Outlook Overview: Into 2026

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of tariffs have been announced and trade deals have been agreed with a number of key countries. We expect the Supreme court to uphold Trump’s reciprocal tariffs, but rejection would likely see the Trump administration announcing alternative tariffs. Our economic baseline remains for a slowing rather than a hard landing for the U.S., with tax cuts from the 10yr budget bill only mildly stimulative in H1 2026. We look for a further 25bps from the Fed in October and December followed by a further cumulative 50bps in 2026. While Trump appointees will increase at the Fed, they are unlikely to dominate voting or actual policy rate levels but could led to internal Fed disagreements and communication problems.

· Other DM economies have the headwind of tariffs on U.S. trade, but economic recoveries are also being restrained by population aging; slow productivity and in certain countries cautious consumers. Tariffs outside the U.S. are also disinflationary, as they hurt exports and employment; and as China is seeking to redirect excess production at competitive prices. This points to further easing from the ECB and BOE, though fiscal policy is mixed with UK tightening but Germany easing. Further BOJ rate normalization will be slow, as inflation slows.

· For EM countries, the tariff reality is also a headwind for exports and capex, with the scale influenced by the scale of openness for the economies. For China, a modest consumer, plus continued drag from residential investment, structural drag from population aging and slowing productivity points to a trend slowdown to 4%. However, further fiscal stimulus is highly likely and suggests 2026 GDP growth of 4.5%. India should prove resilient, due to domestic stimulation. Brazil will likely slow as the lagged effects of very tight monetary policy feed through.

· Geopolitically our baseline (70%) remains for the war in Ukraine to drag into 2026, as Putin maintains a hard line stance and talks fail to reach a ceasefire or peace deal. President Xi could ask Trump for an understanding on Taiwan reunification, but the U.S. is likely to keep the strategic ambiguity policy. While this strategic ambiguity policy towards Taiwan remains in place, a military invasion of Taiwan would be too high risky for Xi (here).

· For financial markets, the U.S. equity market is overvalued and at risk of a correction in the coming months, especially with any bumpiness in the economic slowdown. For most DM government bond markets, we look for further yield curve steepening, both on easing and as the combination of budget deficits and QT means heavy supply for the market to absorb (here) – Japan is more complex with BOJ tightening and QT. The USD downtrend will resume at a modest pace against DM currencies, but more mixed versus EM currencies.

· Risks to our views: A hard landing in the U.S. economy would spillover globally in GDP terms and we have raised the risk of a U.S. recession from 25% to 30%. While this would likely trigger more aggressive Fed easing, it could still prompt a bear market in U.S. equities, and a noticeable decline in the USD.

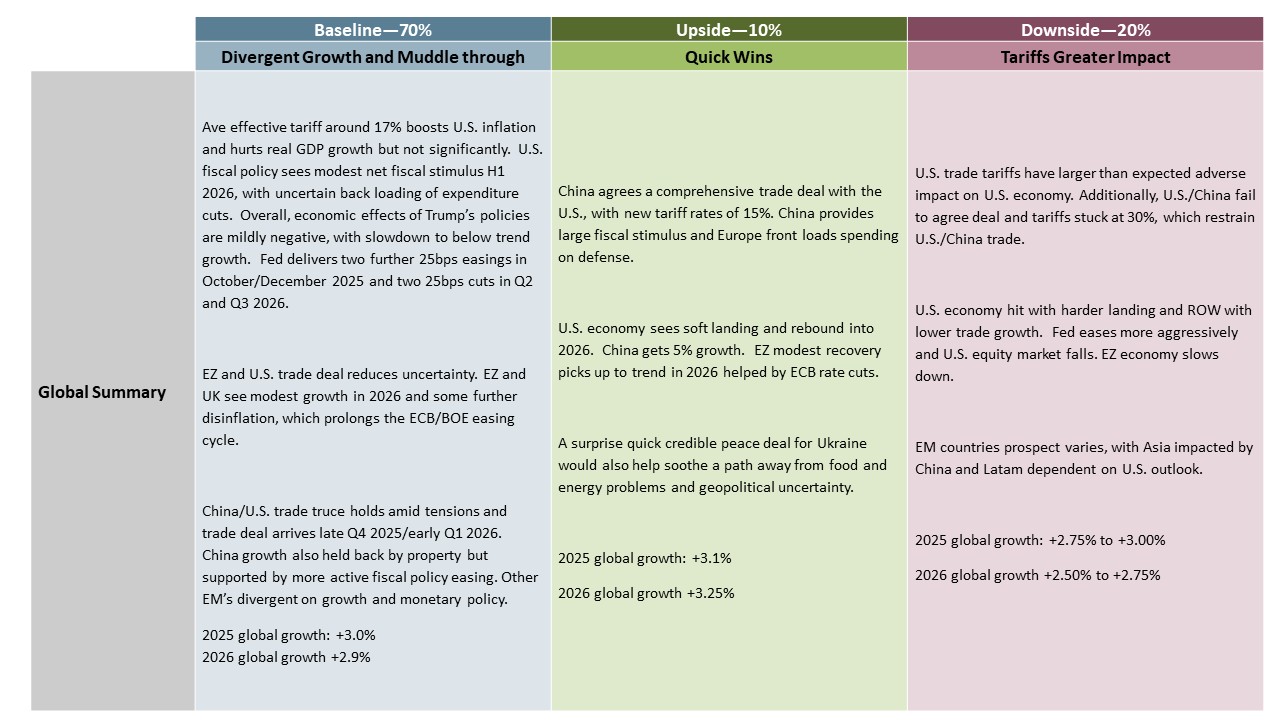

Figure 1: Economic Scenarios

Source: Continuum Economics

Market Implications

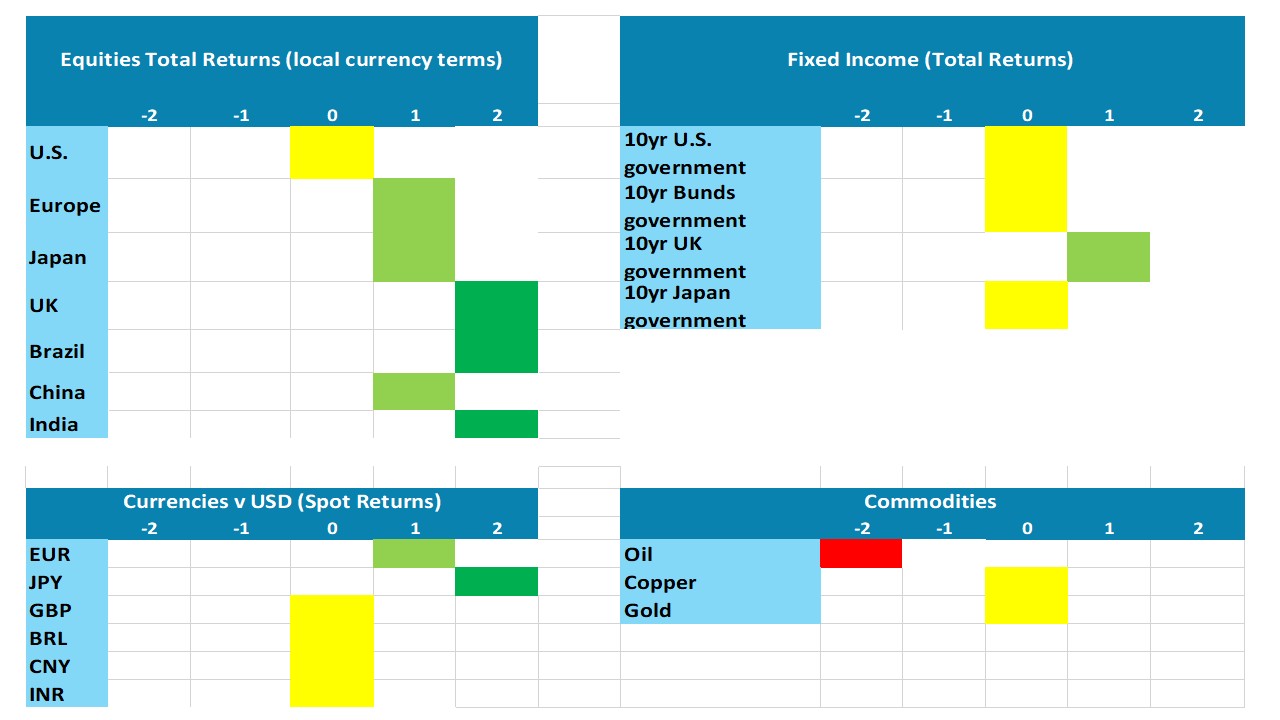

Figure 2: Asset Allocation for the Next 15 Months

Source: Continuum Economics Note: Asset views in absolute total returns from levels on September 23 2025 (e.g., 0 = -5 to +5%, +1 = 5-10%, +2 = 10% plus).

· Government Bonds. The clearest process is further yield curve steepening. On our baseline, this would mean consistent easing from the Fed that drags down 2yr yields, with 10yr yields falling further in the next 6 months but drifting back up above 4% as the economic weakness is seen to be a mid-cycle slowdown. On a harder landing, 10yr U.S. yields can come down to 3.5%, but 2yr falling even more. Meanwhile, we see 10yr Bund yields at 3.00% by end-2026 on Germany fiscal expansion and an end to the ECB easing cycle. Finally, 10yr JGB yields will likely reach 1.75-2.00% region in 2026, as we see one further 2025 hike followed by a 25bps hike in Q1 2026 and on very large BOJ QT.

· Equities. Softening of economic data can cause a new 5-10% correction in U.S. equities, alongside further intermittent tariff action from Trump. Recovery should be seen by end-2026 to 6600 end 2026 – Fed rate cuts, soft landing and share buybacks. A hard landing means a sharp selloff to 5000. Other DM markets will follow the U.S., as less overstretched valuations are countered by domestic structural problems. India can track other markets in the next 6 months, but should outperform the U.S. by 5% by end 2026.

· FX. Prospects remain for DM currencies to make further moderate gains versus the USD in the next 15 months. Foreign investors are concerned about being overweight U.S. assets, with erratic Trump administration policymaking, overvalued USD and U.S. equities. EM currencies will be more divergent, with Turkish Lira forecast to fall on stubborn inflation, but the Brazilian Real likely to gain further ground versus the USD on very high yield spreads.

· Commodities. OPEC is now reversing the 2nd set of voluntary oil production cuts from 8 countries, which shows a keenness to sell oil. While EM demand growth is still reasonable, this extra supply will likely eventually mean a further decline in oil prices in 2026. We see WTI at and USD53 by end-2026.

Figure 3: Key Events

| From July 2025 | French Parliamentary Election | The surprise snap parliamentary election in July last year, much to President Macron’s consternation, actually made his minority government even weaker, instead creating three clear factions with the legislature. A fresh government has been toppled but a new one is being formed facing key battles over immigration, pension reform and the budget any of which could see it toppled too. Opinion polls suggest that if/when a fresh election occurs, this will not change parliament materially with adverse fiscal and economic implications. President Macron has ruled out fresh elections but he may come under pressure to resign, although he is likely to try and complete his term which runs to 2027. But the political impasse, via any possible fiscal and economic crunch could yet trigger further political upheaval. | |

| October 26, 2025 | Argentina Legislative Election | Argentina will hold legislative election in October 2025. Half of the Chamber of Deputies (127 seats from 257) will be renovated for a four-years mandate. Additionally, one third of the Senate (24 seats for 74) will also up for a 6-years mandate. Most of the polls are suggesting that President Javier Milei will now find it difficult to increase the participation of his far-right party, La Libertad Avanza, in both houses. Protests has grown against the fiscal austerity, which has helped the centre left Peronists. | |

| May 2026 | Powell Replaced as Fed Chair | It sees certain that Trump will replace Powell as Fed Chair. Should Trump choose a current Fed Governor such as Waller or Bowman, markets would probably feel some relief as both, while likely to be more dovish than Powell, would seek to maintain Fed credibility on inflation. A former Fed official such as Warsh or Bullard would also cause limited alarm. An outsider to the Fed, particularly if not familiar to the markets, would be more concerning, but Trump is still unlikely to be able to build an FOMC where the majority of voters are subservient to his will. | |

| September 13, 2026 | Sweden General Election | The current right-wing coalition still has very slim effective majority in parliament even with the far-right Sweden Democrats offering support. This is all the result of the 2022 election, which brought a fragmented result but locking out the Social Democrats even though they are the largest party. This fragmentation was a result of a more polarized parliament and polls suggest more of the same, but with a general drip more to the left. But even if left-leaning parties return to power, it unlikely to change much given the current focus on defence but where an election issue may be a speedier defence build-up. | |

| By September 20, 2026 | Russia Parliamentary Elections | Russia is set to hold its next parliamentary elections by September 20, 2026 to determine the State Duma, the lower house of the Federal Assembly. All 450 seats are up for grabs, with 226 needed for a majority. As of current polling trends, United Russia (YeR) leads with around 53% support, potentially securing 266 seats; Communist Party (KPRF) trails with 13%, projected to win 65 seats; and Liberal Democratic Party (LDPR) holds 11%, aiming for 54 seats. We expect United Russia, led by Dmitry Medvedev, remains dominant after its 2021 victory. | |

| October 4 and 25, 2026 | Brazil General Election | In 2026, Brazil will hold general elections to elect the next President, renew all the Chamber of Deputies seats, and two-thirds of the Senate, while also electing the governors of all Brazilian states. Lula will likely seek re-election, while opinion polls suggest Lula will likely face Freitas (an ex-Bolsonaro minister here). However, any irrational decisions by Bolsonaro, such as nominating his wife or son for the presidency resulting in a fragmented opposition, cannot be ruled out. | |

| November 3, 2026 | U.S. Mid Term Elections | All seats in the House and a third of the seats in the Senate will be up for election. With the current Republican majority in the House of five seats being marginal even a modest level of disappointment in the Trump administration, which seems likely, could see the Democrats gain control of the House, but it will be a lot harder for the Democrats to make the necessary gain of 4 seats in the Senate. We think a recession may be required to see the Democrats take the Senate. |

Source: Continuum Economics