China: GDP Resilient in Q2, But

• We do see H2 weakness relative to H1, as exports to the U.S. will slow again and the effects of the government consumption trade in programs fades. However, H1 has been higher than our forecasts and thus we are revising 2025 GDP growth to 4.8% v 4.4% previously. We keep 2026 GDP growth forecast at 4.5%.

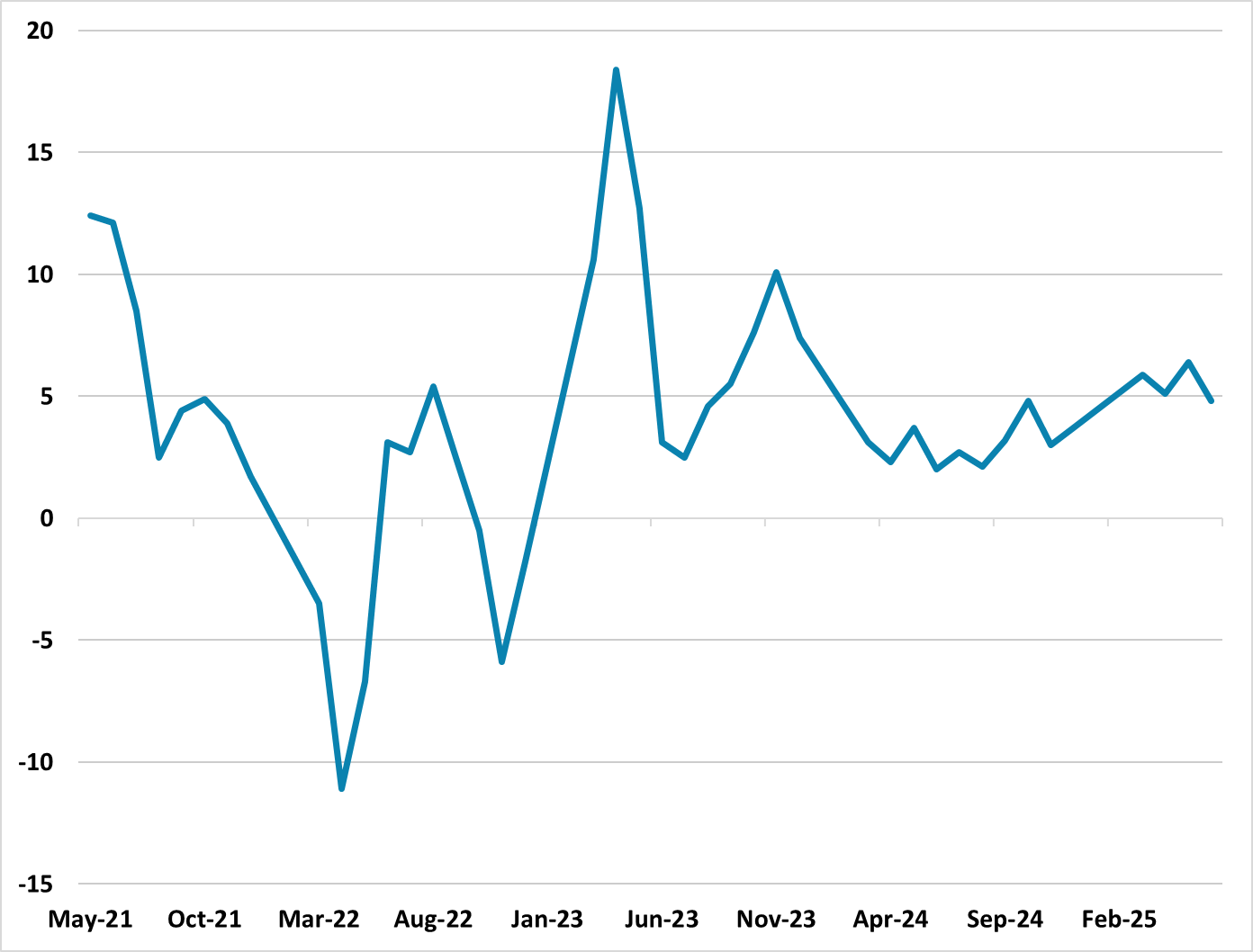

Figure 1: Retail Sales Yr/Yr (%)  Source: Datastream

Source: Datastream

The latest China data shows GDP in Q2 stronger than expected at 5.2%, but an unbalanced economy in June moving towards Q3. The 1.1% real GDP rise in Q2 reflects resilience of net exports outside of the U.S.; some rebound in exports to the U.S. late Q2 after the trade truce and government investment spending. Private investment spending remains weak, with June fixed investment at a low 2.8% Yr/Yr YTD and residential property investment at -11.2% Yr/Yr YTD.

Consumer spending also contributed to Q2 GDP growth according to NBS, but this is due to the government trade in programs that continue to boost some retail sales categories in June – Household and communication appliances up +32.4% and 13.9% respectively. Other areas of retail sales were soft, with a number of categories declining Yr/Yr. The key eating out slowed to +0.9% Yr/Yr, which reflects the underlying nervous mood among households that are uncertain about employment/income and housing wealth. Industrial production in June at 6.8% was stronger than expected helped by high tech manufacturing. However, this may not be sustained, with the underlying softness in domestic demand that is causing noticeable disinflation. The GDP deflator was negative for the 9th quarter in a row and thus nominal GDP is modest by China’s standards.

We do see H2 weakness relative to H1, as exports to the U.S. will slow again and the effects of the government consumption trade in programs fades. However, H1 has been higher than our forecasts and thus we are revising 2025 GDP growth to 4.8% v 4.4% previously. We keep 2026 GDP growth forecast at 4.5%.Extra policy action is unlikely to be spurred by the data and instead the market is looking to the late July Politburo meeting to see whether extra fiscal policy is announced. We feel that some top up measures could be announced in the coming months in the Yuan500-1000bln range to help support economic momentum, but the authorities do not feel under pressure to do more. Though Trump is threatening 100% secondary tariff on any country buying Russian oil, China would likely switch buying. The main trade talks will also likely avoid worst case scenarios (here).