China Disinflation Rather than Deflation

May China CPI remains negative Yr/Yr, but the breakdown is consistent with disinflation rather deflation. Deflation could end up as a drag on the economy, but while growth remains close to the 5% target and CPI is regarded as disinflation rather than deflation, further policy easing will be slow. We now look for only one further 10bps cut in the 7 day reverse repo rate in Q4.

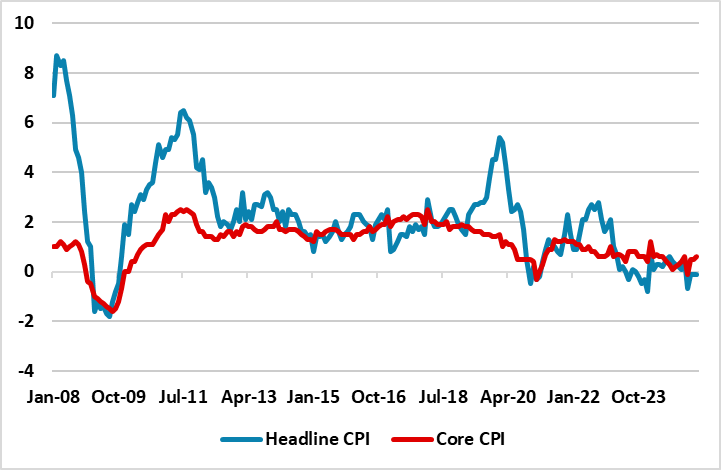

Figure 1: China Headline and Core CPI (Yr/Yr %)

Source: Datastream/Continuum Economics

The latest China CPI figures for May show a small negative of -0.1% Yr/Yr, with intense competition causing consumer goods prices to fall -0.5% Yr/Yr versus -0.3% in April. The trade freeze with the U.S. from April has caused a redirection of supply partially to the domestic market. BYD the EV carmaker has recently cut prices, including an eye catching 34% for one car. However, service price inflation still remains positive on a Yr/Yr basis, while core inflation ex food and energy at +0.6% Yr/Yr is consistent with disinflation rather than deflation.

The distinction between disinflation rather than deflation is important for the economy. Deflation would delay consumption and investment, as households and companies would delay purchase decisions. However, no broad based signs exist that this behavior is being seen in the household sector. Soft consumption is a function of housing market woes and employment concerns. It could be that disinflation helps support real consumption somewhat, where the trajectory is modest rather than deteriorating. However, private business sluggish investment reflects squeezed profits from the disinflation and this is a small drag on the economy – SOE and LGFV investment is much larger and should be a support for the economy. While growth remains close to the 5% target and CPI is regarded as disinflation rather than deflation, further policy easing will be slow. We now look for only one further 10bps cut in the 7 day reverse repo rate in Q4 to 1.3%.