Indonesia’s July CPI Rises on Food Prices, But BI Still Has Room to Ease

Despite a food-driven uptick in July CPI, Indonesia’s inflation remains comfortably within Bank Indonesia’s target range. BI retains room to cut rates further in H2—though global uncertainty, particularly around US trade policy and Fed moves, may temper the pace of easing.

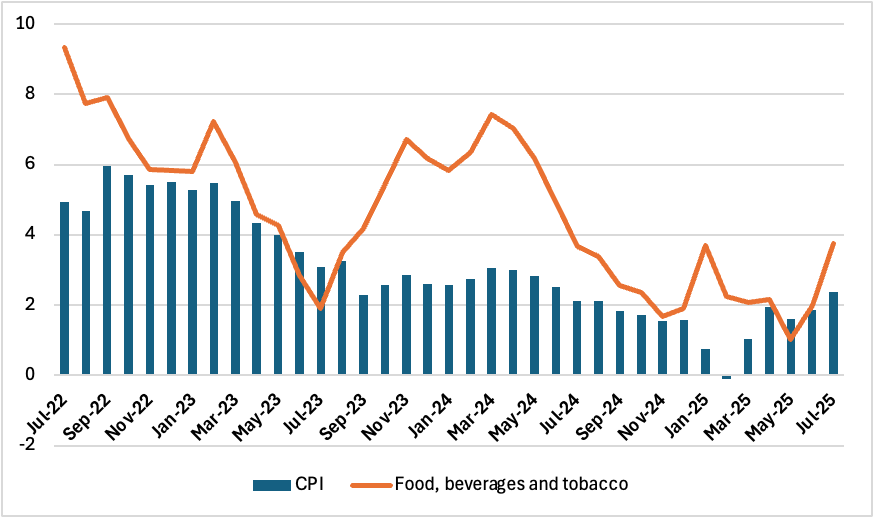

Indonesia’s consumer price inflation accelerated to 2.37% yr/yr, up from 1.87% in June, according to Statistics Indonesia (BPS). This marks the highest headline reading since May, driven primarily by a surge in food prices. On a monthly basis, prices rose by 0.3%, following a 0.2% increase in June.

Figure 1: Indonesia CPI and Food Inflation (% yr/yr)

Source: Continuum Economics

The July inflation print was shaped almost entirely by food inflation, which jumped to 3.75% yr/yr from 1.99% the previous month. This component alone contributed 1.08 percentage points to the headline rate. Other categories either saw muted increases or outright disinflation. Notably, core inflation—which strips out volatile items like food and energy—eased further to 2.32% yr/yr, the lowest level in seven months. This suggests that underlying price pressures remain contained.

Despite the uptick in headline CPI, the overall inflation picture remains well within Bank Indonesia’s (BI) official target band of 2.5% ±1%. The rise in food prices is largely attributed to seasonal and supply-side effects, while inflation expectations remain anchored.

In this context, Bank Indonesia is likely to retain its interest rate stable. The central bank surprised markets last month with a 25bps rate cut, bringing the policy rate down to 5.25%—the third such move in 2025. Consequently, any additional easing will likely be paced cautiously. The central bank must also weigh external risks, including global trade slowdown and the trajectory of the Federal Reserve's monetary stance. For now, BI appears to be striking a careful balance—supporting growth without jeopardising price or currency stability.