Markets: Profit-Taking or More?

• For now we see some further profit-taking on risky positions in gold/silver/copper/equities and short USD positions. However, a bigger macro catalyst is required to produce a deep correction in equities and major risk off. The nomination of Kevin Warsh for Fed chair is unlikely to be the catalyst, as his previous hawkishness is not representative and a major change in Fed decisions remains unlikely. The U.S. economy/AI revenue growth and Trump erratic decision making are all catalysts for a deeper correction, but none at the moment is producing the news flow to immediate turn a pullback into say a 5-10% U.S. equity market correction. Iran/reciprocal tariffs and U.S. labor market will be watched in the coming weeks.

Gold/Silver and now Equities and short USD positions are being unwound. How much further can it go?

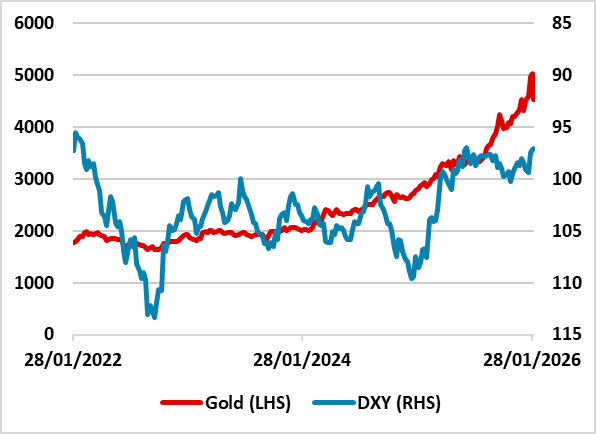

Figure 1: Gold Prices and Inverted DXY ($ and Index)  Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

What is the cause of the risk off in metals and the spillover to other markets and how will it play out?

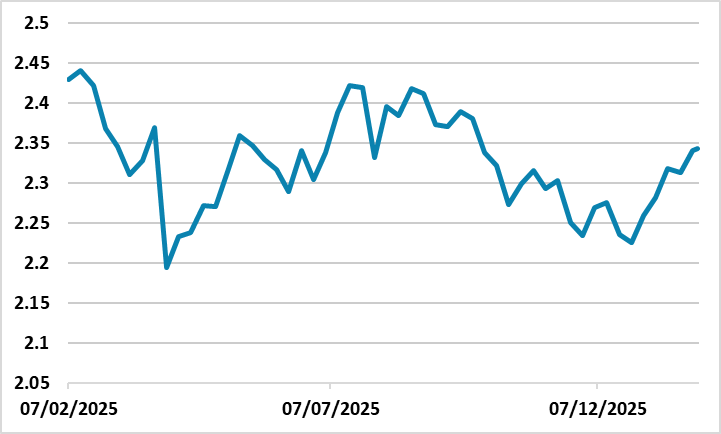

• Metals speculative froth. After a great performance last year, interest intensified for gold, silver and copper in January but has gone into significant reverse in the past few sessions. Some have pointed to Kevin Warsh appointment as Fed chair as a catalyst. While this could be partially true for gold/silver, the DXY and U.S. Treasury market has not seen the magnitude of movements elsewhere. The DXY has bounced, but it’s recent correlation with Gold has been weak (Figure 1). Meanwhile, 10yr U.S. Breakeven inflation expectations have hardly moved (Figure 2). As we shared in our thoughts on Kevin Warsh (here), he will likely be more dovish than his previous role as Fed governor but restrained by the majority of voting FOMC members remained focused on their views on economy/inflation/Fed Funds and neutral rates. This is why the reaction to Warsh nomination as Fed chair has been muted in the U.S. Treasury market. The gold and silver sharp pullback reflects speculative longs taking profits and then liquidating as stops got hit. Copper longs have built up on anticipation that Trump could impose 15% tariffs on Copper imports (Commodity Outlook here) and have also been hit by profit-taking and now stops. This selloff in metals could carry on for a couple of days and dent sentiment multi week/month, but what about equities?

Figure 2: 10yr Breakeven U.S. Inflation (%)  Source: Bloomberg/Continuum Economics

Source: Bloomberg/Continuum Economics

Global equities have seen some risk off after the sharp pullback in gold and silver. However, this appears to be profit-taking after a hot run in EM equities since the start of the year and all equities markets since last April’s lows. The bigger question is whether the U.S. equity market see a modest correction or a sharper pullback. This is dependent on three factors in the shape of the economy, AI and Trump.

• Economy. On the U.S. economy, financial markets are relaxed about the recent hard and soft data, with the Fed shifting its assessment to solid growth at last week FOMC meeting. However, the weak link is the labor market, where less immigration is producing less employment growth. This is then slowing aggregate wage growth, which has not yet hit consumption as household savings rates have fallen. Household savings rates are now below normal however and we see slowing consumption and overall growth into 2026. This could take time to arrive, but any weak U.S. labor market data could spark worries over the U.S. economy and hence still overvalued U.S. equities (here). This means that the January employment report on February 6 is still important.

• AI. The 2nd issue is AI optimism. Microsoft results hurt the stock price and raised questions about CAPEX versus current AI revenue momentum. Meta results and bounce however meant that the impact on the S&P500 was less. The winners and losers in AI are a theme that will continue in 2026, with a focus also on Oracle and the key question of whether Open AI revenue continues to grow explosively (here). Any slowdown in rapid industry AI application revenue could cause a wider shakeout in tech, but this is currently a risk rather than a reality. Overall the earnings season has been reasonable so far and not a catalyst to deepen profit-taking and cause say a 5-10% overall market correction. We do feel that the U.S. equity market will see a 5-10% correction this year, but we feel that spring/summer is more likely as employment/income and consumption slow.

• Trump’s problems. Iran is currently in the spotlight, with Trump armada but threats of military actions cooling over the weekend with reports of high level talks. The risk of a spike in oil and gasoline prices is too great even for a caviler Trump and we feel that pressure will continue and produce a deal. We also feel that though Greenland will be threatened again by Trump, but will stop tensions short of a blockade or invasion (here) and a negotiated solution will be seen. However, the Trump administration’s hyperactive start to 2026 is unlikely to achieve success on the number one issue for voters in the shape of cost of living concerns. Trump can either control himself or distract by causing problems elsewhere. ICE’s soften of immigration tactics in Minnesota show a more cautious Trump but he loves to shift the media focus by distracting on other issues. For financial markets, the biggest potential issue is the Supreme court ruling on reciprocal tariffs, with our baseline being a partial or full rejection. The Trump administration will likely threat 122 and 301 tariffs (here), which can create trade policy and financial market uncertainty. This is a potential adverse equity market catalyst if handled badly by the Trump administration.