Brazil: March 50bps Cut?

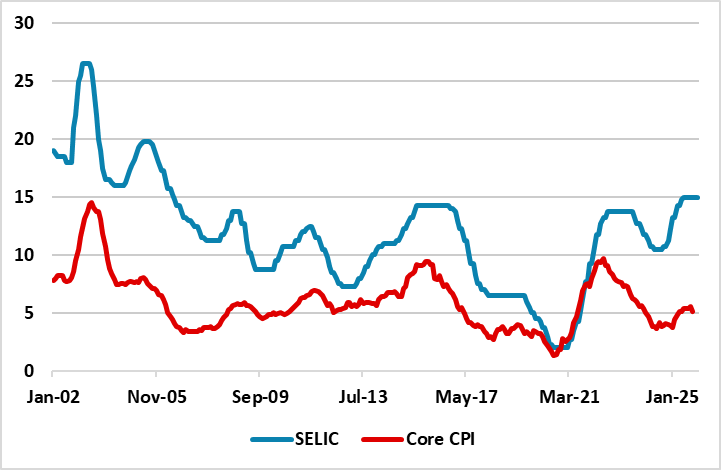

BCB remain focused on getting inflation converging towards the centre of the inflation target range at 3% looking at the December statement. It appears that the economic weakness is not yet great enough to get the BCB to signal a January cut. Nevertheless, with headline inflation falling, the real interest rate is going up and policy is becoming more restrictive. The BCB will likely frame any easing as offsetting an increase in real policy rates due to falling inflation, rather than signalling a more aggressive pace. This should mean a 50bps step in March 2026 followed by a moderate pace of easing in 2026.

Figure 1: Brazil Core CPI and SELIC Policy Rate (%)

Source: Datastream/Continuum Economics

The December BCB statement did not provide major clues on prospective policy easing and kept the current bias towards ultra-restrictive policy. Key points include

• Economy slowing, but still inflation pressures still. BCB remain focused on getting inflation converging towards the centre of the inflation target range at 3% looking at the December statement. Though the Q2 2027 inflation forecast was trimmed from 3.3% to 3.2%, and the November inflation slowed to 4.46%, BCB want to see a lower trajectory for inflation. This was clear in the section on above target inflation in the statement. They appear willing to keep ultra-tight monetary policy for a while longer, despite clear evidence of a slowing economy – Q3 GDP growth at 0.1% and Q2 revised down to +0.3%. It appears that the economic weakness is not yet great enough to get the BCB to signal a January cut, with the labor market still seen to have some resilience. BCB are also likely wary that 2026 will see an easing of fiscal policy.

• March cut? Nevertheless, with headline inflation falling, the real interest rate is going up and policy is becoming more restrictive. Combined with the lagged effects of ultra-high rates on the economy and disinflation, this builds an argument to reduce the degree of restrictive policy in Spring 2026. We see the most likely date being the March 18 2026 meeting rather than April 29. However, the BCB will likely frame any easing as offsetting an increase in real policy rates due to falling inflation, rather than signalling a more aggressive pace. This should mean a 50bps step in March 2026 followed by a moderate pace of easing in 2026. We see a 50bps cut in June, before 200bps in H2 to take the SELIC down to 12%. H2 will likely see more inflation convergence and this can see BCB ensuring that policy moves from ultra-restrictive to restrictive. Nevertheless, in 2027 the BCB easing is likely to be moderate rather than aggressive and will be data dependent and we see a further 250bps to 9.5%. This would still be mildly restrictive policy rate level, with the market viewing 8% as being around neutral policy rates, with the BCB having estimated a 5% neutral real policy rate in the past (here).