China Slow Diversification: Gold And Others

China’s diversification from U.S. Treasuries appears to be at a slow pace. Gold is the obvious alternative if geopolitical tensions were to rise or skyrocket in the scenario of a China invasion of Taiwan. However, Gold holdings are merely creeping higher and suggesting no urgency from China to accelerate reserve diversification. We estimate the odds of a Taiwan invasion are 5% in 2025/26 and 20% in 2027/28 (here).

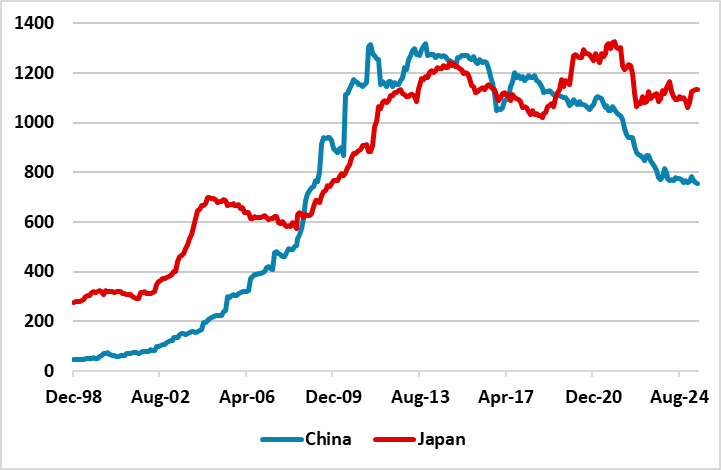

Figure 1: China and Japan Holdings of U.S. Treasuries (USD Blns)

Source: BEA TICS

U.S. Tics data shows that China reduction in U.S. Treasury holdings has ground to a halt in 2025 (Figure 1), but still remains USD482bln below the Jan 2016 level. Overall China FX reserves have been in the USD3000-3400bln during this period. Though the TICS data is not falling, China is still likely diversifying from U.S. Treasuries. Some of its holdings are in Belgium and Luxembourg and the Luxembourg overall total has increased since 2016. China is also known to be interested in the extra yield pick-up from U.S. agency paper and so it is unclear how much FX reserves have been diversified away from USD assets – the normal holdings were around 60% in the 2010’s.

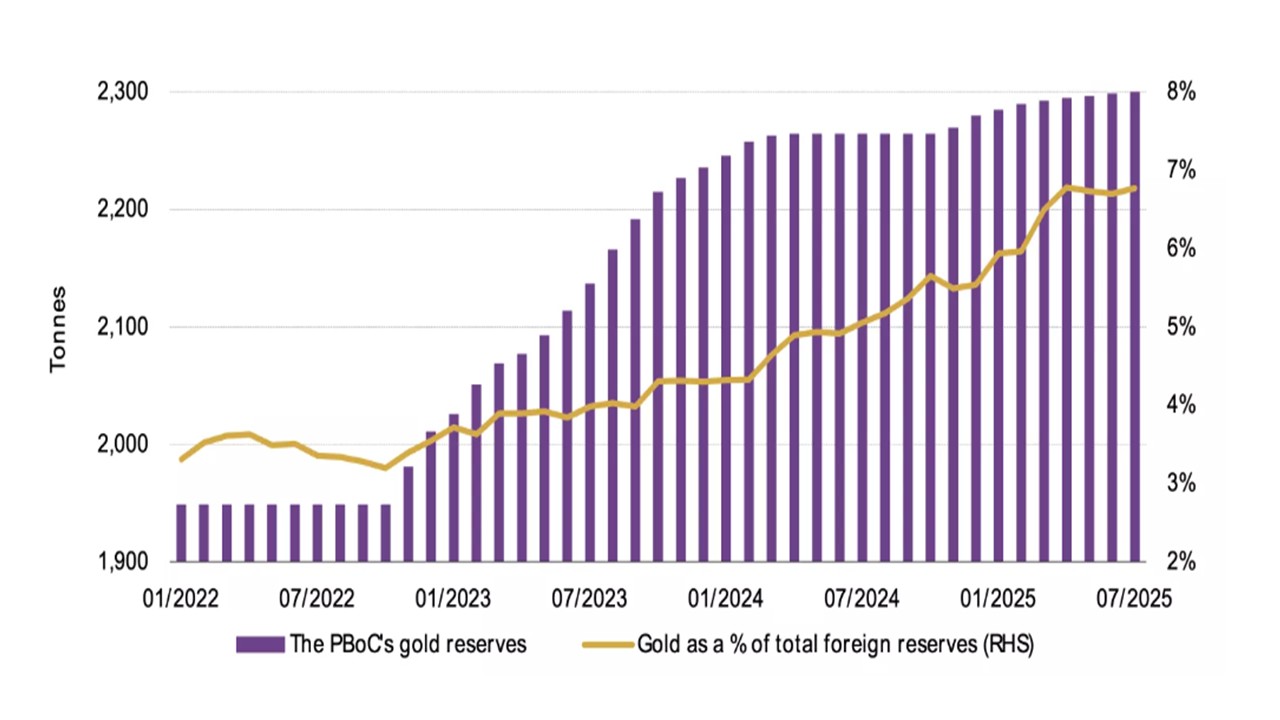

One problem is the relative liquidity and lower yield of EZ government bonds and JGB’s – Japan assets are also unattractive in a Taiwan invasion scenario if the U.S. become involved and uses the key Okinawa bases (here). Gilts provide an alternative, but do not have the same liquidity as U.S. Treasuries. Major EM government bonds have higher yields, but Brazil and S Africa come with debt sustainability risks (here). China also appears reluctant to reduce the overall size of FX reserves and return funds home, given how much was used in 2015 to curb capital outflows and this is a linger concern for China Communist party. China has bought gold as an alternative to USD assets, but the pace has slowed over the last year (Figure 2). This could reflect the higher price of gold and China reluctance to overpay for gold.

Figure 2: Reported official gold holdings and gold as a percentage of total foreign exchange reserves

One interesting question is whether China will speed up U.S. Treasury rundown again in the future as it did in the immediate aftermath of the Ukraine war. The U.S. and Europe’s freezing of Russia FX reserves is likely to have been a shock to China’s authorities. If China decides to invade Taiwan then this could see such sanctions imposed on China, which would argue for a quicker pace of reserve diversification in the one to two years beforehand.

However, we feel that President Xi is unlikely to agree an invasion in the coming years, both as the military build up to 2027 continues and the high risk of failure if the U.S. gets involved – the U.S. enjoy clear superiority in submarine capabilities (aircraft carrier superiority could be counted by China large ballistic missile stocks). Thus, China will likely continue to pressure Taiwan but stop short of major escalation. China could use U.S. President Trump’s impatience for a trade deal by asking Trump not to intervene in any future China military reunification of Taiwan. However, on balance we expect the strategic ambiguity policy will likely be maintained by the U.S. We estimate the odds of a Taiwan invasion are 5% in 2025/26 and 20% in 2027/28 (here).