Mexico: 25bps Cut and Now Pause

Banxico cut by 25bps to 7.0% as expected with a downward revision to 0.3% for 2025 GDP growth. Below trend GDP is forecast in 2026 and we see this prompting further easing in March and June 2026 by 25bps each, but MXN weakness restraining Banxico pace. We then see Banxico going on hold for the remainder of 2026, as it waits for the lagged effect of its large easing cycle to feedthrough.

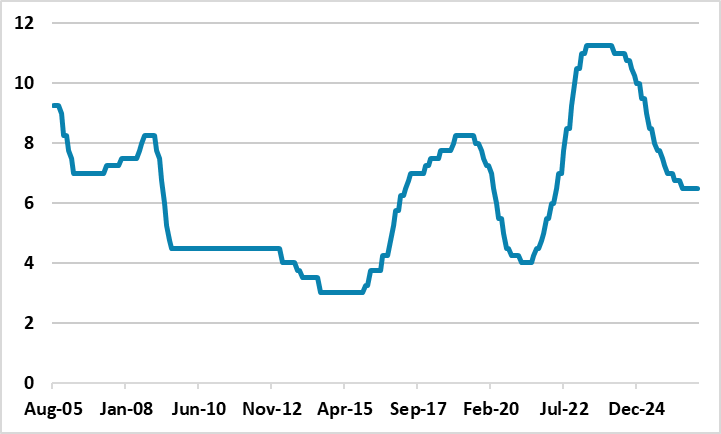

Figure 1: Mexico CPI and Banxico Rate (%)

Source: Datastream/Continuum Economics

Banxico cut by 25bps to 7.00%, with concerns about the economy being the key driver. Though Banxico guided towards a positive Q4 GDP reading, the Q3 contraction and Q2 weakness has prompted a 2025 GDP forecast downgrade to 0.3% and kept a sluggish 1.1% forecast for 2026. This more than outweighed a slight upward revision to the near-term inflation trajectory and still sticky core inflation numbers. Banxico are still forecasting that headline inflation will fall to the 3% target by Q3 2026 and they are placing more weight on forecast rather than near-term inflation. It was also interesting that only Jonathon Heath voted against the decision, as the market had been nervous that a 2nd board member could join Heath.

The forward guidance seems to be towards a pause. The Banxico statement noted that they will “evaluating the timing for additional reference rate adjustments.” Combined with assessing the impact of lagged monetary easing, the sequence of easing at every Banxico meeting will likely be broken. However, Banxico 2026 GDP forecast is on the low side and Mexico has to deal with the USMCA review in July 2026. USTR are due in early January to provide guidance on President Trump’s desires, but it is likely to be for renegotiation rather than simple review. This can prolong trade uncertainty potentially throughout 2026, as we see a deal only late 2026/early 2027 (here). However, we also feel it can prompt a correction of the Mexican peso (here), which Banxico will be apprehensive about.

We see this prompting further easing in March and June 2026 by 25bps each, but MXN weakness restraining Banxico pace. We then see Banxico going on hold for the remainder of 2026, as it waits for the lagged effect of its large easing cycle to feedthrough. Banxico are likely to keep the door open to still lower rates as the center of the real neutral rate estimates is 2.7% meaning 5.7% nominal rate with a 3% inflation target.