China Slowdown In July

• Retail sales sluggishness reflects households cautious due to the hit to housing wealth and uncertainty over jobs and wage growth. Investment softness reflects not only residential property weakness, but also a slowdown in government infrastructure. This weakness could see a top up fiscal package in the coming months to keep growth on target to 5%. A PBOC cut in the 7-day reverse repo rate is possible before year-end, but the PBOC is reluctant to squeeze banks interest rate margins further.

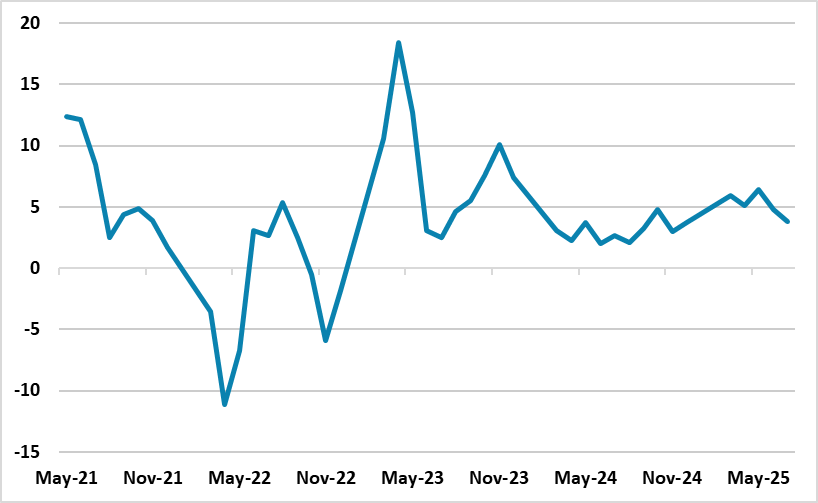

Figure 1: Retail Sales Yr/Yr (%)

Source: Datastream

The July data in China was weaker than expected across the board. Though a hot and wet July had some impact, it also reflects underlying weakness in place. Retail sales at 3.7% Yr/Yr saw continued sluggishness in a number of key areas such as autos (-1.5%) and catering/eating out (+1.1%), with the areas benefitting from trade in programs showing a mild slowdown. Elsewhere, residential property investment at -12% Yr/Yr YTD, plus property sales -6.2% Yr/Yr YTD, reflects the ongoing weak sentiment in the sector. The monetary data earlier this week saw a net repayment of Yuan489bln by the household sector in July, while CPI reflects this weakness of domestic demand versus supply. Households are cautious due to the hit to housing wealth and uncertainty over jobs and wage growth.

Additional weakness was seen in fixed investment at 1.6% Yr/Yr YTD versus 2.8% last month and public investment 3.5% versus the June reading of 5.0%. Reports suggest that weather could have played a part, while the government investment spending has still to kick in fully. However, this weakness could see a top up fiscal package in the coming months to keep growth on target to 5%. Industrial production at 5.7% was marginally weaker than expected, but is still benefitting from overall exports holding up at the moment – with redirection from the U.S. to Asia exports.

The data has sparked speculation about a PBOC cut in the 7-day reverse repo in September or Q4. It is possible, but the PBOC has shown little interest in further monetary easing. The authorities are concerned that further rate cuts could be counterproductive by squeezing banks interest margin and then hurting lending growth. A 25bps cut in the RRR is more likely before the end of the year, but would be largely symbolic. We have the next 10bps cut in the 7-day reverse repo rate coming in Q2 2026.