Mexico: March Pause Rather Than Cut?

Banxico paused as expected, but revised the peak in inflation to 4% from 3.7% and pushed back the forecast of when inflation is expected to hit the target. Though the economy is still expected to be below trend in 2026, the inflation/growth tradeoff is causing Banxico members to debate whether further interest rates cuts are appropriate. This argues against a cut in March. However, a weak economy/disinflation, plus threats of new tariffs for Mexico from the U.S. over USMCA and Cuba, can see a 25bps June and September cut to 6.50%.

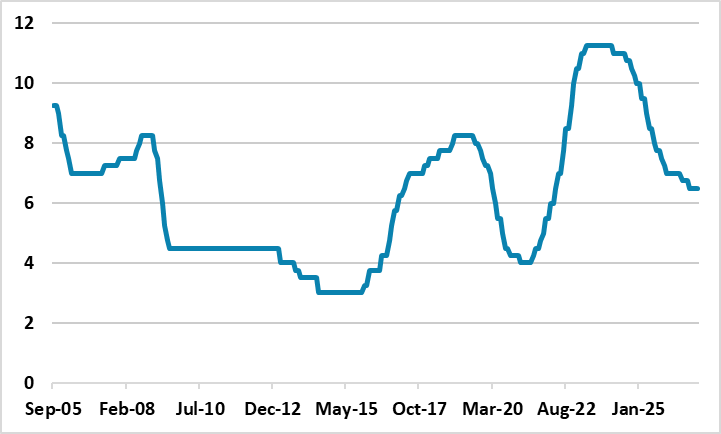

Figure 1: Banxico Rate Including Forecast (%)

Source: Continuum Economics

Banxico reset forecasts on the 2026 inflation path higher, with the peak in inflation to 4% from 3.7% and 3% now projected to be hit in 2027 rather than Q3 2026. Recent inflation data appears to be the cause of the Banxico rethink. Though Q4 GDP came in better than expected at 0.8%, the Q3 contraction and Q2 weakness means that 2025 will be well below trend and Banxico still projects below trend 2026 growth. This increasing output gap promises future disinflation and allows Banxico to continue to forecast lower inflation in H2 2026 and 2027, so the rethink delays hitting the target rather than a more serious rethink. The forward guidance is towards a pause in the coming meetings. Banxico officials debated whether it was appropriate whether further rate cuts are needed, though Banxico left the door open to further cuts if the data warranted. With the real policy rate at 3.1% using 1 year inflation expectations, the current real policy rate is above the central 2.7% estimate for neutral real policy rate. Additionally, we would agree with the prospects that the slow economy helps disinflation, which should reopen the door to further interest rate cuts later in the year. However, the upward revision to the inflation projections, plus the new forward guidance suggests no cut in March and probably May.

We favor a 25bps cut in June and September due to the above reasons, but also the risk of new trade tensions with the U.S. that could amplify the disinflation process. President Trump’s desires, remains for renegotiation rather than simple review of the USMCA. This can prolong trade uncertainty potentially throughout 2026, as we see a deal only late 2026/early 2027 (here). Additionally, Trump is threatening countries like Mexico with extra tariffs if they continue to supply oil to Cuba. However, we also feel new trade tensions could also prompt a correction of the Mexican peso, which Banxico will be apprehensive about and this could delay the rate cut we forecast for June.