China: Retail Sales Reasonable

• Retail sales in May was helped by government trade in programs, but the overall retail sales momentum is reasonable. The industrial production slowdown looks to have been driven by the U.S. tariff chaos in April/May, which has become less adverse after the Geneva trade truce with the U.S.

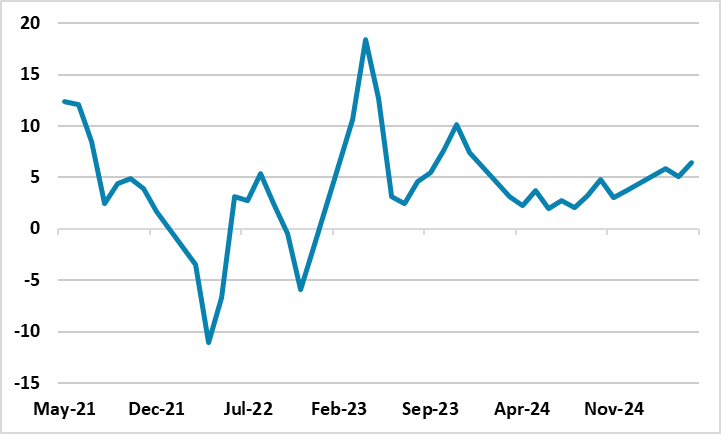

Figure 1: Retail Sales Yr/Yr (%)

Source: Datastream

China retail sales data was better than expected with a 6.1% Yr/Yr figure versus the 5.8% in May. The government trade in program continues to help retail sales, with home appliances +53% Yr/Yr and mobile phones/communications also a bright spot at +33%. Eating out also rose to +5.9% Yr/Yr versus +5.2% Yr/Yr in April, due to two holiday periods in May. However, some areas of consumption remain weak, with auto sales +1.1% Yr/Yr. Overall, we would prefer to see retail sales as reasonable rather than accelerating, given the uncertainty over wage and jobs growth.

Industrial production slowed in May to 5.8% Yr/Yr versus 6.1% in April, which likely reflects the impact of penal tariffs that froze U.S./China trade. Even high-tech manufacturing slowed to 8.6% Yr/Yr versus +10% in April. The trade truce and lower tariffs agreed with the U.S. should mean that the trade issue becomes less aggressive in the coming months, though the June figure could still see soft industrial production from the April/May trade crisis. Additionally, we feel that the 30% tariffs on China exports to the U.S. will remain in place through until Q4 at least (here), as it will take 6 months to get a proper trade deal given the difference of opinion between the two side on key issues.

Extra policy action is unlikely to be spurred by the data and instead the market is looking to the late July Politburo meeting to see whether extra fiscal policy is announced. We feel that some top up measures could be seen in the Yuan500-1000bln range to help support economic momentum, but the authorities do not feel under pressure to do more.