Trump’s Tariffs and Markets

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely expected by market. However, negotiations will be difficult and if the EU/Canada or Mexico were hit with 30% from August 1, or China from August 12 then this could open the alternative scenario or high teens average and a worse growth/inflation trade off that could wake markets from its summer doldrums.

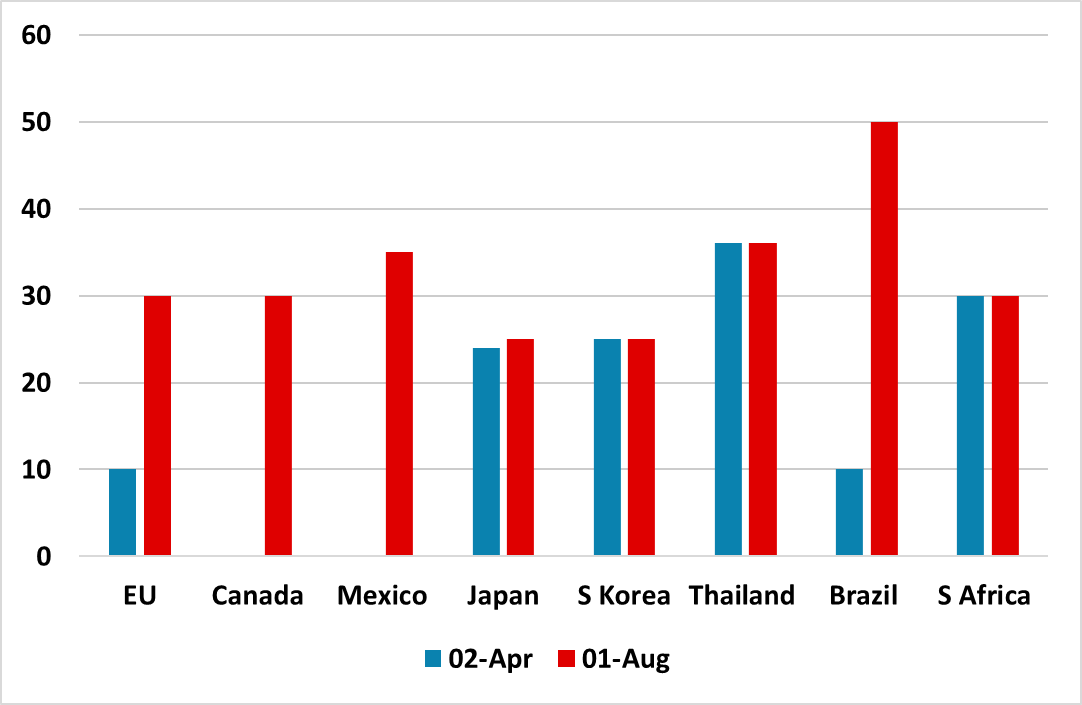

Figure 1: August 1 Reciprocal Tariffs (%)

Source: White House/Continuum Economics.

Trump’s new flurry of letters to 25 countries has not prompted much adverse market reaction. The assumption in financial markets are that some deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. Such an outcome would be consistent with the Trump administration approach, with Vietnam and now Indonesia (here) agreeing an in principle deal; India and Taiwan not getting August 1 deadline so far and the fact that the 90 day reciprocal tariff deadline has been delayed by a further 3 ½ weeks. This could all still be a path towards average 15% tariff rate (here). The 100% secondary tariff threat from early September against countries trading from Russia is also expected to be negotiated away or diluted or delayed.

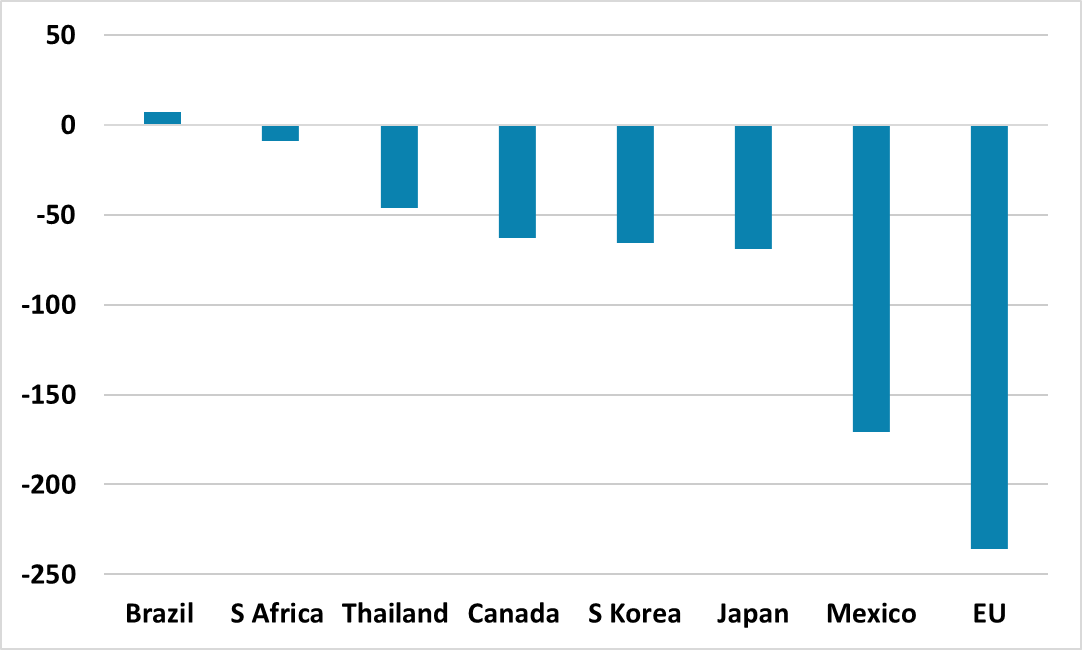

The 25 countries are a contrast in bilateral trade positions with big surpluses for some countries (Figure 1 and 2), but 16 countries with small trade surpluses of less than USD10bln or trade deficit with the U.S. Some of these were likely chosen for perceived left wing policies and/or right wing restrictions (e.g. Brazil and S Africa), others could be a warning to others to do a deal with the U.S. (e.g. Bosnia/Serbia/Sri Lanka) and six likely targeted to reduce the trade imbalance (i.e. EZ/Japan/Canada/Mexico/S Korea and Thailand Figure 2).

Figure 2: 2024 Bi Lateral Trade Deficit for U.S. (USD Blns)

Source: BLS/Continuum Economics.

Canada and Mexico escaped the reciprocal tariffs in April, due to previous trade drama and agreements over Fentanyl and Canada dumping Treasuries in April (evident in the U.S. tics data). Even if USMCA complaints goods would not be hit, it would still hurt Canada and Mexico. However, this is likely to be an attempt by Trump to renegotiate USMCA early and we could be back to a tariff being implemented only to later be cancelled or delayed/reduced on the basis of the bilateral negotiations.

Japan and S Korea are also getting tough treatment on tariffs threats. One compromise would be a Vietnam style deal with a 15% reciprocal tariffs; a quota at 10% for some car exports to the U.S. and some restrictions on reexports from China. However, the negotiations are additionally impacted by the Trump administration demand that Asia allies increase defense spending like NATO countries, which is a major political issue in Japan (here) even before the Upper House election on July 20. If the U.S. can reach deals with India and/or Taiwan in the next 2 weeks then this could intensify pressure for a deal by Japan or S Korea. It is also unlikely that they will introduce any counter tariffs. However, it is uncertain whether the U.S. can reach a deal with either country by August 1 and whether that means a further 30 day delays or higher than 10% reciprocal tariffs.

This leaves the EU, which faces a higher 30% reciprocal tariffs than the April 10% and has shocked the EU commission (here), especially after the deal at the NATO summit over European defense spending. Trump has a long dislike of the EU, while the EU are threatening counter tariffs if the 30% is implemented. The EU is also slower moving than the Trump administration, which has spent too long trying to get the reciprocal tariff rate down to zero. Though a trade deal is possible by August 1, it is not certain. The U.S. could also be using the EU to soften up other countries, as it did with China earlier in the year.

For financial markets, some deals, some further delays and some implementation of the higher tariffs could be consistent with the assumption of circa 15% average tariff held by the market and seen to be consistent with a moderate slowdown, temporary pick up in inflation and some Fed easing. However, if the EU/Canada or Mexico were hit with 30% from August 1, or China from August 12 then this could open the alternative scenario or high teens average and a worse growth/inflation trade off that could wake markets from its summer doldrums.