Reciprocal Tariffs: Some Hikes, Deals and Delays

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semiconductors and some pharma, the average effective rate is around 15% and close to market expectations. However, this will still slow the economy into H2 and boost CPI on a temporary basis.

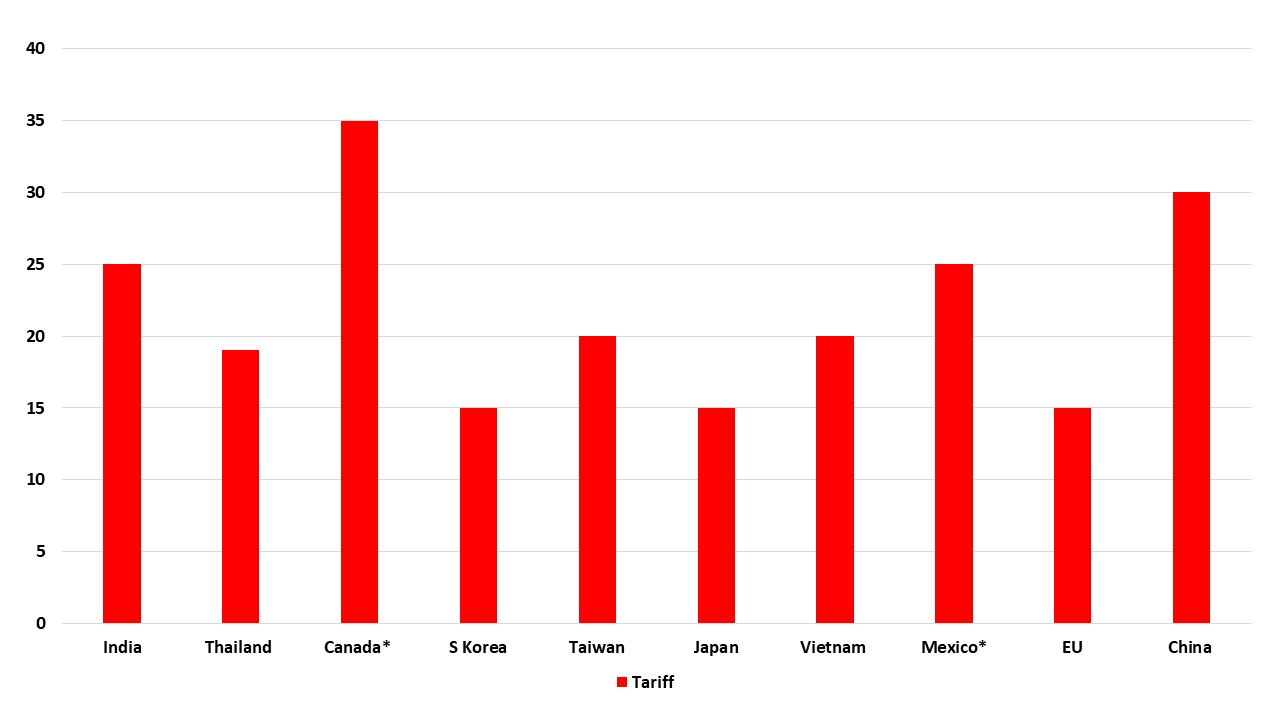

Figure 1: August 1 Reciprocal Tariffs (%)

The new executive order (here) includes high reciprocal tariff on a dozen countries that catches headline such as Syria 41%, Switzerland 39% and South Africa 30%, but the vast majority of new rates are in the 10-15% region depending on whether the U.S. is running a small trade surplus or deficit with the country. The top 10 countries with the largest bilateral deficit (Figure 1), either have trade deals (EU/Vietnam/Japan/S Korea/Thailand); delays (Mexico and soon likely China) or tariffs imposed (Canada/India/Taiwan). Furthermore Taiwan is expected to reach a deal that lowers it’s 20% rate before or just after the August 7 implementation date for the reciprocal tariffs and India will be keen to try to resolve the disappointment of the 25% tariff and negative comments from Trump (Brazil politically motivated 50% has lots of exemptions). Meanwhile, it is worth remembering that USMCA goods from Canada and Mexico are exempt from the 35% and 25% current tariffs and that Trump aim is to improve the USMCA with these countries. Finally, the U.S. has exempted semiconductor/phones/some pharma and energy products, which reduce the effective rate for the U.S.

This all means that the average effective tariff rate is around 15% or just above, which is broadly in line with market expectations. This helps explain why the adverse headlines have not prompted a major reaction from financial markets -- equities are off, but the USD not significantly changed before the U.S. employment report.

However, we still expect the tariffs to slow U.S. growth and on a temporary basis lift U.S. inflation, which we outlined in our June outlook view (here). The Fed also remains in a cautious mood (here). Moreover, Trump feel confident about tariffs, both as economic and inflation numbers have not seen much impact and the U.S. equity market has rebounded from the April selloff. With his approval ratings not slipping, and trade deals having been done with some big countries, Trump appears to want to implement pharmaceutical tariffs at 25% (15% for EU is carve out holds) – other products are also possible as well, but with less confidence than pharma. Trump also wants 40% for transhipment in some deals to mainly restrain China. Though the average effective rate could come down marginally with more trade deals, it could then move up with higher pharmaceutical tariffs.