also a reduction in auto and auto parts from 25% to 15%. What do recent deals mean for negotiations with other countries?

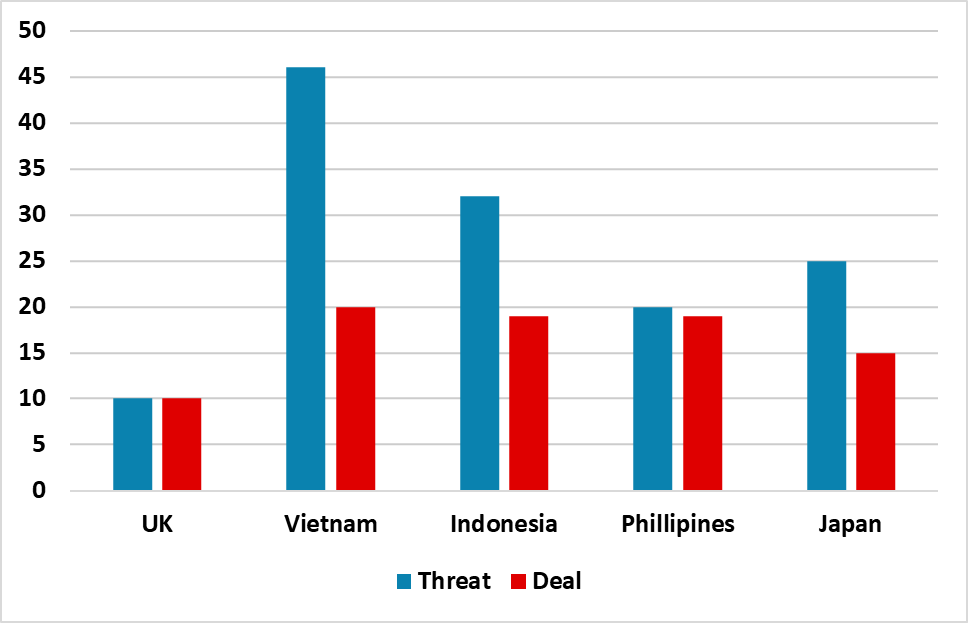

Figure 1: Reciprocal Tariff Threats and Outline Deals (%)

Source: Continuum Economics.

Japan deal with the U.S. is better than Philippines/Indonesia or Vietnam’s. Japan has agreed 15% for reciprocal tariffs, but crucially a reduction in auto and auto parts tariffs from 25% to 15% (without any UK style quota). Though the deal includes USD550bln investment by Japan in the U.S., this is likely to include existing commitments and new money will likely be much smaller – Trump reports that a JV will be set up for an Alaska gas project with Japan, which suits Japan’s needs. Finally, the deal does not include any extra commitments to Japan’s military spending, which the U.S. had been pushing for (here).

Indonesia and Philippines managed to agree 20%, while Vietnam was 20% reciprocal tariffs with 40% for transshipments (from China). Does this mean a two tier target for the U.S. on reciprocal tariffs, given that the UK managed to agree 10%? Japan is certainly a strategic ally in geopolitical terms, as the Pentagon sees Japan Okinawa bases as being the most important military asset if a conflict were to occur over Taiwan between China and the U.S. This could have helped Japan reach a better deal than its Asian neighbors. However, the U.S./Philippines relationship is the most crucial in the South China sea, given China grey warfare in that region (here). The specific rates that are agreed could also be the U.S. wanting to reach some deals to pressure China/EU/Canada and Mexico but also other countries wanting to avoid higher threatened reciprocal tariffs (Figure 1). Trump is also keen to shift the news cycle to trade deals from Epstein. These are also only high level outline terms in some cases and trade framework deals in others, with detail lacking. Thus the Japan deal does not mean that other countries can agree 15% reciprocal and for autos.

India and Taiwan are also reported to be trying to get deals done before August 1, but the situation with the EU is fluid. The EU had viewed U.S. negotiating demands for a 15-20% base reciprocal tariff as being too high and it is only a 50% chance of a deal being agreed in the coming months or the EZ being hit with higher reciprocal tariffs. China 90 day deadline is August 12 and the U.S. will likely want to ensure that the recent deals/threats for other countries will get China to agree open access to U.S. goods/some commitments on investment in the U.S. in return for a circa 20% reciprocal tariff – 15% would likely be too low for the U.S. China does need more food imports given the recent drought and could agree LNG buying commitments, but would be reluctant to agree specific targets to reducing the size of the bilateral deficit. However, Trump is allowing NVADIA to start exporting some semiconductors to China again and Trump appears more focused on trade than strategic restraint of China. China could see an opportunity to get a trade deal done with Trump, but August 12 could be too early and U.S. Treasury secretary has indicated Tuesday that Trump will likely agree an extension -- mostly likely 30 day to September 12. We still target Q4 2025 for a U.S./China trade deal.