AI/Humanoid Robots and Disinflation?

· Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but productivity enhancements and product innovation could be disinflationary like Information and Communications technology (ICT). One other key uncertainty on a 1-5 year period is over the net adverse impact on white collar employment and wage rates from generative AI/agentic AI, though blue collar workers should be much less impacted due to the less developed nature of humanoid robots. The more that AI is labor displacing rather than labor enhancing, the greater the potential disinflation. For now we are not inclined to see more disinflation boost to GDP than the ICT wave in the next 1-2 years and the impact will be less on EM economies ex China than DM and China. On a 3-5yr view (2028-30), the effects will likely be larger, but it is difficult to quantify at this stage. Our thinking is evolving and we will return to this issue in 2026.

Economists and fund managers need to form a view on the impact on AI and Humanoid robots on inflation over the cycle (1-2 years) or structural time horizon (3-5 years), rather than longer time scale of AI champions/ pessimists (10-25 years).

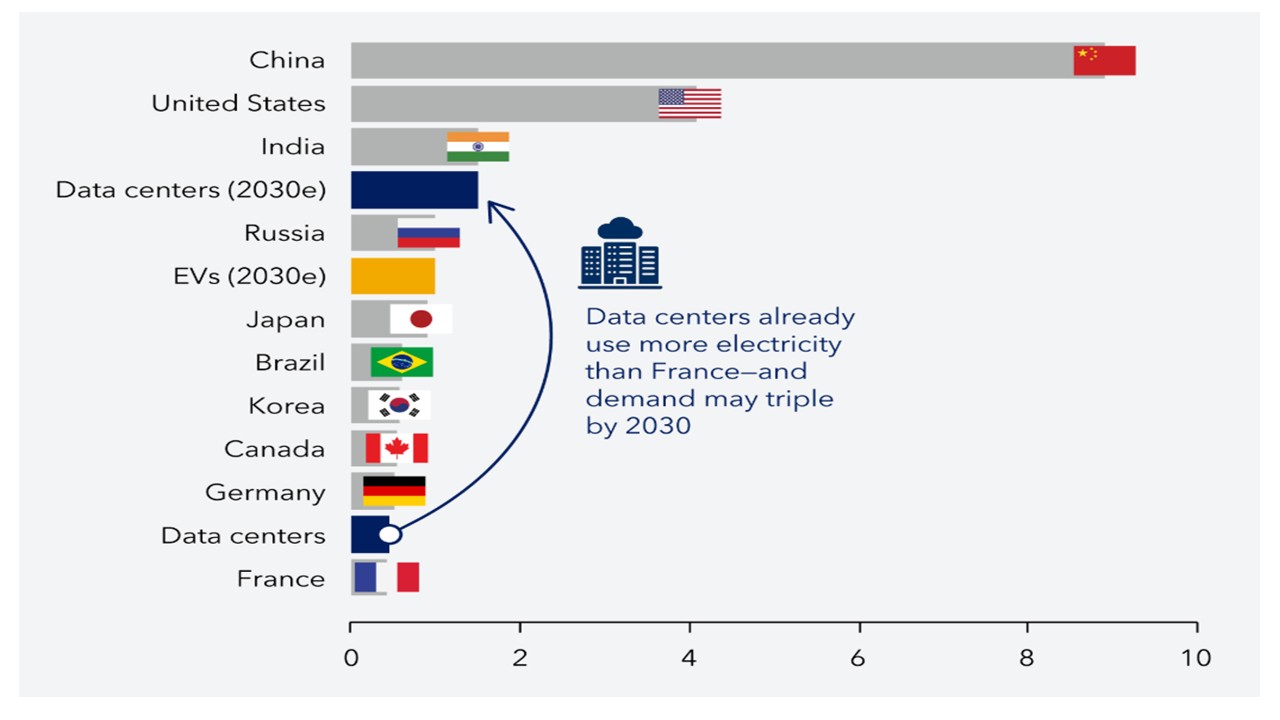

Figure 1: Electricity Demand (Thousand Terra Watt Hours)

Source: IMF (here)

Technology has helped to provide a disinflationary force in recent decades, through lower product prices including telecommunications and squeezing prices between manufacturing and consumers via e commerce platforms. IMF research notes that the ICT revolution has had a small negative impact on inflation (here). One U.S. Fed governors’ study estimated -0.25% for PCE inflation (here). Will AI accelerate this trend or not? Some disinflation and inflation influences include

· Product disinflation? AI impact on product prices is still developing, as the initial waves have involved generative AI tools that have been provided free or on a subscription basis. Even so, tech companies need to generate extra revenue from AI to meet return requirements from heavy technology/data centres investment and also running costs (power and scarce local water suppies), which suggest that they could try to increase revenue via increased subscription prices. Prices of other products could be reduced, if AI agents or other evolutions can reduce production costs (worker replacement is considered in more detail below). However, the BIS (here) modelling suggests increases in supply and demand mean an uncertain impact on inflation. Additionally, AI adoption rates by companies are not yet broad based and the U.S. macro impact in the next year may not be noticeable outside of business investment. Though AI should help productivity and hence disinflation, much uncertainty exists over how much productivity benefit will occur from the AI rollout. Meanwhile, some AI safety gurus also worry that lack of regulation in the U.S. could mean AI eventually disrupts social media (and tech advertising revenue); distorts elections or could cause geopolitical dangers such as enabling terrorists to launch viruses or new forms of cyber-attacks (here). The probability of these event risks in the next 1-5 years range from marginal to moderately high depending on the expert’s opinions, which is a fluid probability for economists and fund managers to consider. This could increase growth and inflation volatility, if any major events occur.

· Power/Commodity demand AI requires more power in data centres compared to existing technology setups (here), with an investment wave in power already under way lead by the U.S. says the IMF (here and Figure 1). However, it could prompt an increase in overall U.S. power costs, if new fuel supply cannot keep pace with the extra power demand from AI. Other countries are less advanced in AI server centres and associated power build up. More generally, China is still pushing forward with a major solar power expansion, both for energy security and also climate change reasons. EU/UK are slower in building extra overall capacity, with the focus remaining on new renewables but retiring fossil fuel power generation. Additionally, it is worth mentioning that China trend growth slowdown in the 2nd half of the 2020’s will reduce commodity demand, which is important given China’s dominant demand in certain commodities.

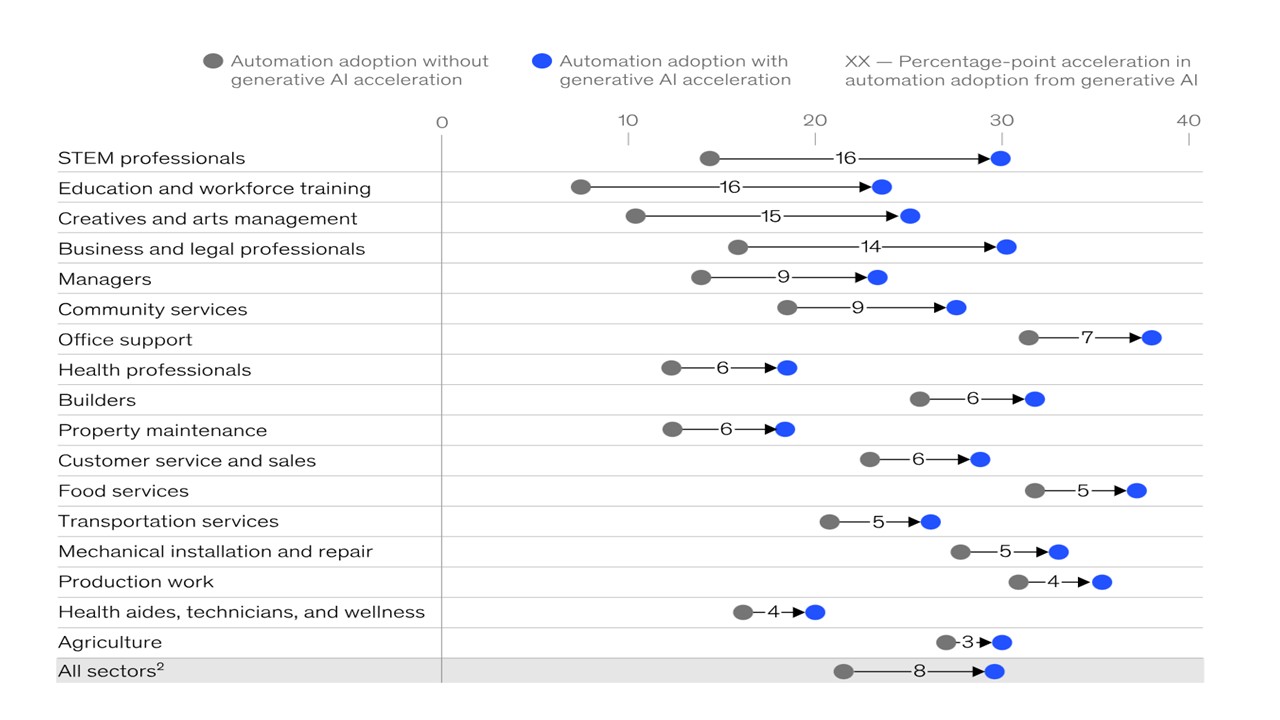

Figure 2: 2030 Automation Adoption U.S. (%)

· AI replacing white collar jobs. Generative AI is already working alongside existing workers, but threatening to replace some roles. The new wave of AI agents is also designed to integrate work processes more, but also to save costs by making white collar jobs redundant. The focus is on jobs with repetitive processes, which can be replaced. McKinsey estimated that an extra 8% of U.S. hours worked (Figure 2) could be automated by generative AI by 2030. However, AI gurus note that advances in AI technology will also threaten to replace creative jobs in the coming years. The IMF 2024 paper (here) estimates that up to 40% of workers could be impacted by AI. Nonetheless, economists and fund managers need to separate 10-15 years from now from the cyclical (1-2 years) and structural (3-5 years). In the U.S. anecdotal reports have already suggested that some companies have slowed recruitment in anticipation that AI could replace certain white collar roles. Some experts see only temporary net rise in unemployment on a 1-5 year view given still narrow sectoral adoption (here) and as new roles are created alongside some losses for routine white collar jobs. A UK study also forecast a temporary unemployment effect (here). Other experts note that AI is not just a tool like other technology revolutions, but the ability to solve problems (via narrow or eventually general intelligence (AGI) can mean a wider set of job losses that could translate into structural unemployment/inequality/ government tax revenue problems. The long-term risk of AI replacing jobs is already starting to appear in workers concerns (UK here), which emphasize that expectations of the future can impact current decision making by workers/households. This is difficult to gauge on a 1-5 year view and we will watch labor market data to dynamically evolve our understanding and forecasts.

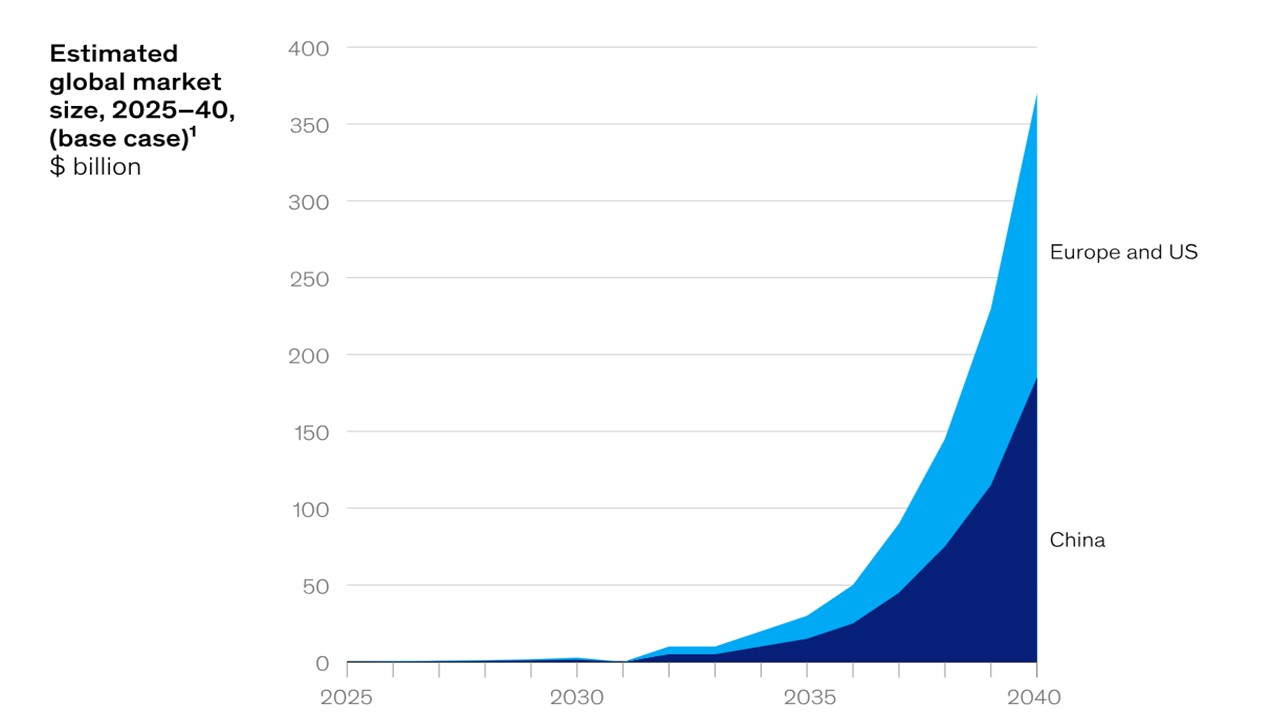

· AI Humanoid Robots: A 2030’s story? AI guided humanoid robots are being championed as the next big AI wave. However, practical rollout in most areas is unlikely to be rapid. Humanoid robots are currently USD150-250k according to McKinsey, while also require spending for maintenance and battery life is currently problematic (here). Additionally, the range of hand movement also does not match human capability, which restrict the ability to replace blue collar workers e.g. plumbers. Autonomous vehicles usage can ramp up further and replace blue collar drivers, though adoption has been modest rather than rapid. AI non-humanoid robots could be scaled up in manufacturing setting however, where the cost savings could be large enough. It is worth noting that China’s use of robots in manufacturing has surged in recent years to overtake Japan’s intensity of usage and come close to S Korea high levels. Overall, humanoid robots are more of a 2030’s story (Figure 3), which limits adverse impact on blue collar employment.

Figure 3: Estimated Global Market General Purpose Robots (USD Blns)

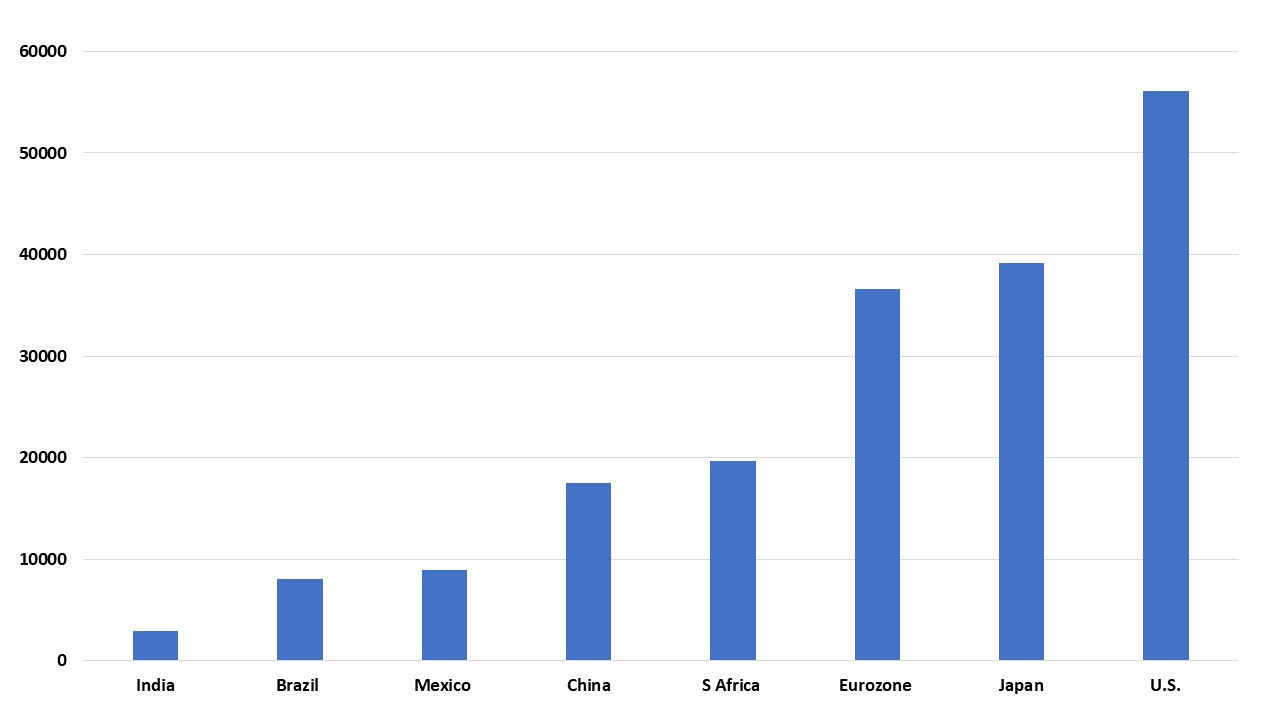

· AI labor replacement: DM and China more than other EM’s? Relative wage rates mean that AI labor replacement is a more realistic option in certain sectors in DM economies and China and less so in other EM economies. The IMF expects that broader AI adoption to be slower in EM ex China also due to lack of infrastructure or management to integrate AI (here). The U.S. and China will be the most closely watched, given they are leading the way – though the bias for economists will be towards the U.S. given the better data.

Figure 4: Relative Wage Rates Per Annum (USD)

Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but product innovation could be disinflationary like ICT. One key uncertainty on a 1-5 year period is over the net adverse impact on white collar employment and wage rates from generative AI/agentic AI, though blue collar workers should be much less impacted due to the less developed nature of humanoid robots. For now we are not inclined to see more disinflation than the ICT wave and the impact will be less on EM economies ex China than DM and China. In the meantime it could be worth watching the Deepmind Netflix documentary (here).