Banxico Review: Slower Pace for 25bps Cuts

Banxico cut by 25bps to 7.5%. However, Banxico pushed up the near term inflation forecasts, which could mean that the November 6 meeting does not see a rate cut but rather Banxico waits until the December 18 meeting. This is our view and we look for 25bps to 7.25%. We then see two further 25bps cuts in 2026 to 6.75% and likely to be delivered in March and June.

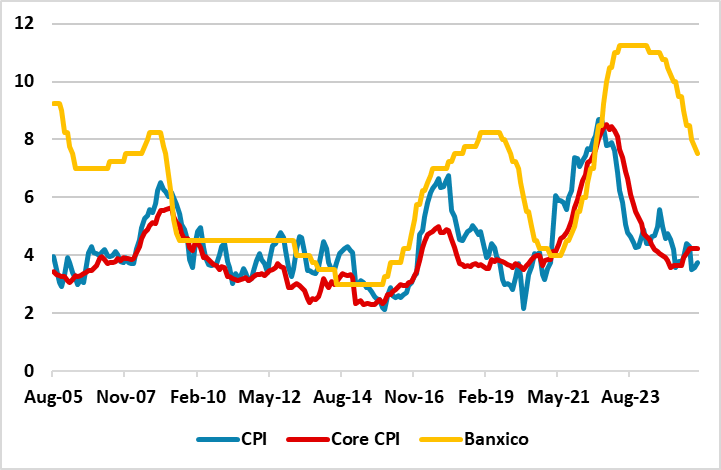

Figure 1: Mexico CPI and Banxico Rate (%)

Source: Datastream/Continuum Economics

Banxico cut the policy rate by 25bps to 7.5% as widely expected and still citing concerns about below trend growth and the prospect that it will cause disinflation. Crucially headline and core inflation are still forecast to reach the 3% target in Q3 2026, as the lagged effects of sluggish growth feedthrough. While Mexico has a 90 day delay on tariffs, Trump still wants to renegotiate USMCA and this can create trade headwinds and uncertainty. Mexico has also imposed tariffs on China to temper U.S. concerns, but this will hurt trade and also produce a rise in the price of certain imports. Thursday surprise announcement of 100% tariff on patented drugs by Trump also underlines his volatile nature.

Against this backdrop, the majority of Banxico still appear inclined to undertake further easing in monetary policy, though Jonathon Heath was once again the dissenter. Forward guidance in the statement remains towards further easing. However, Banxico pushed up the near term inflation forecasts, which could mean that the November 6 meeting does not see a rate cut but rather Banxico waits until the December 18 meeting. This is our view and we look for 25bps to 7.25%.

The question of the terminal rate splits the market with some seeing current conditions pointing to a 6.0-6.5% terminal rate. Others including ourselves see 6.5-7.0% by the terminal rate area. We forecast two further 25bps cuts in 2026 to 6.75% and likely to be delivered in March and June. We prefer this profile, as quarterly easing allows Banxico to see the effects of the easing cycle but also to cut more deeply if they are concerned. If Banxico cut quickly to 6.75% and paused, then it would have to explain the restart of the easing cycle.