Trump’s 50% Steel And Aluminum: Negotiating Leverage?

• President Donald Trump increase in steel and aluminum tariffs from 25% to 50% is not just about boosting the steel and aluminum industry. It also a demonstration that Trump remains in control of tariffs and can aggressively change tariffs to increase negotiating leverage. It is a message that countries need to do trade deals quickly with the U.S. or else.

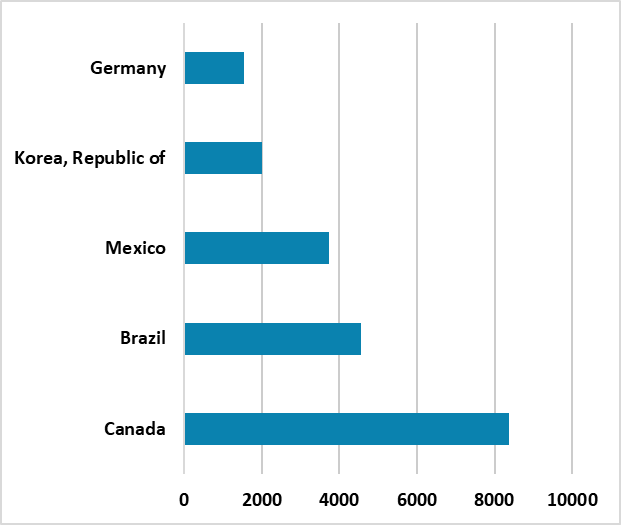

Figure 1: Top 5 Importers of Steel to U.S. (USD Mlns)

Source: US/Continuum Economics

President Trump announcement of 50% steel and aluminium tariffs from June 4 reflects his well-known protectionist views of the U.S. steel industry and the intent to rebuild the industry. However, the wider context is that it reflects Trump’s desire to show that he is still in control after the US court of international trade ruling (here). Trump art of the deal involves maximum threats in negotiation, which needs to be backed up occasionally with action. This negotiating pressure has been undermined by the court ruling and uncertainty in the U.S. whether the Supreme court will uphold the original ruling or side the president. By imposing 50% tariff swiftly, Trump can claim that he is still in control and that countries need to do trade deals with him or else the situation will get worse.

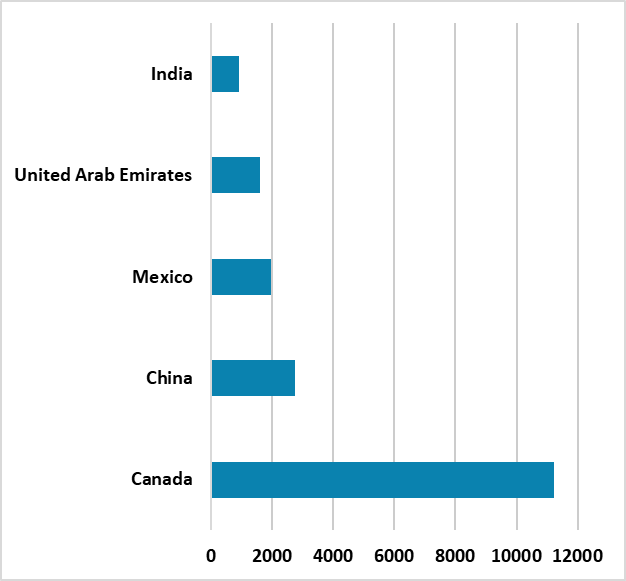

This is high risk negotiations, but Trump likely feels cornered and has to show he can still take action. Section 301 takes too long and section 122 (up to 15% for 150 days) may be a card that the Trump administration plays if the Supreme court rules against reciprocal tariffs. The Trump administration is also trying to pressure China by claiming that the trade truce is being undermined by China, with USTR Greer indicating the real concern is that rare earth metals exports from China are not back to normal – a Trump focal issue. If the U.S. court of international trade original ruling is upheld, then the U.S. would lose the 10% reciprocal tariff but also the 20% fentanyl tariff. The countries most hit by the increase from 25% to 50% are Canada (Figure 1 and 2), Brazil/Mexico on steel. Trump will likely view this as an opportunity to negotiate again with Canada and Mexico for a better USMCA.

Figure 2: Top 5 Importers of Aluminum to U.S. (USD Mlns)  Source: US/Continuum Economics

Source: US/Continuum Economics