Indonesia Q2 GDP Beats Expectations

Q2’s outperformance gives Indonesia’s economic planners breathing space. Investment recovery is a strong positive signal, but sustaining growth in H2 will depend on policy agility, export resilience, and keeping domestic consumption robust.

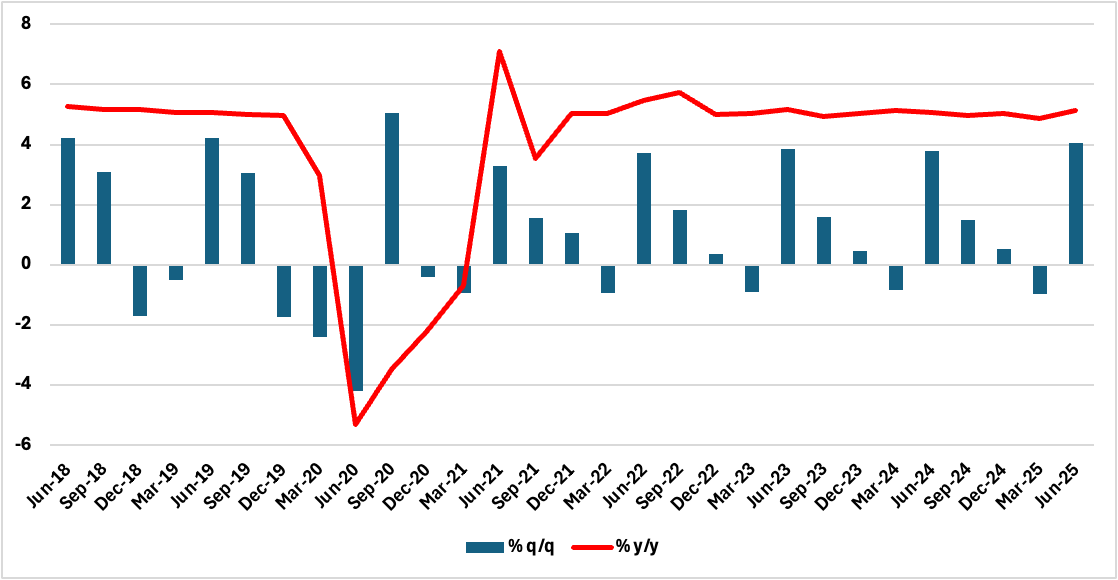

Indonesia’s economy expanded by 5.12% yr/yr in Q2 2025, exceeding our expectations and marking a solid rebound from 4.87% yr/yr in Q1, according to Statistics Indonesia (BPS). This brings first-half GDP growth to 4.9% yr/yr—just shy of the 5.08% seen in H1 2024 but well aligned with the government’s 5% full-year target. On a quarterly basis, the economy grew by 4.04%, recovering strongly from the Q1 contraction of 0.98% q/q.

Investment-Led Rebound with Broad-Based Support

The headline print was underpinned by a sharp recovery in gross fixed capital formation, which surged nearly 7% yr/yr in Q2—the strongest investment performance since mid-2021. This was a clear reversal from the 2.1% yr/yr pace in Q1, led by robust activity in construction and capital goods such as machinery and equipment. Private consumption remained the mainstay of growth, contributing 2.6 percentage points to the headline figure, with solid household spending across transport, food, and hospitality.

Net exports provided only a mild positive contribution as both exports and imports accelerated at a double-digit pace. Exports of goods and services rose 10.7% yr/yr, while imports increased 11.6%, driven in part by stronger demand for capital and consumer goods.

Figure 1: Indonesia GDP Growth (%)

Source: Statistics Indonesia, Continuum Economics

Sectoral Drivers on the Supply Side

On the production side, manufacturing remained a key growth engine and registered a notable pick-up in momentum. Transportation and storage services added another 0.7pps to growth, reflecting continued strength in domestic logistics and mobility. Construction and information & communication sectors also supported expansion, each contributing 0.5pps. Agriculture growth decelerated due to seasonal factors, though no major contraction was recorded.

Importantly, all sectors saw positive growth in Q2—indicating the breadth of the recovery following a weaker Q1 outturn.

Outlook

The stronger-than-expected Q2 result suggests that Indonesia's economy is weathering global headwinds better than anticipated. The sharp improvement in investment is particularly encouraging, as it may indicate a shift towards more productive and resilient growth. With inflation still within Bank Indonesia’s target range and the rupiah showing relative stability, there remains room for another interest rate cut in H2, especially if external demand moderates.

That said, momentum will need to be sustained in H2 to hit the upper end of the government’s growth target. Trade risks, particularly from US tariffs starting August, and uneven global demand could soften export performance. Additionally, fiscal room remains tight amid efforts to keep the deficit below 2.5% of GDP.