China: Housing Still A Headwind

Last October, China’s government support package has helped turn residential property less negative and our baseline is that residential property will likely deduct around 0.75% from 2025 growth and 0.5% from 2026. However, the risks for the economy could turnout worse than our baseline view on residential property. Though the spotlight will fall on trade again with China’s 90-day deadline in August 14, it is also worth watching housing developments.

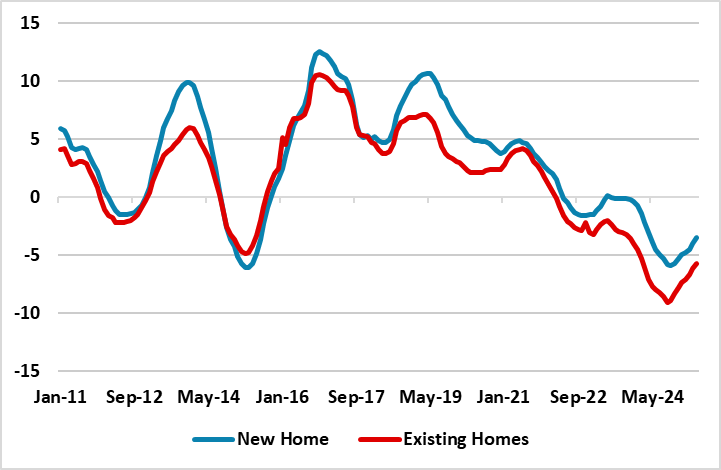

Figure 1: New and Existing House Prices (Yr/Yr %)

Source: Datastream

China housing market has attracted less attention with the trade war and then trade truce with the U.S., alongside economic numbers that have been consistent with a 4.5-5.0% growth picture. The residential property sector has been getting less worse, which should mean it subtracts less from GDP than 2024. The October 2024 housing market support package (e.g. relaxed deposits/lower mortgage rates/funds to buy some completed property) helped, while March 2025 saw extra Yuan500bln of equity capital for the six largest state banks to boost lending growth. M2 growth has picked up in recent months and credit supply should be helped in the coming quarters. Combined with pent-up demand (particularly in tier 1 cities), this produced a spring bounce in home sales. However, the situation has been less negative, rather than positive.

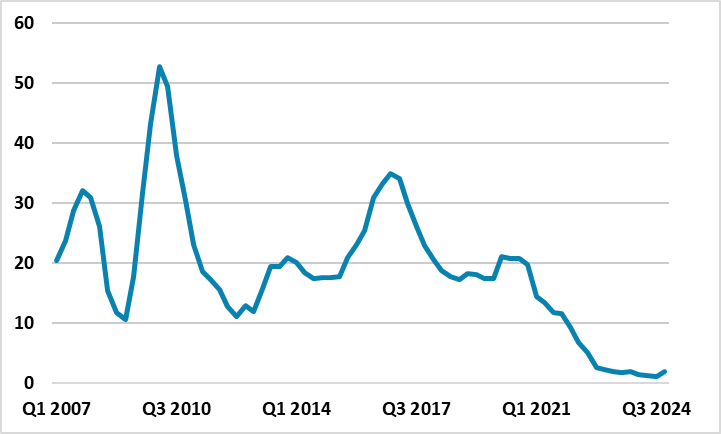

Figure 2: Mortgage Loans (Yr/Yr %)

Source: Datastream

Net mortgage loans have been subdued (Figure 2), while the excess of production over domestic demand is restraining employment and wage growth and thus produces a headwind to housing demand. Consumer confidence also remains subdued, partially as the decline in house prices has been persistent (Figure 1) and prices have not reached a bottom nationally. China authorities have tried to avoid sharp decline in new or existing home prices to avoid a panic, but this means that house price to income ratios still remain elevated and it will likely take a couple of years before house prices bottom. Meanwhile, structural reforms to speed up rural to urban migration or enhanced safety nets (health/unemployment and pensions) that would reduce precautionary savings are not a policy priority for Beijing. Combined with the excess of completed and uncompleted homes, this all stops a proper recovery in the residential property market.

Overall, the data suggests that nationally the housing market has not reached bottom. Residential property will likely deduct around 0.75% from 2025 growth and 0.5% from 2026 (here). However, the risks for the economy could turnout worse than our baseline view on residential property. If confidence relapses then this could hurt home sales and then house prices/new construction. Additionally, the authorities are not taking large enough measures to absorb the excess of completed and uncompleted homes, which remains as an overhang to a proper bottom being formed in the property market. Though the spotlight will fall on trade again with China 90-day deadline in August 14, it is also worth watching housing developments in H2 2025 and into 2026.