No Rush to Ease: RBI Flags External Risks, Holds Policy Steady

The RBI held the policy rate at 5.5% in its August 2025 meeting, opting for a strategic pause after front-loading 100bps of cuts earlier this year. While inflation has dropped sharply, global trade risks and sticky core prices argue against further easing for now. The central bank’s neutral stance signals a data-driven, flexible approach in the face of external uncertainty.

Commensurate with our view, the Reserve Bank of India (RBI) held the policy repo rate steady at 5.5% in its August 2025 meeting today , maintaining a neutral stance following a cumulative 100 basis points of easing since February. This unanimous decision, led by Governor Sanjay Malhotra and the Monetary Policy Committee (MPC), reflects a strategic pause—one grounded in confidence over India’s near-term macroeconomic stability, but tempered by a rising wall of global uncertainty.

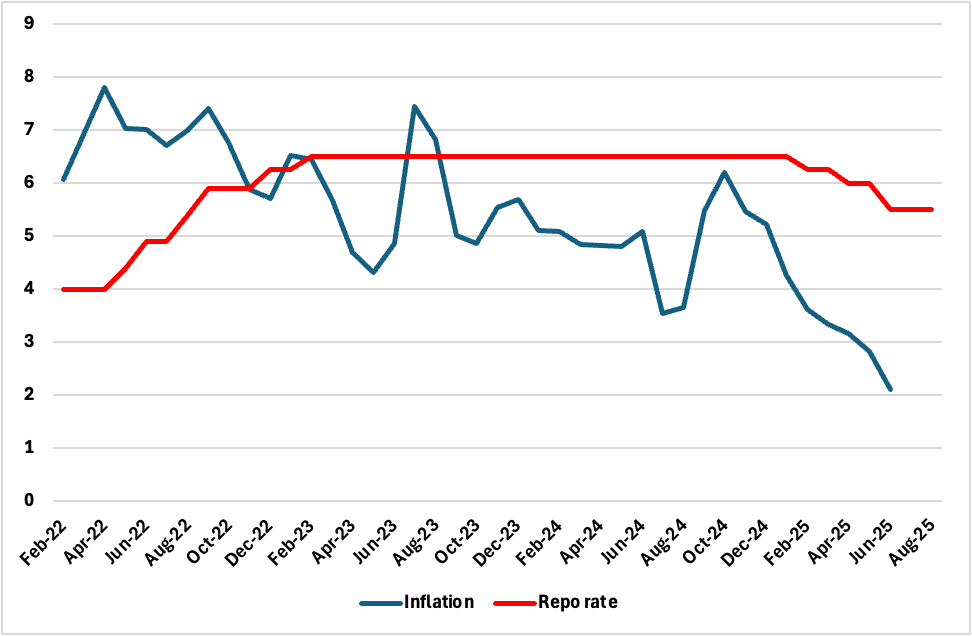

Figure 1: India CPI and Repo Rate (%)

Source: Continuum Economics, RBI

A Pause with Purpose

The decision to hold was expected and reflects a sensible calibration. With headline CPI inflation at just 2.1% yr/yr in June, and inflation averaging below 3% for the first quarter of FY26, the RBI has room to pause and allow the effects of its recent rate cuts to percolate through the economy. The Standing Deposit Facility (SDF) and Marginal Standing Facility (MSF) were also left unchanged at 5.25% and 5.75%, respectively. Notably, the RBI governor mentioned that the transmission of the earlier 50bps cut is not complete as yet.

However, this is not a complacent hold. By retaining a neutral stance, the RBI has made clear it is entering a watchful phase—monitoring evolving risks, rather than closing the door to future action. The guidance was notably cautious: rates could be cut again if global growth deteriorates or hiked if external inflationary shocks mount. In essence, the RBI is keeping its powder dry.

Inflation: A Breather, Not the End of the Battle

Perhaps the most significant policy signal came via the downward revision to the FY26 inflation forecast—from 3.7% to 3.1%. This reflects recent disinflation in food and fuel categories, aided by a strong monsoon, high agricultural output, and a favourable base. But while current data is benign, forward-looking risks remain. The RBI now expects inflation to rise to 4.9% in FY27, as global trade frictions, higher tariffs, and potential energy shocks feed through. Core inflation remains sticky in segments like healthcare, education, and transport and close to 4% yr/yr . The sharp rise in gold prices and the weakening rupee also raise second-round price risks.

In short, while the current inflation path justifies a pause, the balance of risks is shifting. The RBI has rightly avoided getting locked into a dovish posture, choosing instead to preserve credibility and flexibility.

Growth Forecast: Holding Firm at 6.5%

The RBI retained its 6.5% yr/yr GDP growth projection for FY26, despite fresh global headwinds, including new US tariffs on Indian goods and heightened geopolitical stress. This reflects confidence in domestic demand and the resilience of India’s consumption-led growth model. The MPC pointed to strong private consumption, capex momentum, and robust agricultural outlook as buffers against external volatility.

Yet, there are emerging signs of unevenness. Industrial output growth has moderated, and export sectors face real risks from slowing global trade and currency volatility. India’s growth outlook remains solid—but the margin for positive surprises is narrowing.

External Pressures: The Real Risk

The INR continues to face pressure, trading near 87.7/USD as on August 6, while forex reserves have dipped, despite remaining healthy at around USD 699bn. The RBI has been active in managing rupee volatility and absorbing capital outflows—but these interventions are not without cost. With the current account surplus from Q4 FY25 unlikely to sustain, and import pressures rising, India’s external position could come under greater stress in the coming quarters.

The 25% US tariff on Indian exports—along with additional 25% tariff related to Russian oil import—pose meaningful downside risks to both external balances and investment sentiment. These are not transitory frictions. They represent a re-pricing of India's external environment, requiring monetary policy to remain alert and nimble.

From a macroeconomic standpoint, the August decision strikes the right balance. The RBI has already front-loaded support through a sharp easing cycle. Inflation is temporarily subdued, and growth remains stable. The prudent course is to pause and assess. Further cuts now could fuel capital flight or compress real rates unnecessarily. On the other hand, a premature pivot to tightening would risk derailing the fragile recovery in investment and consumption. The MPC’s forward guidance—data-dependent, cautious, and non-committal—is exactly what the moment demands.

We expect the RBI to hold through Q3, with the next rate cut likely in late 2025, contingent on both sustained disinflation and a clearer deterioration in global growth conditions. If external shocks escalate—especially on the trade or energy fronts—the pause could extend further.