Latin America

View:

January 02, 2026

December 22, 2025

December 19, 2025

Mexico: 25bps Cut and Now Pause

December 19, 2025 8:15 AM UTC

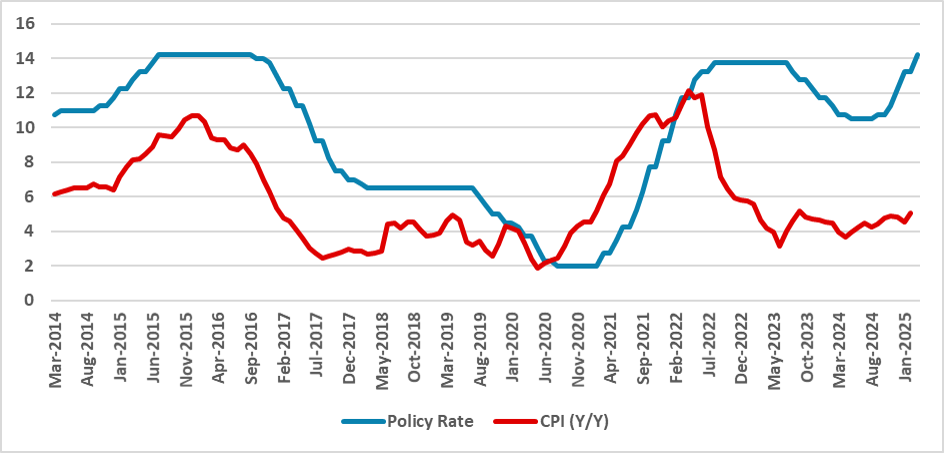

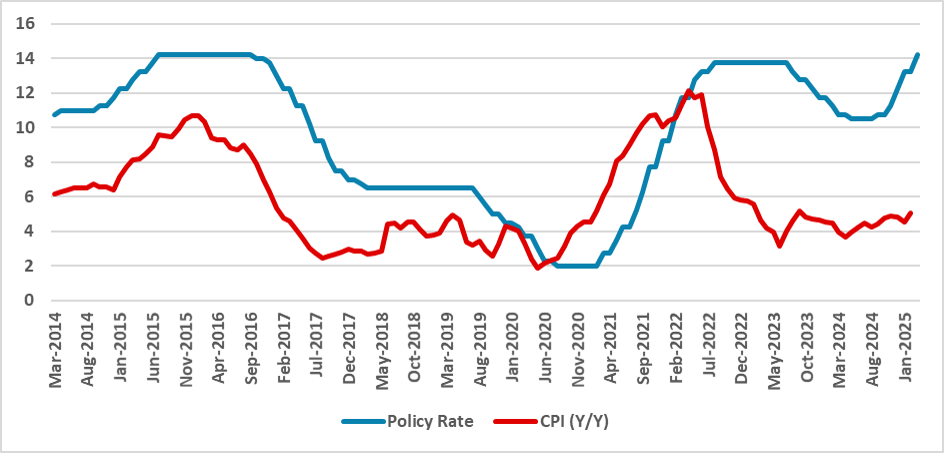

Banxico cut by 25bps to 7.0% as expected with a downward revision to 0.3% for 2025 GDP growth. Below trend GDP is forecast in 2026 and we see this prompting further easing in March and June 2026 by 25bps each, but MXN weakness restraining Banxico pace. We then see Banxico going on hold for the rem

December 17, 2025

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

December 12, 2025

Equities Outlook: Choppy Up For 2026 and Down for 2027?

December 12, 2025 8:05 AM UTC

· The U.S. equity market is underpinned by the bullish AI/tech story and a soft economic landing into 2026. However, overvaluation is clear and this leaves the market vulnerable to a 5-10% correction on moderate bad news e.g. economic data. We see the S&P500 having a choppy year a

December 11, 2025

Brazil: March 50bps Cut?

December 11, 2025 8:00 AM UTC

BCB remain focused on getting inflation converging towards the centre of the inflation target range at 3% looking at the December statement. It appears that the economic weakness is not yet great enough to get the BCB to signal a January cut. Nevertheless, with headline inflation falling, the real i

December 09, 2025

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

December 05, 2025

November 27, 2025

USMCA Renegotiation: Hostage To Trump

November 27, 2025 2:55 PM UTC

• Trump could decide to go on an early offensive over the July 2026 USMCA review or could wait until after the November congressional elections to act tough given it could cause new cost of living fears for U.S. voters. This could mean that at times the USMCA negotiations are upsetting fo

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 18, 2025

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 17, 2025

Financial Stability Risks: Vulnerable To A Recession

November 17, 2025 1:00 PM UTC

The November Fed financial stability review highlights continued concern over hedge funds and insurance company leverage, while the IMF GSFR is concerned about U.S. equity market overvaluation and growing links between banks and non-bank financial intermediaries. However, the main adverse shock wo

November 07, 2025

Banxico: December In Doubt and Pause Closer

November 7, 2025 9:56 AM UTC

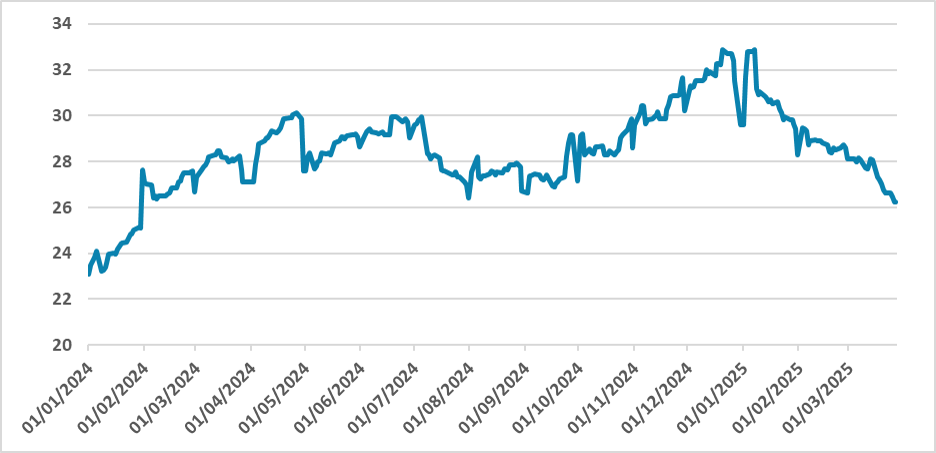

The December Banxico meeting is not guaranteed to see a further 25bps cut, with the November Banxico statement showing more caution over persistent core inflation pressures and given the cumulative easing already seen. Combined with the risk of a Fed pause in December, plus Banxico’s Mexican Peso

October 01, 2025

AI/Humanoid Robots and Disinflation?

October 1, 2025 9:40 AM UTC

· Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but productivity enhancements and product innovation could be disinflationary like Information and Communications technology (ICT). One other key uncertainty on a 1-5 year

September 26, 2025

Banxico Review: Slower Pace for 25bps Cuts

September 26, 2025 6:39 AM UTC

Banxico cut by 25bps to 7.5%. However, Banxico pushed up the near term inflation forecasts, which could mean that the November 6 meeting does not see a rate cut but rather Banxico waits until the December 18 meeting. This is our view and we look for 25bps to 7.25%. We then see two further 25bps

September 25, 2025

September 23, 2025

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

Equities Outlook: Correction Then Up In 2026

September 23, 2025 7:15 AM UTC

• The U.S. equity market’s bullishness reflects good corporate earnings reality, buybacks and the AI story. However, we feel that the U.S. economy can deteriorate still further in the coming months, as the lagged effects of tariffs boost inflation and restrain spending/hurt corporate ea

September 18, 2025

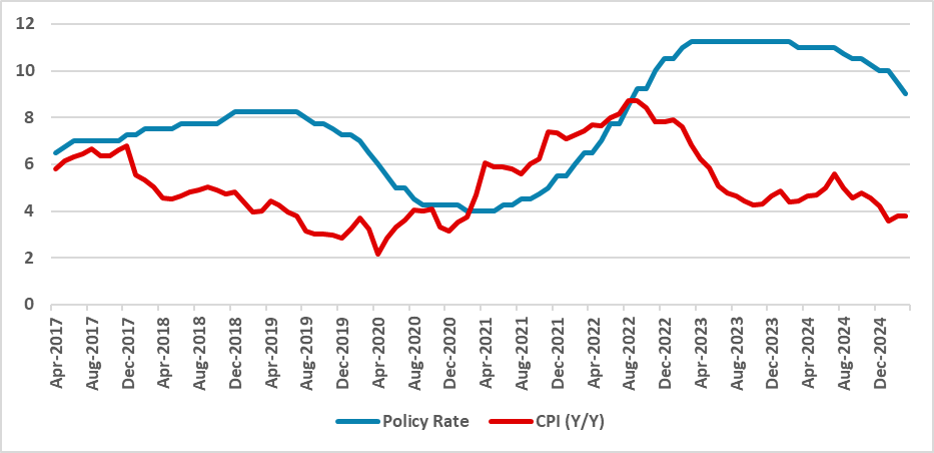

Brazil: 15% Well Into 2026

September 18, 2025 6:29 AM UTC

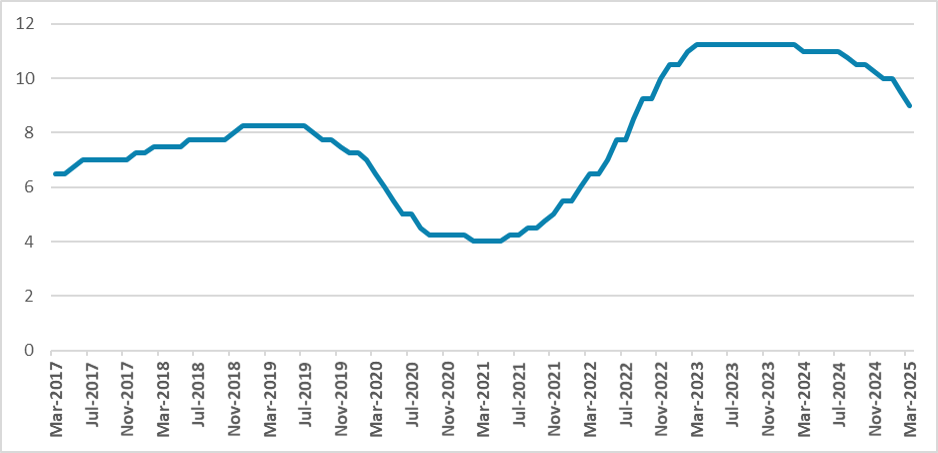

The BCB statement was clear that the deanchored inflation picture still requires interest rates to be kept at current levels for a very prolonged period of time. The consensus for economists is that this will change in Q1 2026 with a 50bps cut, though ideas of December are fading. We suspect it

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 08, 2025

August 08, 2025

Mexico: Further 25bps Cuts Ahead

August 8, 2025 6:44 AM UTC

Banxico forward guidance, plus trade policy risks with the U.S. now see us forecasting an end 2025 policy rate at 7.25% with two 25bps cuts in September and December. We now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rat

July 03, 2025

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

June 27, 2025

Mexico: Back Toward Neutral Policy Rates

June 27, 2025 6:56 AM UTC

Banxico has cut by 50bps to 8.00%, while also signalling in its statement that further easing will now be data dependent. Our forecast is for easing to move to a 25bps pace and to come once a quarter – most likely in September and December. Some improvement in the monthly inflation trajectory woul

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

June 19, 2025

Brazil: Last Hike And Then Long Hold

June 19, 2025 6:33 AM UTC

Though the BCB surprised and hiked by 25bps to 15%, the statement signalled that policy will now go on hold for a very long period. Some economists feel that by year-end, that the BCB will be confident enough to move from very restrictive to restrictive and lower the SELIC rate. We would suspect

June 03, 2025

May 08, 2025

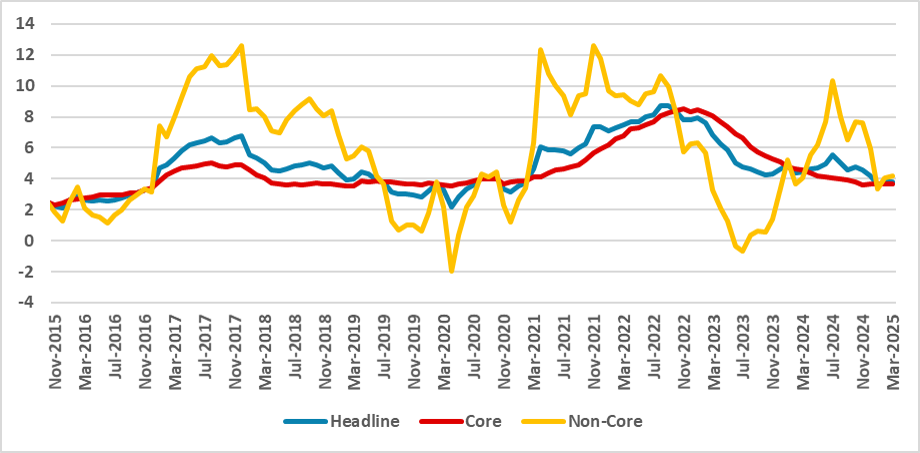

Brazil: Reaching the Rate Peak

May 8, 2025 6:43 AM UTC

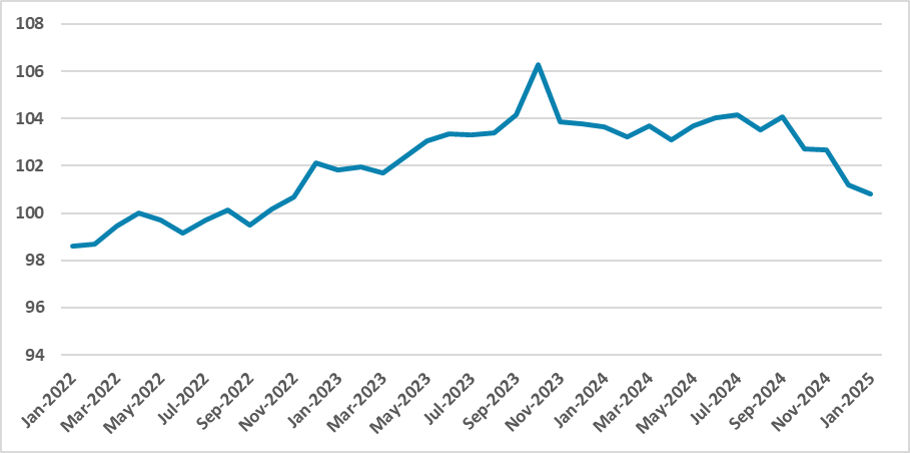

Forward guidance from the BCB after the 50bps hike to 14.75% suggests that we are close to a rate peak, with inflation concerns now cited on both sides. The disinflationary impact of Trump tariffs on global trade and commodity prices is now being watched, as BCB members have signaled over the last

April 30, 2025

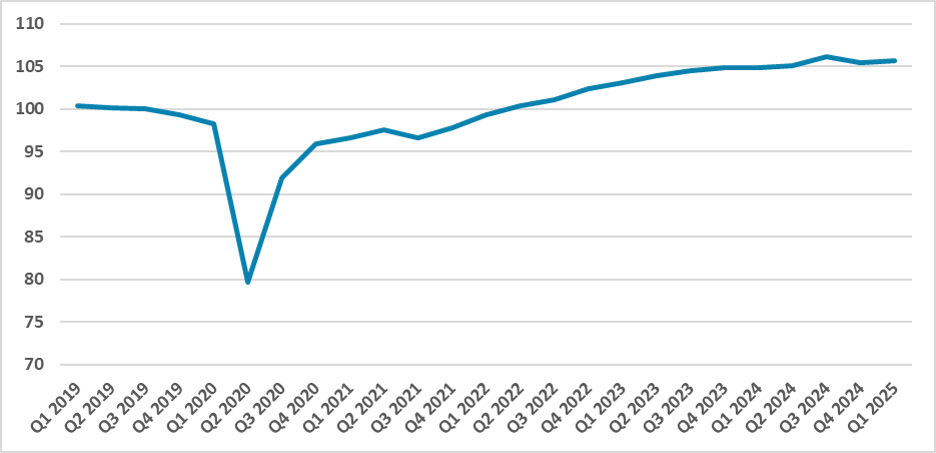

Mexico’s GDP Review: Saved from the Technical Recession, but Growth Slows

April 30, 2025 2:52 PM UTC

Mexico narrowly avoided a technical recession in Q1 2025 with 0.2% GDP growth, driven by a volatile rebound in agriculture. However, industrial output contracted and services stagnated, highlighting a broader economic slowdown. Uncertainty over potential U.S. tariffs and tight monetary and fiscal po

April 28, 2025

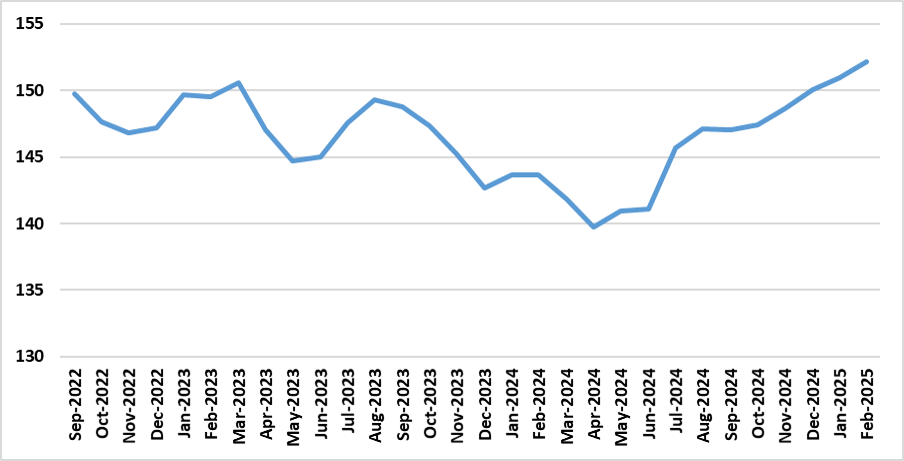

Argentina: Activity Continues Growing

April 28, 2025 1:15 PM UTC

Argentina’s economy grew 2.3% in February and 6% year-on-year, showing continued short-term recovery driven by financial and mining sectors. However, rising imports and an overvalued exchange rate are straining reserves, despite IMF support. While agricultural exports may ease pressure mid-year, s

April 23, 2025

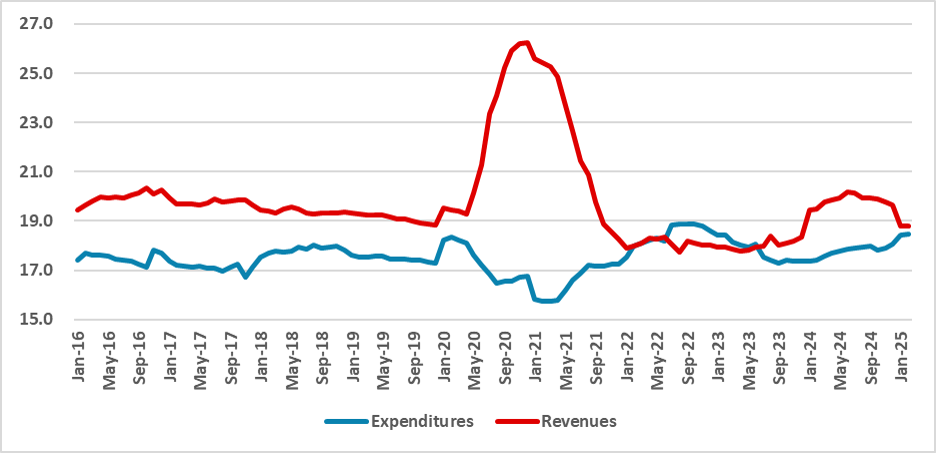

Brazil: Fiscal Result Improves but Structural Changes Remains in Doubt

April 23, 2025 5:57 PM UTC

Brazil’s fiscal data shows slight improvement, with a 0.1% primary deficit by February and a 2024 deficit in line with targets, excluding flood aid. The 2025 goal is a 0% deficit, but structural issues remain. Recent gains stem from reduced court-ordered payments and delayed hiring. However, risin

April 17, 2025

Banxico Minutes: Comfortable about the Cuts Amid the Volatility

April 17, 2025 2:26 PM UTC

Banxico’s latest minutes confirm a cautious but steady path toward policy normalization, with the policy rate expected to reach neutral levels (7.00–8.00%) in 2025. While the economy shows signs of deceleration and a negative output gap, inflation continues to ease, nearing historical averages.

April 15, 2025

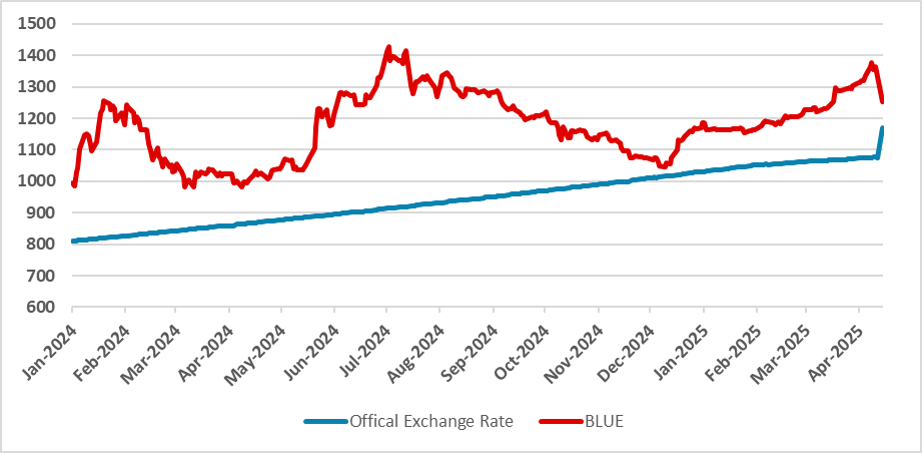

Argentina: Moving to Phase 3, Bands Flotation

April 15, 2025 8:33 PM UTC

Argentina launched Phase 3 of its macro plan, ending currency restrictions for individuals and securing a USD 20B IMF deal to stabilize falling reserves. The Central Bank shifted from a crawling peg to a target band exchange rate regime, allowing for a 1% monthly devaluation within ARS 1,000–1,400

April 11, 2025

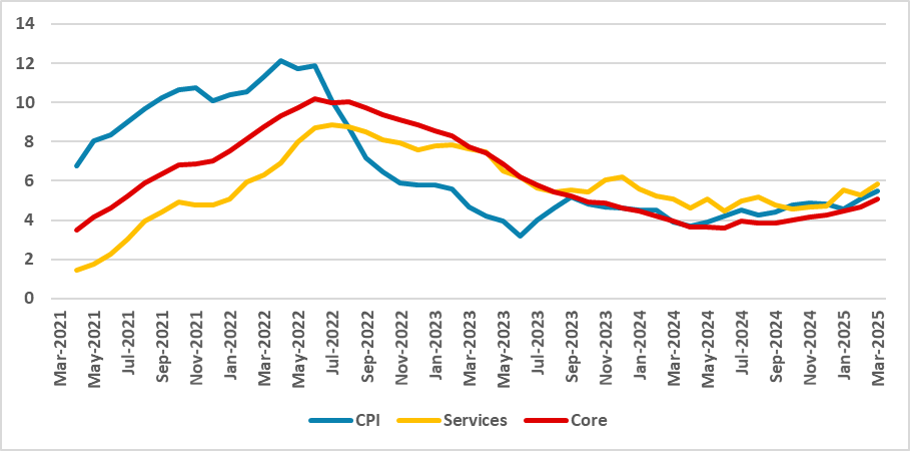

Brazil CPI Review: March Acceleration, Hike Confirmation

April 11, 2025 2:21 PM UTC

March CPI in Brazil rose 0.6%, above expectations, pushing the annual rate to 5.5%. Broad-based price increases, especially in food, signal persistent inflation pressures. Core inflation, notably in services, is well above the BCB’s target, and external volatility adds risk. With activity and cred

April 10, 2025

Mexico CPI Review: Moving as Expected

April 10, 2025 2:20 PM UTC

Mexico’s March CPI rose 0.31%, matching expectations but below the historical average. Annual inflation edged up to 3.80%, driven by core components like food and services. Non-core inflation fell due to lower energy prices. Food saw strong gains, while transport costs declined. The narrowing gap

April 08, 2025

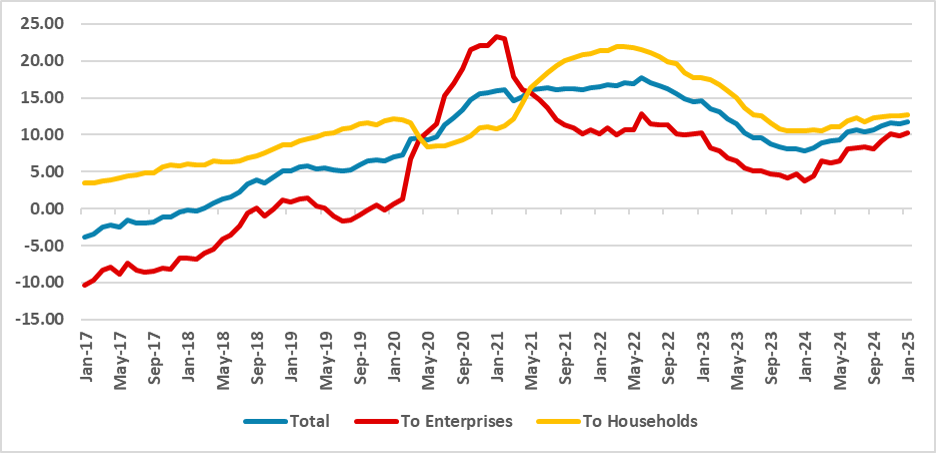

Brazil: Credit Accelerating Despite Higher Rates

April 8, 2025 6:44 PM UTC

The Brazilian Central Bank (BCB) has resumed raising the policy rate due to persistent inflation concerns, despite expectations of credit deceleration. In contrast, credit has accelerated in recent months, indicating that the credit channel through monetary policy may be compromised, increasing disi

April 04, 2025

Argentina: Reserves Depleting, New Devaluation?

April 4, 2025 6:28 PM UTC

Argentina's foreign reserves have recently fallen to USD 26 billion, the lowest since February 2024, largely due to Central Bank bond payments and difficulties acquiring USD. While internal demand recovers, imports are outpacing exports, complicating reserve accumulation. Additionally, maturing Cent

April 03, 2025

Mexico: Saved from Tariffs?

April 3, 2025 7:56 PM UTC

Mexico has avoided reciprocal tariffs but still faces steel, aluminum, and auto tariffs. Authorities are negotiating to exempt goods, though retaliatory tariffs on U.S. imports seem unlikely. Mexico's economy is slowing, with growing recession fears and diminishing nearshoring prospects. The industr

March 29, 2025

Banxico Review: Lowering Rates Amid Tariffs

March 29, 2025 9:29 PM UTC

Mexico’s Central Bank (Banxico) has cut the policy rate by 50 bps to 9%, in line with market expectations. The tone of the communiqué suggests a more dovish stance, with the board moving towards a neutral rate. Inflation has reached its lowest level since 2021, while economic growth has slowed. B

March 27, 2025

March 26, 2025

LatAm Outlook: Navigating the Uncertainty

March 26, 2025 9:56 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico institutional reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump victory, and the menaces of Trump imposing tar

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

Equities Outlook: Turbulence Ahead

March 26, 2025 9:05 AM UTC

· U.S. trade wars will likely hurt U.S. growth and raise inflation, with only small to modest Fed easing and a 10yr budget bill that will likely be neutral to negative for the economy. With valuations still very high (Figure 1), we see scope for a correction to extend into mid-year th

March 25, 2025

BCB Minutes: Caution Rather than Optimism

March 25, 2025 10:51 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate by 100bps to 14.25% amid signs of economic deceleration, including slower growth, job creation, and consumption. The BCB highlighted external uncertainties, such as U.S. trade policy, and domestic challenges with rising inflation. It emphasized

March 19, 2025

BCB Review: Confirming More Hikes

March 19, 2025 10:38 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate by 100 bps to 14.25% and signaled further hikes, likely reaching 15.0% by May, potentially ending the current tightening cycle. The BCB emphasized inflation concerns and strong economic activity, suggesting a hawkish stance. Fiscal policy was n

March 12, 2025

Brazil CPI Review: 1.3% Monthly Growth, with Seasonal Impacts

March 12, 2025 10:43 PM UTC

Brazil's February CPI increased by 1.3%, the highest in 22 years, largely driven by the removal of subsidized electricity bills, which boosted Housing by 4.4%. The year-over-year inflation rose to 5.1%, above the BCB's target. Key contributors included Education (up 4.4%) and Food and Beverages (up

Argentina: Fresh IMF Deal on the Pipeline

March 12, 2025 12:00 AM UTC

The Argentine government has issued an emergency decree to authorize a new IMF deal, potentially worth USD 20 billion, to pay off Treasury debt to the Central Bank. This deal includes a 4-year grace period and 10-year repayment terms. The government aims to stabilize reserves, delay debt amortizatio